An updated version of this blog post, published on January 10, 2024, can be viewed here.

Most discussions about biofuels center on ethanol, but biodiesel—a diesel-substitute made from vegetable oils and animal fats—is increasingly important as well. But where does biodiesel come from, and what does it mean for the climate? Like most important things, the answers aren’t black or white—but they’re critical to get right.

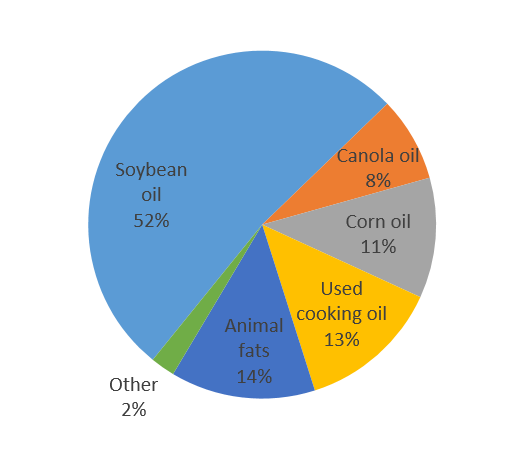

Figure 1: Most biodiesel is made from vegetable oil. The chart shows oils and fats used to produce biodiesel in the U.S. in 2015 (Source EIA Monthly Biodiesel Production Report )

More than 80 percent of biodiesel is made from vegetable oil (the rest is mostly animal fats). The soybean and canola oil that make up the majority of biodiesel is basically the same as the cooking oil you buy at the grocery store, while the corn and used cooking oils are inedible varieties generally used for animal feed and other purposes.

Using more oils and fats for fuel instead of food and animal feed has consequences for competing users of these products and for the global agricultural system. Of particular importance from a climate perspective is the relationship between rising biodiesel use in the United States and palm oil expansion in Southeast Asia, which is a major driver of deforestation and global warming pollution.

Figure 1 shows that palm oil itself is not a significant direct source of US biodiesel production. But there are important indirect links between how much biodiesel we use in the US and how quickly palm oil plantations expand in Indonesia or Malaysia. These connections can be understood by comparing the rise of biodiesel with ethanol, and by examining the sources of biodiesel one at a time.

Ethanol vs biodiesel

Vegetable oils and animal fats are converted into biodiesel via a chemical process called transesterification, after which they’re blended with diesel and used in trucks. Transesterification sounds complicated, but it is a pretty simple chemical reaction (you can actually make biodiesel in your garage); compared with ethanol, the biodiesel production process takes less energy and has lower direct emissions.

The main source of emissions for biodiesel comes from the vegetable oils and fats it is made out of, and not the process of converting them to fuel.

Although ethanol production is much larger, biodiesel has grown more quickly since 2010, more than tripling between 2010 and 2015:

Figure 2: Production of ethanol and biodiesel (Source EIA Monthly Energy Review)

Biodiesel is most often sold as a blend of up to 5 percent biodiesel mixed with petroleum diesel. This is labeled as ordinary diesel fuel consistent with the official specifications. Some trucks can use up to a 20 percent biodiesel blend, but distribution challenges associated with marketing different blends for different vehicles have limited the adoption of these higher blends.

Today, biodiesel accounts for about 3 percent of the diesel fuel sold. For comparison, 10 percent ethanol is blended into most of the gasoline sold today.

Figure 3: Share of renewable fuel blended into gasoline and diesel (Source EIA Monthly Energy Review)

Fuel markets ≠ Agricultural markets

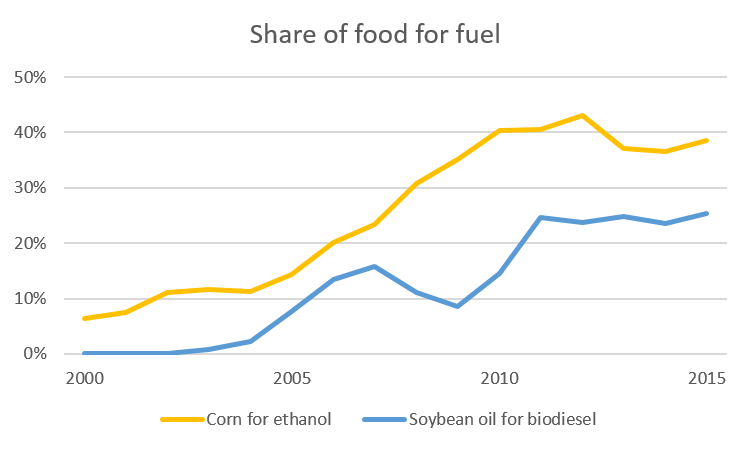

While biodiesel is a relatively small share of diesel fuel, it has a large footprint in agricultural markets. The fact that ethanol consumes about 40 percent of U.S. corn is much publicized by ethanol critics, but less attention has been paid to the growing share of soybean oil being made into biodiesel, now about 25 percent.

One reason for the different level of publicity is that expanded demand for corn to make ethanol increases input costs for meat producers, who have been among the loudest and most persistent ethanol critics. But counterintuitively, increased demand for soybean oil actually makes input costs cheaper for the meat industry. To understand this mystery, read on!

Figure 4: Share of U.S. corn used for ethanol and U.S. soybean oil production used for biodiesel (Source USDA ERS Feed Grains Yearbook and Oil Crops Yearbook)

Soybean freakonomics

Soybeans are an interesting crop, connected to their sister crop corn in complex ways in the agriculture, food and fuel system. While you may occasionally encounter soybeans in their immature form as edamame, the majority of soybeans are crushed to make soybean oil and a high protein meal that is mixed with corn in animal feed.

Soybean oil accounts for only 40 percent of the value of the soybeans, so the economics of soybean production depend jointly on the oil and the meal. As you would expect, increased demand for soybean biodiesel will raise demand and prices for soybean oil, but meal goes the other direction. As more soybeans are crushed to supply oil, the price of soybean meal will fall as increased production meets unchanged demand.

Since soybean prices depend on the sum of oil and meal prices, the net result is that soybean prices are only weakly linked to soybean oil prices. In a specific example worked out and explained in detail here, a 10 percent increase in soybean oil prices led to a 4 percent decrease in soybean meal prices and less than a 2 percent increase in soybean prices. So the impact of soy biodiesel on food prices is mixed, increasing the cost of vegetable oil, but decreasing the cost of animal feed.

But while soybean production is not very responsive to soybean oil prices, other vegetable oils are more responsive, particularly canola and palm oil, which have a higher share of their value derived from vegetable oil. For this reason, increased use of soybean oil to make biodiesel does not lead to much increased production of soybeans, but primarily leads to substitutions among vegetable oils and ultimately more vegetable oil imports.

Import substitutions

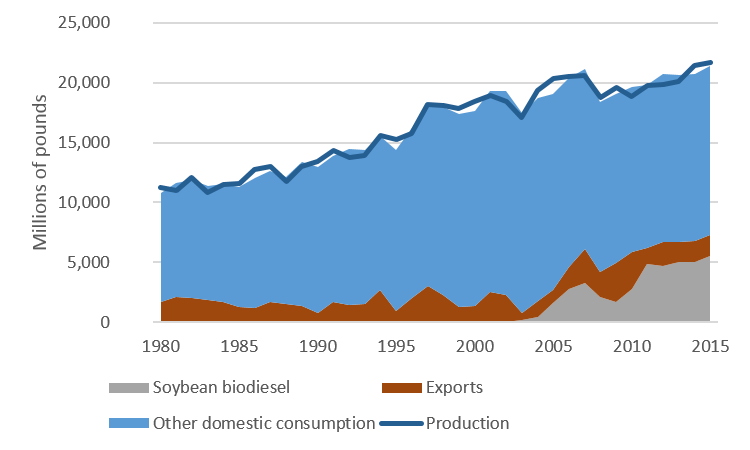

The substitution of imports for soybean oil used as biodiesel is clearly illustrated in recent agricultural statistics. Starting in about 2003, there was a relatively sudden increase in the use of soybean oil for biodiesel. This increase did not result in an associated jump in soybean oil production, which pretty much stayed on its previous trend, driven by steady growth in demand for protein meal.

Figure 5: Uses of U.S. Soybean oil (Source USDA ERS Oil Crops Yearbook)

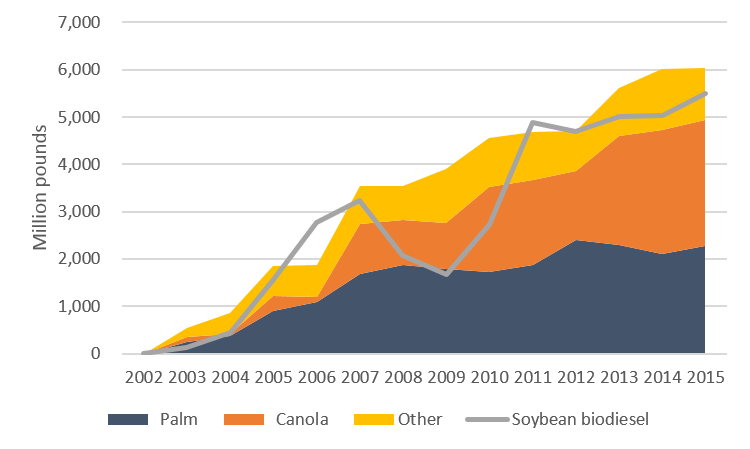

Instead, as US soybean biodiesel production grew, domestic consumption of soybean oil for food and other uses fell. Soybean oil use for food and other uses was replaced by imports of other oils, primarily canola and palm oil. This shows up quite clearly in the chart below, which compares the rising use of soybean oil for biodiesel to increased imports of palm, canola and other oils.

Figure 6: Soybean biodiesel versus growth in vegetable oil imports less exports (Source: USDA ERS Oil Crops Yearbook)

Oreos or truck fuel?

It is clear from the data that expanded use of soybean oil to make biodiesel was matched by growing volumes of imported vegetable oil, but the question of causality is a little trickier. That is because in the same timeframe that soy biodiesel consumption was growing, concern about the health impact of trans fats, mostly hydrogenated soybean oil, led to decreased consumption of trans fats, which were replaced in Oreos and many other prepared foods with other oils.

Some of the hydrogenated soybean oil was replaced with palm oil because of its similar properties. In this telling of the biodiesel story, biodiesel expansion is not the cause of increased imports. Rather, rising imports of palm and other oils were caused by changes in US food preferences attributable to health concerns; expanded production of soybean biodiesel was an outlet for the unwanted soybean oil, providing a substitute market while also displacing fossil fuel use and lowering the cost of soy meal for meat producers.

This optimistic interpretation is not implausible, but it is certainly incomplete. Vegetable oils are traded in a global marketplace, where demand for vegetable oil has been growing steadily. If the soybean oil no longer consumed as hydrogenated oil had been exported (either as vegetable oil or as whole soybeans) it would have found a market among the major vegetable oil importers. Vegetable oils are highly substitutable in many markets, and greater availability of soybean oil would have displaced some of the growing demand for palm oil.

Precisely quantifying these relationships is tricky, but given the link between palm oil expansion and deforestation, this alternative explanation paints a less optimistic picture of the climate impact of soybean biodiesel expansion in the last few years.

No more extra soybean oil for fuel

Regardless of whether you assign causality to falling demand for trans fats or rising demand for biodiesel, that chapter has come to a close. The shift away from hydrogenated soybean oil is now essentially complete; we should not expect a continued surplus of soybean oil.

In fact, the soybean industry is hard at work developing new technologies to regain lost market share in food markets. To the extent they succeed, it will further increase demand for soybean oil and lead to further substitution by palm and other oils.

The point is that increased use of soybean oil-based biodiesel in the US has a limited impact on soybean production, which is primarily determined by demand for protein meal. Instead, the main effect is to tilt the balance of demand in favor of vegetable oils versus protein meal, which favors sources like palm and canola. Canadian canola oil may supply some of this additional demand, but palm oil is the least expensive, fastest growing source of vegetable oil on the global market, and most likely to fill the void left by US soybean oil being used for fuel.

No free lunch

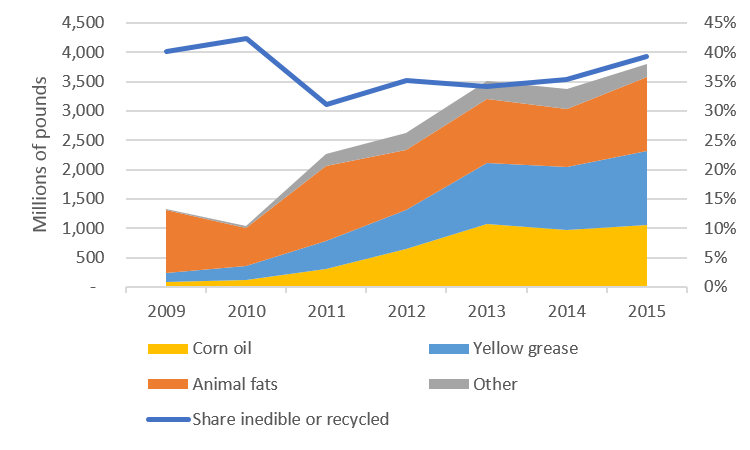

While the majority of biodiesel is made from the same vegetable oil used for cooking, about 40 percent is made from inedible and recycled oils and fats that are not used directly as human food. This share has stayed fairly constant even as biodiesel production has increased.

Figure 7. Sources and overall share of biodiesel made from inedible and recycled oils and fats (Source EIA Monthly Biodiesel Production Report)

Every schoolchild knows that recycling is good for the environment, and so increased use of used cooking oil and other recycled sources to make biodiesel is a feel-good story and gets a lot of attention. But like many stories we tell children, the reality is a little more complex.

It turns out that recycled oils and fats used to make biodiesel are not a free lunch for the environment after all. That’s because for the most part, these oils and other fats are not being diverted from landfills like egg cartons used for art projects. There are existing uses for these resources, including livestock feed, pet food, and to make soaps and detergents. If used cooking oil that was feeding livestock is diverted to fuel, the livestock will have to eat something else instead.

There are certainly some efficiency gains to using a lower value feedstock instead of food grade vegetable oil to make fuel, so while these recycled fuels are not a free lunch, they are certainly a discounted lunch. Determining exactly how much of a discount is tricky, and requires lifecycle analysis to figure out the indirect impact by estimating the replacements in animal feed and other existing markets. But ignoring the need to replace these products leads to unrealistically optimistic environmental assessments.

Biodiesel from ethanol

Another fast growing source of biodiesel is inedible corn oil produced as a byproduct of corn ethanol. Corn oil has historically been more expensive than soybean oil, and thus not an attractive source of biodiesel. But over the last few years, a new source of corn oil emerged that was competitively priced.

The corn ethanol boom of 2005 to 2010 saw a huge increase in production of distillers’ grains, an animal feed co-product of ethanol production that is left behind once the corn starch is made into ethanol. Ethanol producers learned that they could extract corn oil from the distillers’ grains, reducing the fat content of the animal feed in the process.

This distillers’ corn oil smells like a brewery and is not sold for human consumption, but it works for biodiesel and animal feed and sells at a significant discount to edible corn oil. Removing a portion of the oil from distillers’ grains of animal feed reduces its caloric content, but it does not reduce its value significantly. So this approach is quite profitable, and most ethanol producers adopted it.

Biodiesel produced from distillers’ corn oil grew by about ten times from 2010 to 2013, but leveled off thereafter. Corn oil associated with distillers grains is limited by corn ethanol production, and while some further shifting of oil from feed to fuel markets is possible, the increase associated with the ethanol boom is unlikely to be repeated, and is not the basis for a sustainable trend into the future.

Used cooking oil and other recycled feedstocks

One well known source of environmentally-friendly biodiesel is used cooking oil, which allegedly makes your old diesel car exhaust smell like French fries. Together with distillers’ corn oil, used cooking oil (also called yellow grease) has accounted for most of the growth of biodiesel from recycled oils and fats.

But while higher prices for used cooking oil has increased collection somewhat, most of the large sources of used cooking oil were already being collected. Increased demand for waste oil does not increase supply of used cooking oil, since this is a waste product whose quantity is set by demand for corn chips or French fries.

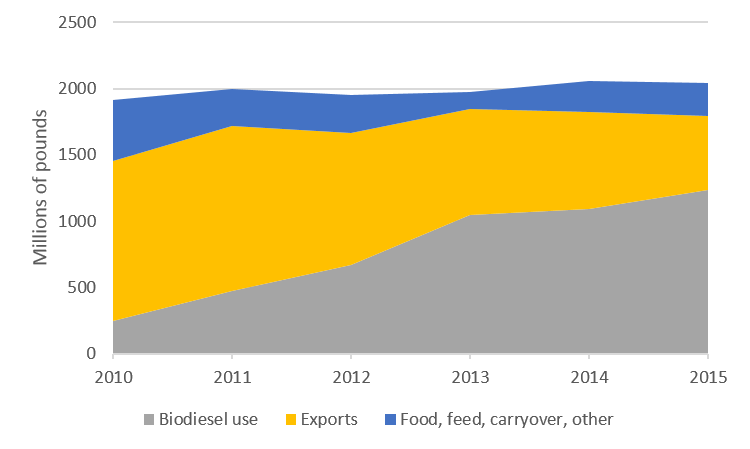

Figure 8: U.S. uses of yellow grease / used cooking oil (Source Render Magazine)

For the last few years, overall production of used cooking oil has been basically steady while biodiesel use grew from a small share to consuming 60% of domestic used cooking oil in 2015. The increase came mostly from reducing exports rather than increasing diversion from waste streams.

Even if 100% of our remaining exports are made into biodiesel, it would increase biodiesel production by just about 5%, and the current importers would have to look elsewhere to replace the lost oil. So there is not much more growth coming.

Slower growth ahead

I’ve walked you through the major domestic sources of biodiesel, qualitatively highlighting the limitations to domestic sources of biodiesel. Last year we commissioned Professor Wade Brorsen at Oklahoma State University to do a quantitative projection, and he determined that 29 million gallons per year of growth would be reasonable from domestic sources.

Twenty-nine million gallons sounds like a lot, and indeed it is enough to fill an additional 44 Olympic-sized swimming pools each year. But it amounts to less than 2% growth a year in biodiesel production, which is itself a small share of diesel production.

If biodiesel production grows faster than this rate it is likely to be either imported, produced with imported sources of oil, or produced by bidding away existing sources of oil from other users, who will in turn be forced to switch to imports.

The potential for significant and sustainable growth in domestic biofuel production depends upon moving beyond food-based fuels made from vegetable oil or corn starch and turning instead to biomass resources. These resources have the potential for significant—but by no means limitless—expansion as the technology to convert them to cellulosic fuels scales up.

The potential and implications of making ethanol from biomass is discussed at length in Chapter 3 of our recent report, Fueling a Clean Transportation Future. And as cellulosic ethanol technology matures, different biological or chemical processes can make the same resources into cellulosic diesel, jet fuel or other fuels or products as well.

What it all means for EPA policy decisions

Talking about government regulations is a good way to put people to sleep (at least my wife), so I saved this little lullaby for the finale. Each year, the EPA must put forth specific regulations to implement the Renewable Fuel Standard (RFS), which Congress passed in 2005 and was amended in 2007. In recent years, this has gotten tricky, as tradeoffs and constraints in the fuel system make realizing Congress’ goals complicated.

Last year the EPA made a major overhaul of its approach to the RFS, which basically put the policy back on track. This year they are sticking quite close to that approach (see this summary for details), which will help build stability and predictability for a policy that has been short of both.

For biodiesel, the EPA has proposed an increase of 100 million gallons, from 2 billion gallons a year to 2.1 billion gallons, the same increase they proposed last year.

Not surprisingly, the biodiesel industry has a more bullish view, and argues that EPA should expand mandates for bio-based diesel by 5 times as much, to 2.5 billion gallons.

This is 17 times more than Professor Brorsen found could be supported by domestic sources of oils and fats. Growth rates this far in excess of domestic resources will inevitably lead to much greater reliance on imports of either biodiesel or oils and fats to replace domestic sources bid away from existing users. The 500-million-gallon a year increase the industry seeks is unsustainable, and would set the industry up for a crash. It would also create a huge hole in the global vegetable oil market which would largely be filled by palm oil expansion.

To provide stable support for the biodiesel industry and to avoid unintended problems across the globe, it is important that policy support for biodiesel growth is consistent with the growth in the underlying sources of oils and fats. The EPA should scale back its proposal in light of these constraints.