Many people expected 2013 to be a slow year for the wind industry as Congress let the federal production tax credit (PTC) expire at the end of 2012 before approving a one-year extension as part of the fiscal cliff deal a few days later. While wind development is unlikely to come anywhere near the record setting 13,124 MW installed in the U.S. in 2012, there are early signs that 2013 could be much better than expected.

This post is part of a series on Ramping Up Renewables: Clean Energy Policies to Watch in 2013.

This post is part of a series on Ramping Up Renewables: Clean Energy Policies to Watch in 2013.

Subscribe to the series RSS feed.

Wind developers are already adding projects at rapid pace. Utilities are issuing RFPs and signing power purchase agreements that will deliver even more low-cost wind power to consumers. And wind turbine and component manufacturers are taking orders and ramping up production to fill those orders.

Here are a few examples of this progress:

- The wind industry installed 958 MW of capacity in the U.S. in January, according to the Federal Energy Regulatory Commission (FERC), representing 78 percent of the total capacity installed during the month and injecting nearly $2 billion of investment in the U.S. economy.

- GE, the nation’s leading manufacturer of wind turbines, predicted that the PTC extension could lead to the development of 5,000-6,000 MW of wind development in the U.S. in both 2013 and 2014, an annual investment of $9-12 billion. Without an extension, Bloomberg New Energy Finance had projected installations to decline to 1,500 MW this year.

- Boston-based wind developer First Wind announced plans to begin construction on 500 MW of wind projects in advanced stages of development in Maine, Oregon, Washington, Idaho, Utah, and Hawaii.

- Xcel Energy, the nation’s leading retail provider of wind power with approximately 5,000 MW at the end of 2012, is seeking regulatory approval in Minnesota and Colorado to accelerate its resource acquisition process so it can add more low-cost wind this year. “We have a great opportunity to see if additional wind resources in Colorado would be of economic benefit to our customers with the extension of the federal tax credit, but we must act quickly,” said Ben Fowke, chairman, president, and CEO of Xcel Energy. “Our request is not being driven by state renewable energy standards, but by the opportunity to reduce costs.”

- Tri-State Generation and Transmission Association, which serves 42 electric cooperatives in four western states, and Alliant Energy Corp. in Iowa both issued RFPs for 100 MW of wind, while three Nebraska utilities (Nebraska Public Power District, Omaha Public Power District, and Lincoln Electric) are signing power purchase agreements for 325 MW of wind this year instead of waiting until 2017.

- DTE Energy’s ECHO Wind project planned for 2013 is reported to cost $52.50 per megawatt-hour. This is significantly lower than wind prices from a few years ago according to the Michigan Public Service Commission, which stated in a recent report “Compared to building a new, conventional coal facility, renewable energy contracts are significantly lower in price…less than any newly built generation including new natural gas combined cycle plants.”

Avoiding another roller coaster ride for the wind industry

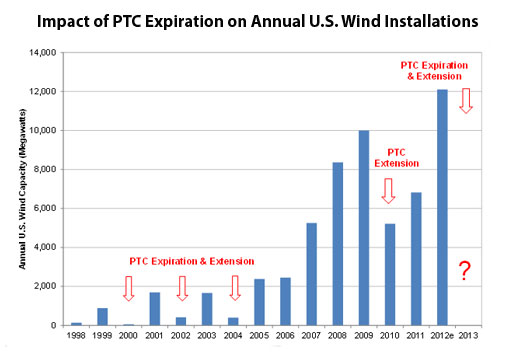

The activity in the first two months since Congress extended the PTC is promising and shows that the wind industry and utilities can move fast to deploy clean energy. But a more deliberative approach that provides greater long-term investment certainty and stability is needed to expand U.S. wind manufacturing capacity and avoid the boom-bust cycle that has wreaked havoc on the wind industry over the past 15 years (see graph below).

Sources: Compiled by UCS based on data from DOE and AWEA.

President Obama pledged in his State of the Union address to double renewable electricity generation from wind, solar, and geothermal energy by 2020. In the President’s Plan for a Strong Middle Class & Strong America, he called on Congress to achieve this goal by making the PTC permanent and refundable as part of comprehensive corporate tax reform.

While a permanent PTC could be politically challenging, his goal of doubling renewable energy is not pie in the sky. The U.S. has already met the President’s 2009 goal of doubling U.S. renewable energy capacity from these sources in less than half the time.

Doubling solar capacity by 2020 would require adding less than 1,000 MW a year on average, which is less than one-third of what was installed in 2012. To double wind capacity to 120,000 MW by 2020, the U.S. would need to add an average of 7,500 MW per year, which is less than what was installed in the U.S. in 2008, 2009, and 2012. It’s also less than half of what the U.S. Department of Energy projects is needed to meet President Bush’s goal of generating 20 percent of total U.S. electricity from wind by 2030, announced during his 2006 State of the Union speech.

Opposition to extending the PTC is misplaced

If this year is anything like last year, we can expect opposition to efforts to extend the PTC or replace it with other long-term policies to support renewable energy. The most vocal opponents of the PTC, including several groups funded by the oil industry’s billionaire brothers Charles and David Koch, argue that the government is playing favorites by granting the wind industry the tax credit.

Last September, Koch-backed Americans for Prosperity and other groups sent a letter to Congress opposing the extension, arguing that it “continues the deplorable practice of using the tax code to favor certain groups over others.” Neither the House leadership nor the Koch-affiliated groups, however, question the fact that fossil fuels and nuclear power have been feasting on billions of dollars of federal subsidies for decades while renewables have been living on scraps.

Time to Level the Playing Field

The question is not whether the federal government has a role to play in helping promising technologies like wind and solar power compete in the marketplace. The question is whether the government should continue to underwrite extremely profitable, mature industries—especially highly polluting ones—at the expense of cleaner, more efficient, low-carbon alternatives. The obvious answer is no.

Feature Image: Lance Cheung, Flickr Commons