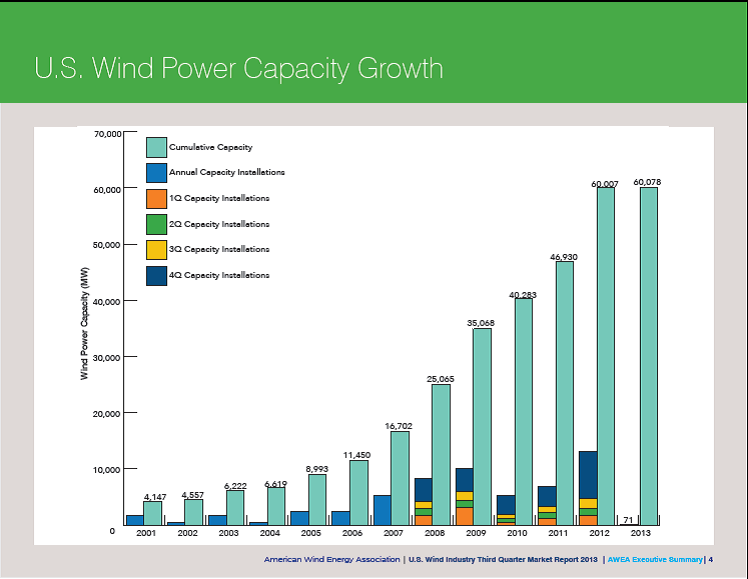

After a very slow start in 2013, U.S. wind development is really starting to pick up. According to the American Wind Energy Association’s (AWEA’s) just released Third Quarter 2013 Market Report, over 7,500 megawatts (MW) of new wind power capacity is under development in the U.S., representing an investment in the U.S. economy of roughly $15 billion. This is good news considering that only 1.6 MW was installed in the first two quarters of 2013, and only 68 MW in the third quarter. After installing a record 13,100 MW of wind capacity in 2012, the slow pace of development in the first nine months of the year can be attributed to the late extension of the federal Production Tax Credit (PTC), a few days after it officially expired at the end of last year (see more details here).

Other key highlights from the report:

- Utilities have signed or announced at least 42 long-term power purchase agreements (PPAs) with wind developers for 5,670 MW of new wind (75% of the total) in 14 states.

- State regulators have approved an additional 1,870 MW of utility-owned projects.

- Utilities have issued at least 28 RFPs for wind, renewables, or other capacity in 2013 that have led to over 4,000 MW of new wind to date in 22 states and the District of Columbia.

- Currently, 2,300 MW of wind capacity is under construction in 13 states, with Texas leading the pack (530 MW), followed by Michigan (362 MW), Nebraska (275 MW), Washington (267 MW), Kansas (254 MW), California (226 MW), and North Dakota (205 MW).

Source: AWEA, U.S. Wind Industry Third Quarter 2013 Market Report.

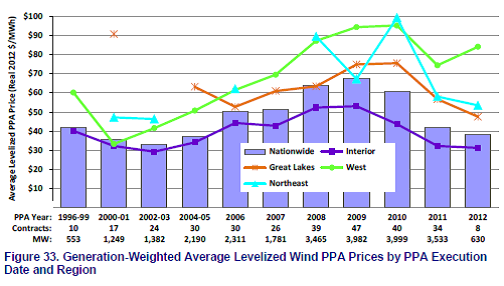

Favorable pricing for new projects

In addition to taking advantage of the PTC before it expires (again), utilities are also seeing very favorable pricing for new wind projects. Project data from the U.S. Department of Energy’s 2012 Wind Technologies Market Report show that PPA prices have fallen from a U.S. average of nearly $70/MWh in 2009 to below $40/MWh in 2012 — a whopping 43 percent decline over a 3-year period.

These reductions in PPA prices are largely due to reductions in capital costs and increases in capacity factors resulting from taller towers and new wind turbine designs. In 2012, PPA prices ranged from about $20/MWh to $80/MWh, with the lowest prices in the Plains states and higher than average prices in the West, Northeast, Great Lakes, and Southeast states (see figure below). Many wind projects in this price range are competitive with, and even less expensive than, new natural gas plants.

Source: Wiser, R. and M. Bolinger. 2012 Wind Technologies Market Report. U.S. Department of Energy.

Utilities are clearly taking notice, as my colleague Mike Jacobs noted, and are even using wind as a hedge against future increases in natural gas prices. For example:

- Xcel Energy has approval from regulators for 850 MW of new wind projects in Minnesota and Colorado at prices ranging from $25-35/MWh (with the PTC) over a 20-year period. According to Ben Fowke, Xcel Energy President and CEO, “It works out to a very good levelized cost for our customers…These prices are so compelling, the energy [cost] associated with it is less than you can do locking in a 20-year gas strip.”

- American Electric Power’s Public Service Company of Oklahoma, signed power purchase agreements for 400 MW of wind energy capacity, noting it decided to triple the amount of requested wind energy capacity. According to a company press release, “The decision to contract for an additional 400 MW was based on extraordinary pricing opportunities that will lower costs for PSO’s customers by an estimated $53 million in the first year of the contracts. Annual savings are expected to grow each year over the lives of the contracts.”

- Several Southeast utilities such as Alabama Power, Georgia Power, Tennessee Valley Authority, and Arkansas Electric Cooperative have recently signed long-term contracts with wind based primarily on economics. According to Paul Bowers, president & CEO of Georgia Power, “Adding additional wind energy to our generation mix underscores our commitment to a diverse portfolio that offers clean, safe, reliable, sustainable and low-cost electricity for years to come.”

Policy matters

Along with economics, policy is another important driver, and clarity about the policy is equally important. The IRS released guidance on PTC eligibility on April 15, and again on September 20, to give developers and utilities more clarity on how to move forward with projects. Under the new rules, projects do not have to be completed and operating by the end of the year to qualify. Instead, they have to be under construction and meet certain milestones and criteria, such as spending at least 5 percent of the project costs before the end of 2013. This gives developers and utilities a little more wiggle room to complete projects compared to the old rules that had a strict December 31 deadline.

State renewable electricity standards (RESs) also continue to be an important driver for wind development. While utilities in most states have enough renewable generation to comply with their current standards, many utilities are planning ahead to meet future requirements to take advantage of the PTC and recent wind turbine cost reductions.