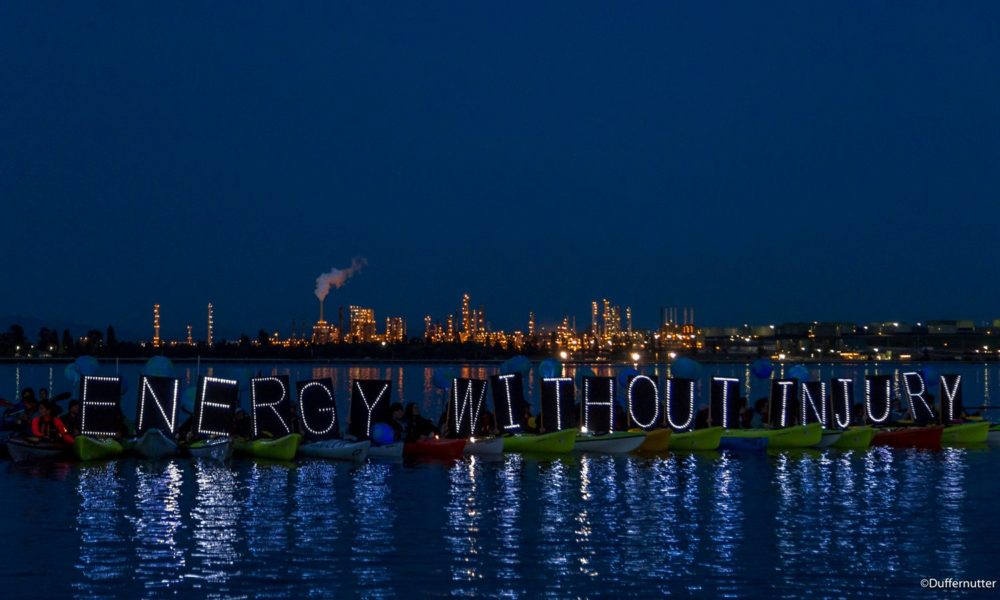

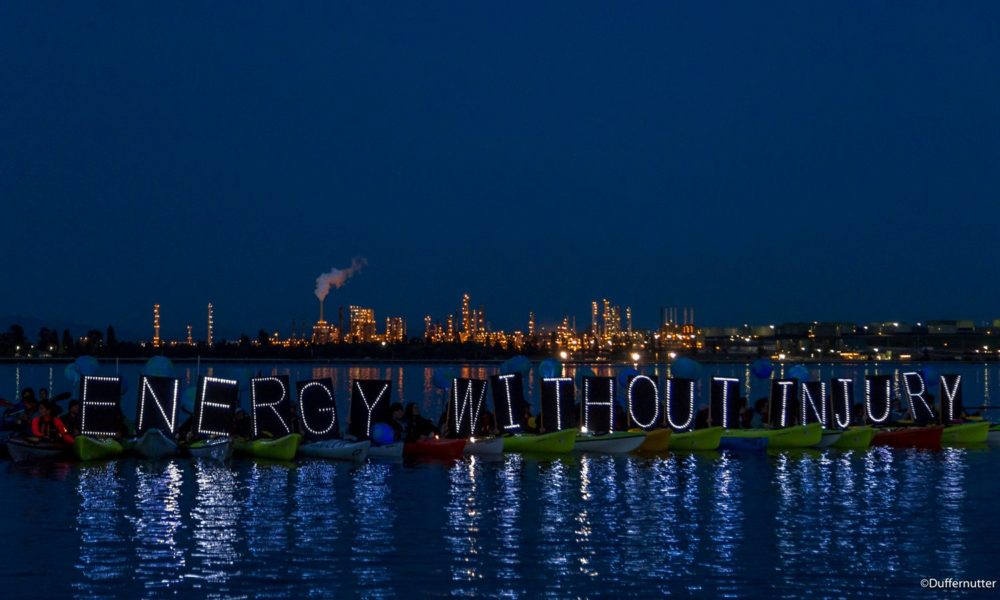

Backbone Campaign/Flickr

Backbone Campaign/Flickr

Nicole Pinko

Backbone Campaign/Flickr

Backbone Campaign/Flickr

Jim Bowen/flickr

Jim Bowen/flickr

Photo: John Fowler/Flickr

Photo: John Fowler/Flickr

Michael Fleshman/Flickr

Michael Fleshman/Flickr

Stephen Melkisethian/Flickr

Stephen Melkisethian/Flickr

rulenumberone2/CC by 2.0

rulenumberone2/CC by 2.0

Silar/CC

Silar/CC

Stefano Campolo/Flickr

Stefano Campolo/Flickr

Jennifer Gidaro/Flickr

Jennifer Gidaro/Flickr

Photo: Rainforest Action Network/Flickr

Photo: Rainforest Action Network/Flickr

GorissM

GorissM

James Palnisad

James Palnisad

Photo: Rainforest Action Network/Flickr

Photo: Rainforest Action Network/Flickr

Photo: nickton/CC BY-NC 2.0 (Flickr)

Photo: nickton/CC BY-NC 2.0 (Flickr)