I’ve said before that the food versus fuel debate is about more than corn, and specifically that using a large share of America’s vegetable oil for fuel would be counterproductive, and would do more to expand unsustainable palm oil production than to sustainably cut oil use and reduce carbon emissions.

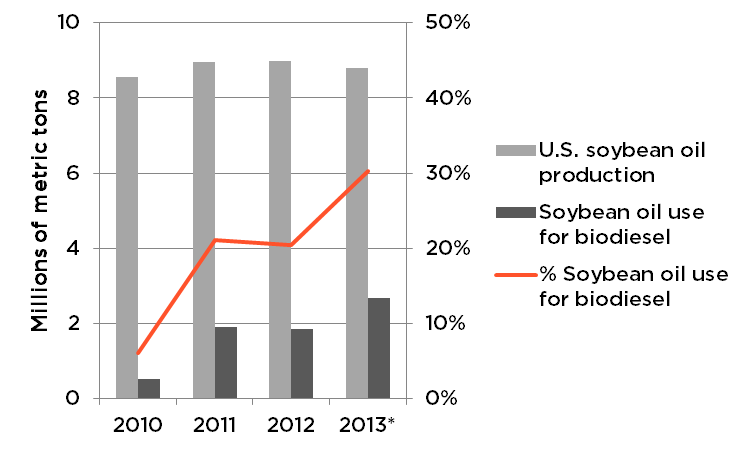

Unfortunately, a perfect storm of poor policy choices led soy biodiesel production to increase by 45 percent in 2013, which represents about 30 percent of the soybean oil produced in the U.S. Now the EPA has decided to take a breather for 2014 and 2015, which makes good sense.

Biodiesel is made from all sorts of different sources, ranging from used cooking oil — which converts a waste into a valuable fuel — to food-grade vegetable oil — which turns valuable food into less valuable fuel. Unfortunately, despite encouraging growth in the production of waste-based biodiesel, the majority of the expansion is coming from soybean oil — causing the problems detailed in the infographic below and which, as I explained in April, does more to drive palm oil expansion and deforestation in Southeast Asia than increase planting of soybeans in the U.S.

In 2013 we called on the EPA to use its authority to ensure that blending constraints for ethanol and delays in the cellulosic biofuel scale up did not lead to biodiesel volumes increasing beyond what was sustainable. Under the Renewable Fuel Standard (RFS), other advanced biofuels (currently sugarcane ethanol from Brazil and biodiesel are the main options) can be used to meet the shortfall in cellulosic production. (You can check out our fact sheet on the complex mandate structure here.)

Unfortunately, the EPA did not take our advice, and, unable to meet the ethanol targets because of the lack of blending infrastructure, obligated parties (that is to say oil companies) turned to biodiesel instead to meet the standards. This phenomenon was amplified by the $1/gallon tax credit for biodiesel, which made blending biodiesel even more attractive (i.e. cheaper). All of this led to biodiesel use growing from a billion gallons in 2012 to a projected total of almost 1.5 billion gallons in 2013, with the majority coming from soy biodiesel, which appears likely to have grown about 45 percent to about 780 million gallons.

780 million gallons of soy biodiesel may not seem like much compared to the 13 billion gallons of corn ethanol produced this year, but the vegetable oil market is much smaller than the corn market, so a smaller amount of vegetable oil-based biofuel can make a big difference. The 780 million gallons of soy biodiesel projected for this year would consume about 30 percent of U.S. soy oil production for the 2013/2014 marketing year. This is up from about 20 percent the previous two years, and less than 10 percent before that. This rapidly escalating share is reminiscent of the escalation of corn used for ethanol (now about 40 percent), and is the reason I have been saying all year that the food versus fuel fight is about much more than just corn.

Soybean oil trends. 2013 data based on projection (details below)

Non-food biodiesel: good, but limited

As I mentioned, there are “good” sources of biodiesel that come from true waste products — but the scale of policy-driven demand for biodiesel is outstripping the low-carbon resources. Let’s look at the trends over the last few years:

U.S. biodiesel feedstock trends. 2013 data based on projection (details below)

I’ve organized the categories roughly from the lowest carbon waste-based biofuels on the left to the more troublesome food-based fuels on the right. It’s encouraging to see healthy growth from the low-carbon end of the spectrum — recycled oils are up almost 47 percent and corn oil, primarily inedible oil recovered from ethanol production, is up 77 percent. But as you can see, most of the growth continues to come from soy biodiesel and other vegetable oils.

EPA breather is a wise move

In their recent proposed rule, the EPA has proposed to hold the biodiesel mandate at 1.28 billion gallons for 2014 and 2015. Since the low-carbon fats and oils, indeed everything aside from edible vegetable oil, still accounts for less than half of this year’s total, that leaves plenty of room for these sources to continue to grow. And the nested structure of the RFS means biodiesel has the opportunity to grow by competing with other advanced biofuels in the rest of the advanced mandate. Using this approach instead of raising the biodiesel-specific mandate allows flexibility for the biodiesel market to grow further if circumstances warrant. I think the EPA would be smart to stick with this proposal, and reject calls to use the exceptional circumstances of 2013 to set a floor for biodiesel production going forward.

A note on the graphs: the numbers are estimates at this point. The Energy Information Administration publishes monthly reports on biodiesel production, but I had to do some extrapolation because the breakdowns have only been published through October. What I did was assume the breakdown of sources for the full year would match the average results for January through October, but that the totals would scale up to meet the 1.479 billion gallons based on the latest EMTS data from the EPA. I got the soy oil production statistics from the Foreign Agricultural Service of the U.S. Department of Agriculture. It takes 7.5 pounds of vegetable oil to make a gallon of biodiesel.

Correction: January 27th, 2014

Since posting this blog, several experts in the biodiesel industry have pointed out some oversimplification in my extrapolation that has led to some errors in my detailed estimates. I have corrected the numbers and graphs accordingly, but my basic conclusions are unchanged.