A new, misleading report on wind power has emerged from the Institute for Energy Research. This small single-issue group has released an analysis of a single federal tax policy – the wind energy Production Tax Credit (PTC) – and hidden an awful lot of relevant information in the process, including the group’s history of payments from fossil fuel interests and its distortions of renewable energy facts.

A few major flaws in the report

The IER report divides the nation into states that are hosting wind farms as receivers of federal Production Tax Credits and states that are net “payers” of federal taxes in this particular category.

IER ignores wind manufacturing and other economic benefits

IER has overlooked manufacturing benefits from the federal wind tax credit. States do not have to host wind turbines to receive benefits from the installation of wind farms.

Jobs and revenues created by the manufacturing of wind turbine equipment and components are more widespread than IER’s analysis shows. There are 10 manufacturing facilities supplying the wind industry in Georgia, 16 in Florida, 21 in California, and 40 in Michigan. In Ohio, 62 facilities make turbine components, reportedly making Ohio the top state in the nation based on the number of wind-related manufacturing facilities.

IER has also taken shortcuts in describing how the PTC benefits consumers where wind-generated electricity adds to the supply and lowers the price of electricity, landowners who receive lease payments from the wind turbines, and local communities that collect tax payments on installed wind farms.

IER left out the wind farm companies’ home states

As IER notes, it is corporations that are receiving the tax credits, not states that host the turbines. Florida is home to the largest owner of U.S. wind farm assets, NextEra Energy Resources, an affiliate of Florida Power & Light. So when IER says in their report “federal subsidies to wind power imposed a heavy tax on Floridians without conferring “benefits” to anyone in the State” the IER did not include Florida’s sixth largest public company.

IER ignores States benefit from other Federal spending

IER fails to describe that many of the states it calls a net payer on the specific program of PTC have an overall net inflow of federal tax dollars. How many of these payers are net receivers? More than half.

Looking at a few sources using a range of time spans, you can see that the map of states that are net recipients of Federal spending overlaps with the IER map that claims the opposite.

IER would get different answer with another energy source’s federal support programs

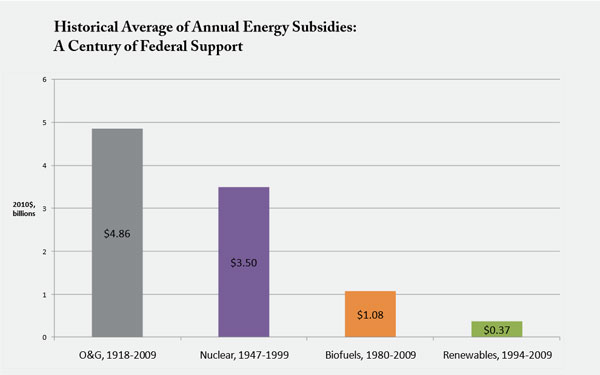

Nuclear power receives a variety of subsidies for the necessary inputs used to build nuclear power plants and produce nuclear power. The graph below shows oil & gas subsidies ahead of nuclear subsidies, and both of these are 10 times larger than subsidies for renewable energy.

Source: DBL Investors

UCS has detailed how nuclear power is still not viable without subsidies. A map of the nuclear power plants shows four in Florida, five in Alabama, and seven in South Carolina. Overall, the states and the money spent for nuclear plant installations shows a different picture of benefiting states from what IER is suggesting about wind energy.

IER has not mentioned their Koch and oil connections

IER routinely refers to the wind production tax credit as a costly “subsidy.” But in previous analyses, IER has been careful to define similar incentives the oil and gas industry has received for nearly a century as beneficial “tax deductions.” When judging the merits of IER’s self-contradictory claims, it helps to know that they are one of many global warming skeptic groups that have received funding from fossil fuel interests such as ExxonMobil and the Koch brothers. Just as important, previous IER claims critical of clean energy policies have failed fact check after fact check by everyone from the Associated Press to the Wall Street Journal.

Elliott Negin of UCS has researched IER’s funding and ties. He wrote: “Over the last decade or so, IER and its lobby arm have received hundreds of thousands of dollars from ExxonMobil; the American Petroleum Institute (API), the oil and gas industry’s trade association; the Center to Protect Patient Rights, a secretive nonprofit group linked to Charles Koch and his brother David, the billionaire owners of the coal, oil and gas behemoth Koch Industries; and the Charles Koch-controlled Claude R. Lambe Charitable Foundation. IER founder and CEO Robert L. Bradley, Jr. is an adjunct scholar at the Koch-founded and funded Cato Institute and the API- and Koch-funded Competitive Enterprise Institute. He also has been a featured speaker at the API- and Koch-funded Heartland Institute’s annual climate science-bashing conference.”