On February 9, 2012, the Nuclear Regulatory Commission approved the first-ever combined operating license that authorized the construction and operation of two new reactors: Vogtle 3 & 4 in Georgia, the first nuclear reactor project to commence construction in more than 30 years in the United States. But less than six months later, cost overruns are approaching one billion dollars while a dispute between the project’s developers and a consortium of contractors over these cost increases and associated schedule changes threatens to delay the project’s expected completion date.

While the reactors are scheduled to come online in 2016 and 2017, when they will actually begin to operate is anyone’s guess given the industry’s long record of cost overruns and schedule delays.

Site preparation already has begun for Vogtle 3 and 4, as shown above. Investing in renewable energy and energy efficiency would eliminate the need for this high-cost, high-risk generation project. Photo: Southern Company

This past April, project owners Georgia Power, Oglethorpe Power, the Municipal Electric Authority of Georgia, and Dalton Utilities announced that Vogtle was $900 million over its original $14 billion budget. Last week, Southern Company — whose Georgia Power subsidiary owns 45.7 percent of the project — revealed that it has failed to reach agreement with Westinghouse, Stone & Webster and other contractors regarding adjustments to the project’s cost.

According to the utility, the dispute over who must pay for what is now reported to be more than $950 million in cost overruns has gone to formal dispute resolution and could affect the project’s completion schedule. Since this project was first proposed, Georgia Power has refused to make most cost and schedule data public and continues to conceal many details about the project’s costs and risks. This should make Georgia ratepayers nervous, given that Vogtle 1 & 2 exceeded their original cost estimates by a whopping 1,200 percent.

Privatizing profits, socializing risks

All this uncertainty about cost and scheduling underscores the considerable financial risk that will be borne primarily by the public, not the utility companies. In Georgia, state law allows the utilities to pass on construction and pre-construction costs for nuclear power plants to ratepayers, effectively providing these utilities with a risk-free, interest-free loan from their customers—a loan that need never be repaid, even if these plants are never completed.

With Vogtle, it’s not only the utility’s ratepayers that are bearing the financial burdens of the project. All U.S. taxpayers could be at risk if Georgia Power and its partners accept an $8.33 billion U.S. Department of Energy (DOE) loan guarantee and receive hundreds of millions in federal tax production credits available under federal law.

Adding to the uncertainty of the project, Southern Company has revealed that its plan to use its portion of the loan guarantee to help finance Vogtle is up in the air. Southern’s latest quarterly SEC statement indicated that it is unclear whether DOE will issue Georgia Power the loan guarantee it seeks, although negotiations with DOE are ongoing. Southern has repeatedly stated that it can finance the plant with or without DOE assistance, given the company’s strong balance sheet and its access to financing thanks to favorable state policies that assure the company retail cost recovery. But this begs the question: If Southern doesn’t actually need the loan guarantee, why continue to seek it?

Cost-effective alternatives are available

Last year UCS commissioned a study by Synapse Energy Economics, Inc. that showed that new nuclear power plants are one of the most expensive options available for meeting Georgia’s energy needs. Synapse found that Georgia is far below the national average in spending on energy efficiency, even though studies show that the state could achieve substantial reductions in electricity use, and thus reduce the need for new generating capacity, by investing in energy efficiency programs.

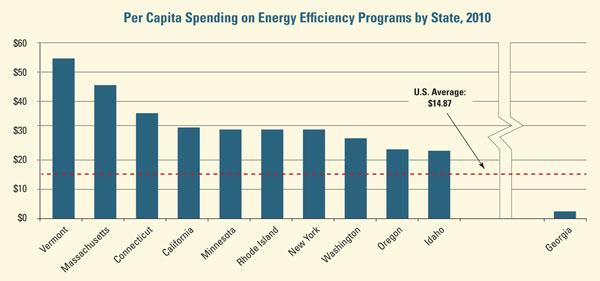

Georgia ranks thirty-sixth in the nation for energy efficiency, according to the American Council for an Energy-Efficient Economy’s (ACEEE) 2011 State Energy Efficiency Scorecard. ACEEE also calculated that Georgia spent only $2.18 per person on energy efficiency programs, well below the national average of $14.87.

Georgia lags far behind most other states (and Washington, DC) in energy efficiency; the state ranks 36th for overall progress on energy efficiency programs, and 45th on per capita efficiency spending.

Source: ACEEE 2011

Synapse also found that by 2025, renewable energy generation could outstrip the contribution from Vogtle 3 & 4 by a factor of more than 6 to 1. But unlike 29 states with policies that require utilities to invest in renewable sources for a minimum percentage of the electricity they provide, Georgia does not have such a policy.

A 2009 report by the Southern Alliance for Clean Energy (SACE) calculated that Georgia has the potential to generate 47,021 GWh of electricity from land-based renewable energy sources by 2025, approximately 35 percent of 2008 retail electricity sales; offshore wind could generate an additional 52,788 GWh. Even Georgia Power recognized the potential for renewable energy development in the state in 2010, asserting that “The state of Georgia and the Southeast have an abundance of forestry and woody biomass resources available for energy use.”

When combined with energy efficiency, renewable energy could completely eliminate the need to build large, high-cost, high-risk generation projects like Vogtle 3 & 4. This is a lost opportunity for Georgia and its citizens. But until Georgia and its utilities take action to pursue more economic alternatives, better hang onto your wallets, it’s going to be an expensive ride.