I don’t think this will be news to anyone, but kind of a lot has happened over the past five years. This is especially true of my all-time favorite topic: California’s power grid.

Think all the way back to spring 2018, a time before PG&E infrastructure sparked some of California’s deadliest and most destructive wildfires; before PG&E intentionally shut off power to millions of customers to prevent utility-caused wildfires; before an August heatwave led to the first rotating blackouts in the state in almost two decades; before state officials delayed the retirement of many polluting once-through cooling gas plants and the state’s last nuclear power plant, Diablo Canyon; before California enacted laws requiring 100% clean electricity and economy-wide net-zero global warming emissions by 2045. The list goes on, but you get the point.

Back in 2018, California legislators were considering a bill that would have created an independent governance structure for California’s grid operator, the California Independent System Operator (CAISO). This would have enabled the CAISO to expand its operations into the rest of the west as a regional transmission organization (RTO), an independent entity that plans and operates the electricity grid.

The overall idea, often referred to as grid regionalization, was to create one grid operator and power market for the entire west. The 2018 bill did not pass, but the idea never faded.

This year, California’s legislature is considering a very similar bill, and for good reason. To be sure, there are still risks and uncertainties associated with the policy change, and California policymakers should seek solutions that mitigate these risks. But a lot has changed in the past five years.

Here are the four biggest things that have changed since 2018 that make grid regionalization worth reconsideration.

Change #1: 100% clean energy goals have spread

At the beginning of 2018, the only state in the country with a 100% clean or renewable energy goal was Hawaii. Now, 22 states plus the District of Columbia and Puerto Rico have 100% clean energy goals on the books. In the west, the list includes California, Colorado, Nevada, New Mexico, Oregon, and Washington. And even in western states without 100% clean energy mandates, some utilities have committed to that goal on their own.

In the past, one of the concerns with grid regionalization was that teaming up with other states might make it harder for California to achieve its ambitious (at the time) renewable energy goals. But now that so many western states have adopted equally ambitious goals, a western RTO would likely be dominated by participants working towards similar clean energy policy goals. These shared clean energy goals would help minimize (but wouldn’t eliminate) the risk that the western RTO implements policies that interfere with California’s transition to clean electricity.

Change #2: Grid reliability challenges are increasing

California’s grid has been facing significant grid reliability issues, struggling to meet peak electricity demand the past few years. There were two rotating outages during a heatwave in August 2020, a close call when a wildfire knocked out a critical transmission line in July 2021, and the state just barely squeaked by in September 2022 when a historic heatwave led to record-high electricity demand. And while the situation isn’t quite as dire in the rest of the west, studies have indicated that the Pacific Northwest and Desert Southwest both will require significant amounts of new capacity to ensure grid reliability in the near term.

In 2018, the grid reliability outlook was much rosier, but now that grid reliability has become a top concern, it’s worth revisiting some of the reliability benefits that would come from grid regionalization.

One of the benefits of a western RTO is that a bigger and more diverse mix of electricity consumers and suppliers could reduce the overall amount of capacity needed to maintain grid reliability. In a western grid that’s increasingly capacity-constrained, even modest reductions in required capacity can be a big help. Sharing resources on a bigger western grid could help utilities across the west meet their grid reliability requirements.

Another reliability benefit of grid regionalization is that a western RTO would be much better positioned to coordinate the response to extreme weather conditions, which are becoming much more frequent as the West increasingly feels the impacts of climate change. A western RTO would have more insight into generator availability and transmission constraints, and could respond more effectively when the grid is in peril. Again, this wasn’t as big of a concern back in 2018, but now that grid operators around the west are dealing with close calls on an annual basis, regional coordination during extreme events could help ensure the lights stay on when the grid is most stressed.

Change #3: Widespread coal power plant retirements

One of the concerns back in 2018 was that grid regionalization would create a larger market for coal power, allowing western utilities to sell their coal power to the rest of the west, including California. To be fair, it’s always been up for debate to what extent this would occur. Proponents of grid regionalization then argued that a broader market would expose coal plants to competition with low-cost renewable energy, and coal plants would operate less often. But opponents countered that many utilities have made a habit of “self-committing” their coal plants, i.e., running those plants regardless of whether it makes economic sense to do so. UCS analysis has found that self-committing coal plants is indeed a widespread practice, so there’s at least a grain of truth to this argument.

However, the past five years haven’t exactly been the best years for coal. No matter how hard utilities, regulators, and policymakers try to prop up coal plants, these plants have continued to succumb to economic pressure since they just can’t compete with renewables, such as wind and solar. Across the country, there has been a steady stream of coal power plant retirements, and that trend is only expected to continue. Many of the coal plants in the West already have planned retirement dates in the next decade, and there are now fewer than 10 coal plants in the western states without a plan to shut down.

Putting all that together, there may still be some limited opportunities for bad-actor utilities to force their coal power into a western RTO. But with so many coal plants having shut down, and with so many more coal plants scheduled to retire, this shouldn’t be a big issue in a western RTO.

Change #4: Southwest Power Pool competition heats up

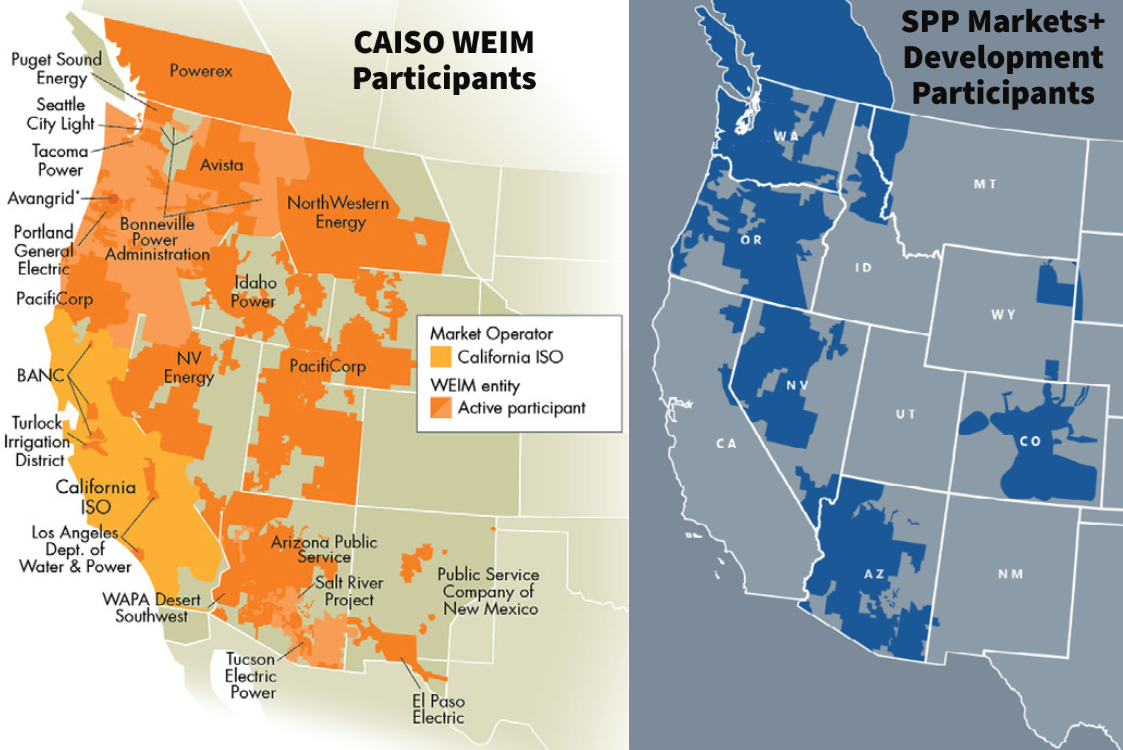

The fourth and final factor that has changed considerably is that, back in 2018, the CAISO was essentially the only entity offering a west-wide system for grid collaboration. The CAISO’s Western Energy Imbalance Market (WEIM) started in 2014, and participation has grown to the point that it now covers approximately 80% of load in the western interconnection. So far the WEIM has been very successful, reducing global warming emissions by nearly 800,000 metric tons of carbon dioxide and saving participants $3.4 billion dollars since the market began. The CAISO is in the process of building on the success of the WEIM with its Extended Day Ahead Market (EDAM), but that market has not yet begun operation and it’s unclear how many western utilities will end up participating…

Because now the CAISO has competition: the Southwest Power Pool (SPP).

SPP is an RTO operating in many of the plains states. It has been moving fast over the past few years to create alternative market offerings for western utilities. In February 2021, SPP launched its Western Energy Imbalance Service which competes directly with the CAISO’s WEIM. SPP has also been rapidly developing its Markets+ offering, which would compete with CAISO’s EDAM.

Interestingly, eight of the 22 entities that currently participate in the CAISO’s WEIM officially joined the effort to develop SPP’s Markets+ offering. That doesn’t necessarily mean that those entities will make the switch to SPP markets, but it’s a strong indication that many of California’s current grid partners aren’t completely satisfied with CAISO collaboration, and they’re exploring other options.

Basically, it’s all up in the air right now. If California doesn’t change its laws to enable the CAISO to expand into a western RTO, the best-case scenario for California is that all this interest in SPP Markets+ fizzles out and the vast majority of utilities in the west join EDAM.

But the worst-case scenario is that western utilities flock to SPP markets, shunning EDAM and quitting the WEIM—in that case, CAISO would be left on its own, without any of the benefits of regional collaboration.

It all comes back to potential changes in California policy. Western utilities may be more interested in sticking with California and joining EDAM if CAISO has an independent governance structure. And some western utilities have expressed an interest in eventually joining an RTO, so they may be more interested in EDAM if that’s a clear step towards joining a CAISO-led western RTO.

In short, without changes to CAISO’s governance, California’s current grid collaborators may join SPP and create a western grid operator without California.

So, what’s next?

A lot has changed for California’s grid since 2018, and all these changes point towards a need to reevaluate the ways in which California’s grid interacts with its neighbors.

But that doesn’t mean California should go full steam ahead on grid regionalization at all costs.

A western RTO would create significant benefits, but it also brings multiple risks, the biggest one being unknown changes to CAISO governance that could lead to adverse outcomes for California. When crafting policy changes to enable grid regionalization, California should seek solutions that mitigate these risks. More on that to come!