The past few years have been ripe with exciting news of new electric vehicle models hitting the market. Recently, the anticipated release of electric light-duty trucks has dominated consumers’ attention. From the more esoteric designs of Tesla’s Cybertruck to Ford’s true-blue F150 Lightning to Rivian’s R1T that invokes the outdoor utility of a Patagonia backpack, it seems that quite soon there will be an electric truck tailored for every consumer.

While the rise of light-duty electric trucks is certainly exciting, it’s the upcoming release of electric heavy-duty trucks that has commanded my attention in recent months.

Zero-emission trucks were hardly considered viable just a few years ago, but now heavy-duty electric trucks – think semis, delivery vans, and other large commercial vehicles – are beginning to hit the roads and are poised to deliver significant benefits for clean air, climate change, and fleet operators. With nearly 80 percent of all heavy-duty trucks traveling less than 100 miles each day, range is no longer the issue it once was. The continued reductions in the price of batteries have also influenced the growth in model availability.

Nearly everything from delivery vans to semis can be electric now

The rapid growth in heavy-duty electric vehicle technology is encouraging. Today, over 100 models of commercial heavy-duty electric trucks and buses are available from manufacturers.

Household names like Volvo, Ford, and Freightliner as well as newcomers like Nikola, Tesla, and Rivian are developing and selling a wide variety of electric medium and heavy-duty electric trucks, from delivery vans to semis. Often an oddity when considering environmental goals, manufacturers seem to be well ahead of regulators when it comes to electrification. Daimler, whose trucks account for over 40 percent of the U.S. Class 8 truck market, plans to “significantly reduce” research and development of combustion vehicles and transition to zero-emission trucks in the next 10 to 15 years.

While the manufacturers are jumping on the market opportunity that heavy-duty electric trucks present, the federal government has no zero-emission sales requirements (for light- or heavy-duty vehicles for that matter) and California’s standards only require 40 percent zero-emissions sales for tractor-trailer trucks by 2035. It’s a vital missed opportunity that regulators are so out of step with the technology in this realm.

Electric trucks deliver wide loads of benefits

The benefits of electrifying heavy-duty truck fleets are significant – recent studies have shown that operating costs for electric trucks can be between 14 and 52 percent lower and repair costs around 40 percent lower than their combustion-powered counterparts. These savings, coupled with the continued decline in battery prices, are making electric trucks increasingly affordable. Although upfront costs for most electric heavy-duty trucks are greater today, research is showing that the total cost of ownership for these vehicles will be less than combustion-powered trucks, in all classes of trucks, before the end of the decade. In states like California and New York with policies that reward early adopters with purchase or fuel incentives, certain classes of electric trucks are showing near-favorable lifetime costs today.

Not only would fleet owners and operators see significant savings on operational expenses, but the rest of us could breathe much easier and the world’s most vulnerable communities and species could see fewer devastating impacts from climate change.

Despite making up only about 10 percent of vehicles on the road, those big, lumbering, loud trucks that deliver your food to supermarkets, goods to warehouses, and equipment and supplies to industry are responsible for 28 percent of greenhouse gas emissions, 45 percent of nitrogen oxides, and 57 percent of fine particulate pollution from vehicles in the U.S. Electric trucks, on the other hand, emit no tailpipe emissions.

While pollution from electricity generation is still significant, the pollution per mile traveled for EVs electric vehicles is significantly less for over 90 percent of US drivers. Additionally, it’s much easier to reduce emissions from stationary power plants and monitor them than reduce the emissions of millions of combustion-powered vehicles.

States play a major role in electric truck adoption

While the technology and availability of electric heavy-duty vehicles are quickly growing, the number of these trucks hitting the road today does not match the speed demanded by the climate crisis and the need to reduce air pollution. Today, less than one percent of heavy-duty trucks on the road produce zero-emissions, largely because of the higher upfront costs of electric trucks.

Policies and programs that create electric truck purchase incentives and invest in charging infrastructure can and will help to accelerate the market towards these cleaner options, but strong regulations that create electric vehicle standards for manufacturers and truck operators are a must to meet the need for clean air and climate stability. California’s zero-emission vehicles sales mandate and federal incentives were largely responsible for the accelerated development of the light-duty electric vehicle market and the same will be true for medium- and heavy-duty trucks and buses.

The good news is five states – Washington, Oregon, New York, New Jersey, and Massachusetts, – have adopted California’s Advanced Clean Trucks regulation, which requires manufacturers to sell an increasing percentage of zero-emissions medium- and heavy-duty trucks, beginning in 2024. In addition, California and New York provide purchase incentives for electric commercial trucks that cover the incremental cost of an electric model compared to its gasoline or diesel counterpart. California is also developing a regulation that would require the state’s largest and most profitable truck fleets to switch to electric options.

National solutions are necessary

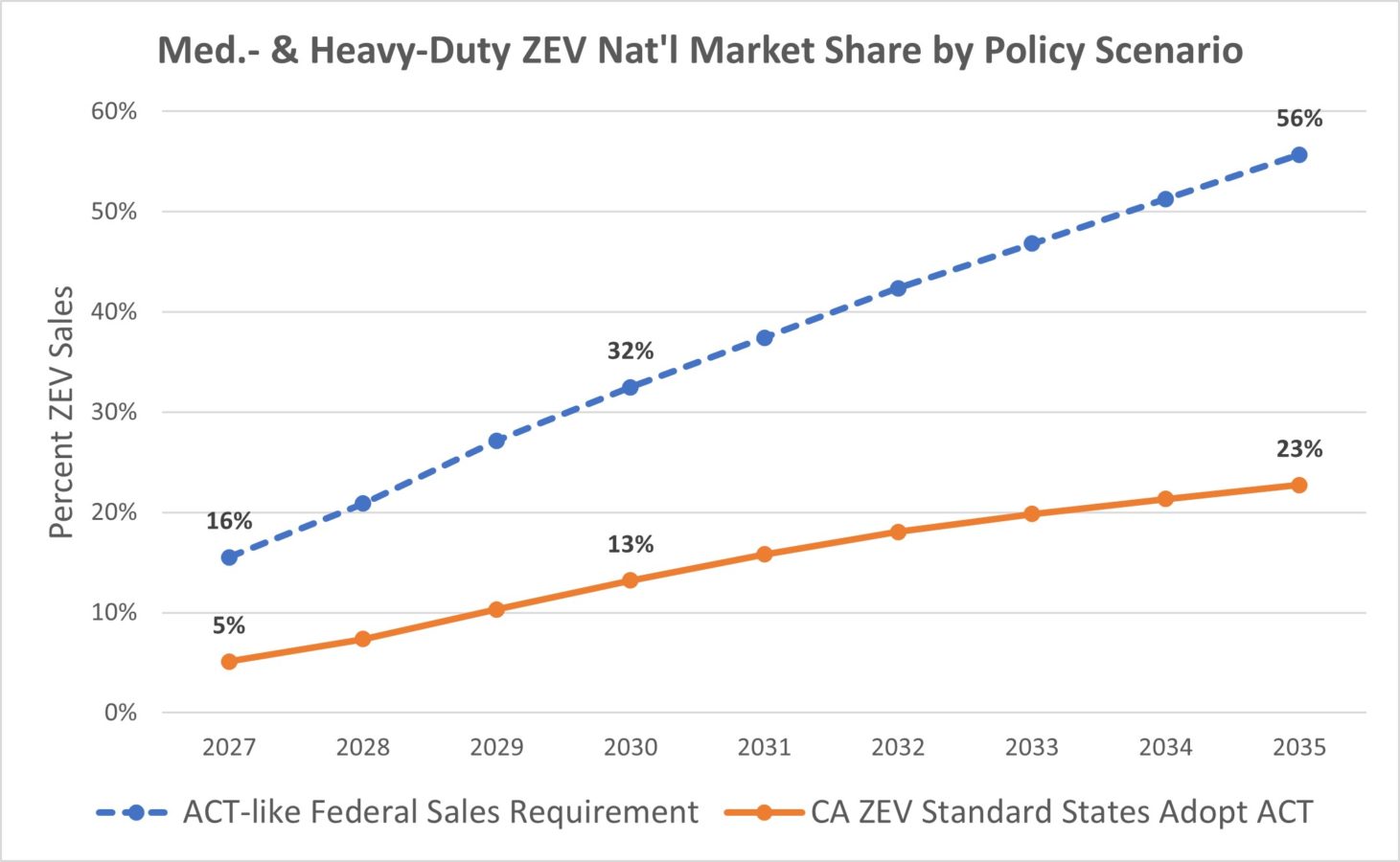

States are taking the lead in this space, but federal actions are necessary to affect the change needed to address climate change and air quality. If only the 15 states that follow the current California ZEV standards adopt California’s Advanced Clean Trucks Rule, only about 1 in 8 trucks sold in 2030 would be electric. However, if the federal government adopted similar sales requirements applicable in all 50 states, electric trucks could be about 1 in 3 of heavy-duty truck sales in 2030, even without purchase incentives (see graph below). That’s a whopping difference and closer to the type of progress we need to see in the transportation sector if we’re serious about reducing carbon emissions and air pollution.

Unfortunately, the Environmental Protection Agency recently missed an opportunity to begin requiring the electrification of medium- and heavy-duty trucks in its proposed update to the nitrogen oxide truck emissions standards.

Let’s turbocharge the zero-emission truck market

Nationwide purchase incentives, combined with sales requirements like the ones in the Advanced Clean Trucks Rule, would accelerate the market at an even more appropriate pace.

The Biden Administration’s Build Back Better proposal includes a 30 percent purchase incentive for electric trucks and buses. If this provision of the bill passes Congress, it would bring significant benefits to the medium- and heavy-duty electric vehicle market. A recent study by Resources for the Future found that a national 30 percent purchase incentive could influence electric trucks and buses to achieve an 80 percent market share by 2035.

Imagine the pace of electrification that could be seen if the Biden Administration moved to a full-court-press against climate change and toxic air pollution from trucks?

While we aren’t going to see electric trucks on every corner by the end of this year, 2022 could certainly go down as the year real momentum started towards a cleaner heavy-duty truck paradigm. With the anticipated release of several cornerstone truck models from Tesla, Nikola, and others, plus the potential for the federal government to act on the issue through purchase incentives and sales requirements, the technology and policy realms are primed to turbocharge the market towards a cleaner and more equitable reality.