I’ve written a couple posts recently on the importance of the Environmental Protection Agency’s (EPA) decisions over the implementation of the Renewable Fuels Standard (RFS) in 2013. This past January, the EPA proposed volume targets for the various types of biofuels mandated by the RFS, and are taking public comments on the proposal until April 7. While this happens every year, we are entering a critical new phase of the RFS and the approach the EPA takes to the volume setting process over the next few years will have broad environmental and socioeconomic impacts.

This post is part of a series on The Future of Biofuels.

This post is part of a series on The Future of Biofuels.

In emulation of the folks over at Wonkblog, of which I am a big fan, I offer some relevant charts and interpretation, as well as UCS’s view on where we are, and the practical path forward for biofuels policy.

Background – Biofuels Phase 1: 2000 – 2010

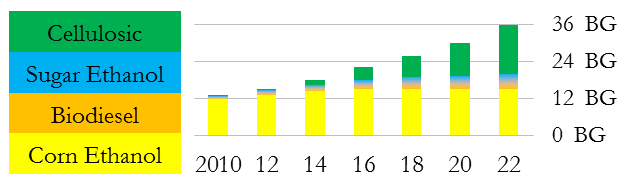

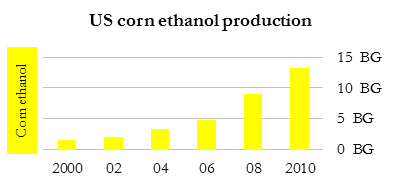

US corn ethanol production expanded by more than 10 billion gallons between 2000 and 2010.

Data source: RFA Data; BG = billions of gallons

With this growth, ethanol went from a minor user of corn in the 2000/2001 marketing year– at 6 percent it was smaller than corn used for sweeteners — to the single largest direct user of corn, consuming 40 percent of the crop in 2010/2011.

Data source: ERS Data

The dramatic changes in the size of the U.S. corn crop, along with rising prices of corn and related commodity crops, led to land use changes and food price increases on a global scale, and triggered a global reaction against the wisdom, the environmental efficacy, and even the morality of diverting such a large share of the corn crop to fuel.

The Decade Ahead for Biofuels

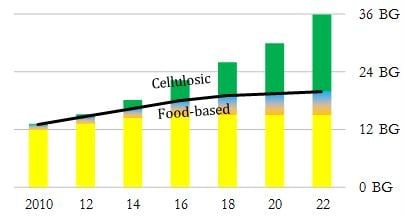

Depending on how the EPA administers the RFS going forward, the next decade could bring even larger changes to agriculture and food markets. The RFS mandates are poised to more than double over the next 10 years, growing from 15.2 billion gallons in 2012 to 36 billion gallons in 2022, a rate of expansion approximately twice as large as was observed between 2000 and 2010 (see this fact sheet for details on the complex structure of the mandate).

The RFS was designed to mitigate the competition between food and fuel by gradually shifting the growth of the mandates away from corn, sugar, vegetable oil, animal fat, and other food-related feedstocks, and toward cellulosic biofuels, made from inedible waste materials, agricultural residues like corn stalks, and environmentally friendly perennial crops.

Less than a quarter of the mandate growth between 2012 and 2022 — just five billion gallons — was intended to be produced from food-based fuels, and the rest was slated to come from cellulosic biofuels.

The Transition beyond Food-Based Biofuels

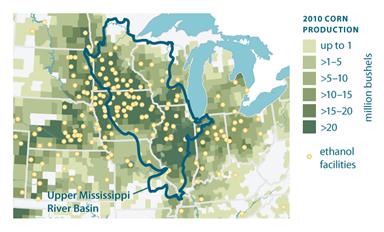

The importance of transitioning away from food-based biofuels has become increasingly clear. Expanded and more intense corn production results in increased fertilizer runoff, which pollutes surface and ground water throughout the Mississippi River basin and is in large part responsible for the annual Gulf of Mexico Dead Zone (more details in this blog and report).

This map shows where the corn is grown in green, and where ethanol is produced with yellow dots.

Data source: NASS

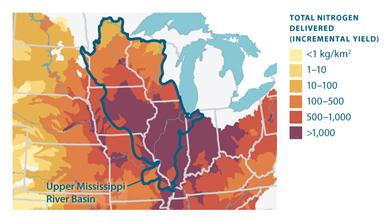

And this one shows where pollution from fertilizer is heaviest:

Data source: Alexander et al. 2008

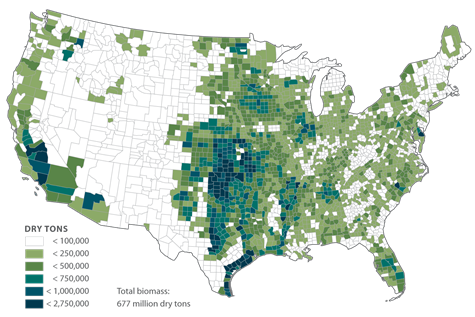

The good news is that biofuel production can responsibly continue to grow if we switch from corn to biomass as a source material or feedstock. Our recent analysis confirms that biomass is available within the United States at levels consistent with supplying even more than 16 billion gallons of biofuel, and can do so in a manner that reduces water pollution and greenhouse gas emissions while improving the overall environmental footprint of our agricultural system. The map below (from our report) illustrates the potential abundance of non-food based feedstocks across the U.S.

From building soil carbon to reducing pollution from corn farming, the case for shifting ethanol’s reliance on corn to a system that relies on wastes, agricultural residues, and environmentally friendly perennial grasses gets stronger all the time.

Delayed Commercialization Means the EPA Has an Important Policy Decision to Make

But while the environmental case for cellulosic biofuels is strong, the rate of commercial deployment is trailing the mandate levels by approximately five years.

INEOSBio Bioenergy center in Vero Beach Florida

KiOR Biorefinery, in Columbus Mississippi

The first commercial scale cellulosic biorefineries recently opened, and this is a major milestone, but it took longer than was anticipated in 2007. The delay means that instead of reaching 100 million gallons per year in 2010, which is what was envisioned when the RFS was enacted in 2007, it is likely to be at least 2015 before production reaches this level. The rate of subsequent expansion will depend on the success of these first facilities, investor assessment of the markets and the durability of a supportive policy environment, including the RFS. However, even with robust commercialization of cellulosic biofuels beyond 2015, far less than 16 billion gallons of cellulosic biofuel will be available in 2022.

According to the EIA’s Annual Energy Outlook for 2012 (AEO2012), actual production levels will be closer to 2.5 billion ethanol equivalent gallons in 2022, leaving a cellulosic shortfall that will grow from almost a billion gallons in 2013 to more than 13 billion gallons in 2022.

Data source: EIA Data

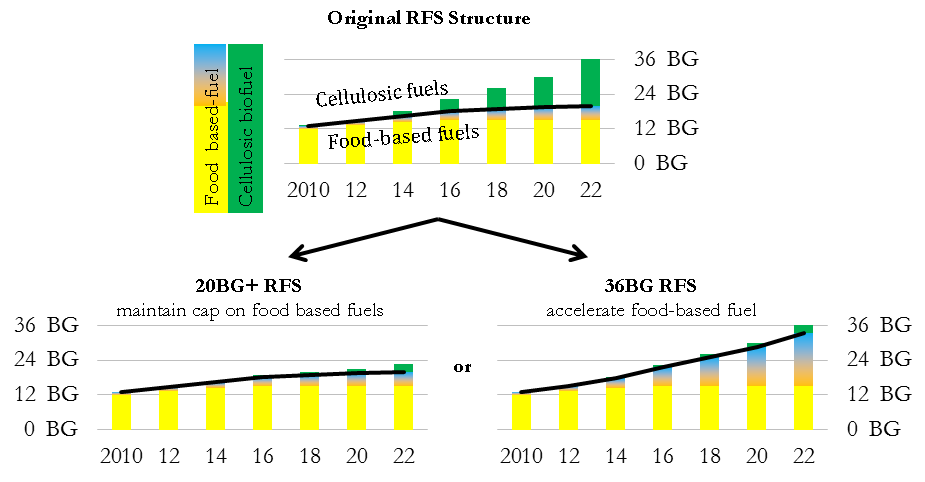

In light of the delayed commercialization of cellulosic biofuels, the EPA faces an important decision. Adjust the overall advanced mandate by the amount of the cellulosic shortfall, resulting in a mandate of 15 billion gallons (BG) of conventional biofuel (mostly corn ethanol), 5 BG for food-based advanced biofuels (primarily sugarcane ethanol and vegetable oil biodiesel), and as much cellulosic biofuel as gets produced (let’s call this the 20BG+ RFS). Or, the EPA can keep the overall biofuel targets fixed at 36 BG, relying on food-based biofuels that qualify as advanced according to EPA’s rules to replace the cellulosic shortfall (let’s call this the 36BG RFS).

The 20BG+ RFS means avoiding additional pressure on food markets, and waiting until cellulosic biofuels scale up to meet make the 36 BG target. Trying to stick to the 36BG RFS means accelerated conversion of food into fuel, making already tight markets for agricultural commodities even tighter.

The Road Ahead, the EPA Holds the Keys…

While the goal of replacing oil with lower carbon, domestically produced alternatives remains as salient today as it was in 2007, a careful examination of the EPA’s choices reveals that in this case, moving faster is counterproductive. In fact, attempting to substantially replace the delayed cellulosic biofuels will make the entire RFS untenable, leading to counterproductive trade flows, indirectly expanding production of food-based biofuels such as corn ethanol and palm oil that do not meet the greenhouse gases standards for the advanced biofuel category.

The decision before the EPA provides the agency with an opportunity to plot a new course forward for biofuels. The EPA must recognize that faster is not always better. Biofuels, especially non-food cellulosic biofuels, can help us to cut projected oil use in half over the next 20 years. But to avoid dead ends on the way, our biofuel policy must consider all the other users of agricultural commodities, starting with food. The EPA’s mandate targets must be based on a thorough analysis of the impact on agricultural trade flows, deforestation, and infrastructure. With smart implementation of existing law, the EPA can navigate these obstacles and set a course for a cleaner future. And that is something even non-wonks can get excited about.

The alternative? It’s grim reading if you care about climate, water quality, or food security. Look forward to a deeper dive into the practicalities of trying to meet the 36 BG target by 2022 in a pair of blogs coming soon.