According to the latest Tracking the Sun report from the Department of Energy’s Lawrence Berkeley National Laboratory (LBNL), prices for installed solar photovoltaic (PV) systems fell between 6% and 14% in 2012. The report also contains a 2013 snapshot for California systems, where prices fell by an additional 10% to 15% in the first 6 months.

Graph depicts the change in median prices for three PV size ranges. Graph courtesy of Tracking the Sun VI, LBNL.

This report is the sixth in a series looking at the price of installed and grid-connected PV systems from 1998 to the present. Price data is the installed cost or up-front cost incurred by the PV system owner prior receiving incentives. Therefore, prices don’t reflect trends in PV performance or other factors that may impact the levelized cost of this electricity. The analysis uses project-level data, and the most recent report synthesizes information from more than 200,000 individual residential, commercial, and utility-scale PV systems, which account for 72% of all grid-connected PV generation capacity installed in the U.S. through 2012.

Cheaper modules continue to drive price declines while “soft” costs linger

Module prices, which have fallen by $2.60 per watt (W) since 2008, have been the single largest factor driving PV system prices down. For the smallest category of PV systems—projects installed on residential homes- lower module prices accounted for roughly 80% of the total drop in system prices.

“Soft” costs not explicitly tied to the module—inverters, mounting hardware, marketing, installation labor, permitting—have also fallen over the long-term, but have remained relatively flat in recent years. These soft costs now represent a significant portion of installed system price, and are the current focus of policy efforts to bring down the price of PV. For example, nine cities in the San Francisco Bay Area have joined forces to simplify and streamline the permitting costs for solar installers, saving customers as much as $3,500 per installation.

PV systems cost more in the U.S.

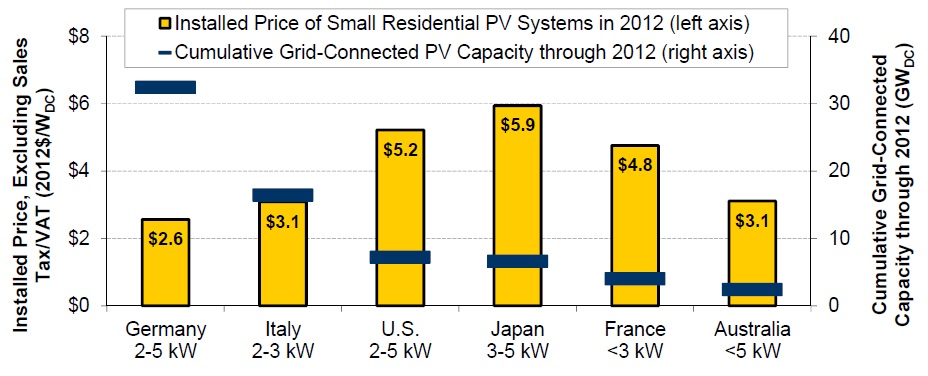

The report also looked at how small residential PV system prices in the U.S. compare to other prominent solar markets around the world. Prices for PV systems in Germany, Italy, and Australia were roughly 40% lower in 2012 compared to similarly sized systems in the U.S. Much of the difference is in soft costs since modules are typically priced by a global market.

Installed prices for small residential PV systems in major solar markets. Graph courtesy of Tracking the Sun VI, LBNL

Cash incentives for PV are also declining

As market prices have fallen, rebates and performance-based incentives provided by state or utility PV incentive programs have decreased as well, by roughly 85% over the past decade. These rebates have declined in response to a larger, more competitive market.

For more information

The report also contains analysis on how installed costs differ by size and location throughout the U.S. One of the most interesting findings about location is that many of the states with the lowest costs for installed PV also have some of the smallest markets. To learn more about the report and its findings, people are encouraged to attend a free webinar on key findings on Friday, August 16th at 11:00 am Pacific Standard Time.