At the beginning of every month, automakers report their sales and auto journalists and analysts pore over the data to see what trends there are to see. Many of the stories that result seem to indicate that doom is on the way for plug-in electric vehicles, so I dug into the data to see what big trends there were to uncover.

It turned out to me that it was almost all good news, which made me realize that we all need to be careful to not read too much into the horse race data and to avoid getting wrapped up in the sales hype that comes with each new vehicle introduction.

Plug-in vehicles are ahead of the pace set by hybrids

This is the second year since plug-in electric vehicles have returned to the U.S. market and they are doing pretty well. With four months left in 2012, over 25,000 plug-ins have been sold in the United States according to data from WardsAuto.com (subscription required). That is almost triple the 9,428 that were sold at the same point in 2011. It also ignores modest plug-in sales from Coda, Fisker, and Tesla because public information on their sales was not consistently available for the year.

A near tripling in sales is stunning enough by itself, but wait, there’s more. In 2001, the second full year of conventional hybrid sales in the United States, combined sales of the Honda Insight and Toyota Prius were about 20,300 units (again according to data from WardsAuto.com). That means that in just 8 months, plug-in EVs have already beaten 12 months worth of sales of conventional hybrids during a comparable period after market introduction. That is an impressive feat given the higher incremental cost of plug-in EVs compared to conventional hybrid electric vehicles, not to mention the state of our economy.

Plug-in hybrids are through the roof

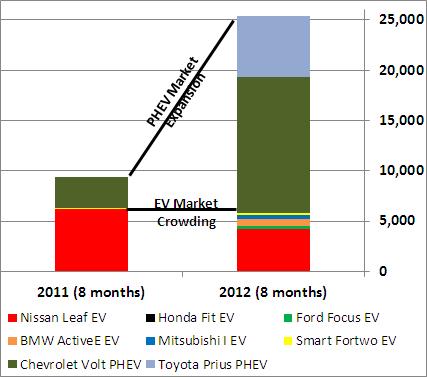

So, where is all this growth coming from? The market so far in 2012 was split roughly 27%/73% between pure battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), but it was the latter that saw the growth.

Plug-in electric vehicle sales have tripled so far in 2012, with plug-in hybrids in the driver’s seat and battery electric vehicles holding steady.

Chevy Volt PHEV sales have been impressive, increasing by about a factor of four so far over the same 8 months last year. In addition, the new plug-in Prius has nearly doubled the sales of the Volt from the same time last year. Together, they are responsible for nearly 20,000 units so far in 2012.

Battery EV options expand

The story for battery EVs is a bit more complicated. If you look only at the most popular BEV, the Nissan Leaf, you might start to raise an alarm. Leaf sales in the U.S. are down 31% compared to the same 8 months in 2011.

But the Leaf now faces competition from five other pure electric cars (see figure). Total BEV sales are actually about the same as they were last year, assuming modest growth from Tesla and Coda. The increased competition with flat sales almost makes the market look crowded as the new entrants appear to be cannibalizing the space that was held almost exclusively by the Leaf last year.

You can’t spin this as “good” news for BEVs, but I’m also not convinced it is bad news. BEVs face greater barriers than HEVs or PHEVs. Right or wrong, a stigma has been created about range anxiety, there’s not enough workplace charging infrastructure out there yet, some manufacturers aren’t doing the best job marketing their BEVs, consumers in key markets are having a hard time getting access to low electricity rates for nighttime charging, and costs still need to come down further. And if that were not enough, there has been negative publicity driven by politics, limited vehicle availability from some automakers, and a tough economy.

At the end of the day, I’d say that BEVs are just getting warmed up but they need more help to thrive.

Plug-ins are doing well, but don’t be blinded by unrealistic hype

Overall these numbers are encouraging. A near tripling in plug-in EV sales means a lot more batteries are being made, which will help drive down costs and/or allow for greater range. (There are already rumors of a 2013 Leaf with either longer ranger or lower cost.) The increased sales also mean that many more people are saving money on gas while becoming familiar with this new technology, an essential step to transition EVs from the early adopter market to the mainstream.

But I have to close with an important caveat. Despite the time I took to put these numbers together, I want to encourage you not to read too much into any of them.

Realistically, it is going to take at least a decade (and possibly more) for the plug-in market to shake out. I’d consider a national EV sales share of 5 percent in 10 years to be a huge success, but from all the excitement that surrounds the launch of a new EV, you’d think that was a pittance.

The real problem may be that automakers and others tend to hype new EV products by predicting revolutionary sales, when we should instead set the more realistic expectation that this is about market evolution.

So, what do you think? Do these numbers tell YOU anything about plug-ins? And what needs to be done to help this important technology become a success?