Last spring, the Midcontinent Independent System Operator (MISO), which operates the electricity grid serving 45 million people across the central United States, found out it was at a higher risk of power outages than it believed. The result, as I explain below, was skyrocketing electricity bills for thousands of people. To avoid similar outcomes in the future, MISO and its stakeholder community went into problem-solving mode.

MISO has historically attempted to ensure reliability of the electricity grid by operating a capacity market, through which “energy resources” such as power plants, wind farms, and energy efficiency or demand response programs get paid for their commitment to deliver electricity in the future. My colleague Mark Specht has described these capacity payments as “like paying for insurance—power plant owners get paid so that their plants are available to generate electricity just in case that electricity is needed.” Capacity markets also exist in other US regions, including the Mid-Atlantic, New England, and New York.

MISO’s capacity market was not able to guarantee enough energy resources would be available to meet the electricity needs of customers in its midwestern states for the next year. As a consequence of this shortage, the price for capacity skyrocketed, ultimately impacting utility bills. The shortage resulted from the accelerated shutdowns of polluting resources such as coal-fired power plants and a higher forecast for energy needs.

In the MISO region, how much energy resources get paid for their commitment to produce electricity has seen big swings. From June 2021 through May 2022 the price was five dollars per megawatt (MW) of electricity capacity provided per day ($/MW-day) for MISO’s midwestern states, but from June 2022 through May 2023 it jumped to $236/MW-day.

Source: Federal Energy Regulatory Commission

This is not the first time price swings have happened, but this time they triggered MISO and its stakeholders to work together and agree on the need to better understand how energy resources get paid for this “insurance” they provide to the grid and how the market might be improved.

As the region continues to transition to a grid powered by clean energy, followed by the needed shutdown of uneconomical, polluting power plants, grid operators have fewer excess resources sitting around available to meet electricity needs. The question of how to ensure reliability and how much should be paid for it has risen in importance.

What went wrong with the capacity market?

MISO’s capacity market runs an auction every spring, and its goal is to ensure reliability for the next year, from June to May. The capacity market serves as a platform for supply and demand for reliability. On the supply side are the energy resources. On the demand side are the utilities responsible for ensuring their customers have access to reliable power.

Utilities have the option to participate but are not required to do so if they prefer to meet their reliability needs independently. Most utilities, representing 95 percent of the demand in MISO’s footprint, own energy resources or have contracts to meet their reliability needs without needing to go to the capacity market. While only 5 percent of the total demand in MISO relies significantly on the auction, that 5 percent is still key to ensuring grid reliability and avoiding shortages that can impact thousands of customers.

As part of its capacity auction, MISO looks at supply and demand to determine how much utilities will pay for the capacity to meet its reliability targets. The grid operator establishes the details that govern the capacity market, with input from stakeholders and oversight from the Federal Energy Regulatory Commission.

Every year MISO identifies its reliability needs for the next year—the megawatts of energy resources needed to meet its reliability target of no more than one outage event every 10 years—and determines the price for different levels of reliability.

In a competitive market, supply and demand would act freely and adjust to one another and a price would emerge—the “invisible hand” of the market. In a regulated market like capacity markets, however, the hand is not so invisible, as MISO determines how the demand side of the market will behave in terms of quantities needed and how much the resources needed to meet that demand will be paid.

Typically, in competitive markets, supply increases as the price increases, because suppliers want to make more money by selling at the higher price. Demand, conversely, decreases as the price increases, because consumers are less interested in paying for something as it gets more expensive.

Until now, MISO has followed a different approach to the typical behavior of demand. Instead of gradually increasing demand for capacity as price decreases, MISO has been applying an approach that results in big price swings.

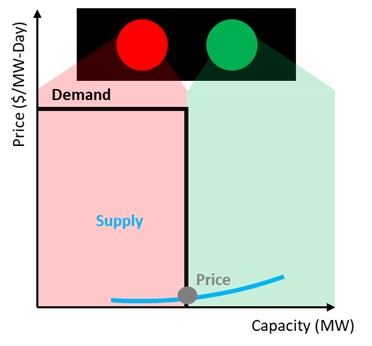

With this approach, if supplies meet MISO’s reliability target the price is low. If supplies do not meet the reliability target the price is high. My colleague John Moore at the Natural Resources Defense Council says you can think of this as MISO running its capacity market with a traffic light that only has a green light and a red light, no yellow.

If supplies meet the grid’s needs, reliability is good—the light is green. No matter how much excess capacity exists, the price for reliability will be low, even if the excess is very close to how much is required. For instance, MISO has seen prices for capacity as low as $0.01/MW-day.

Now, if supplies do not meet the needs identified by MISO when it calculates its reliability target for the next year, then the grid is in trouble, and prices will skyrocket and power outages are more likely to occur, much like what unfolded in spring 2022. Prices for the Midwest region of MISO’s footprint reached close to $240/MW-day.

What is the impact on reliability and utility bills?

A market that results in big price swings and that may be harming grid reliability draws attention. That attention has led MISO together with its stakeholders (including states, utilities, renewable energy developers, and clean energy advocates) to work on a solution to address this problem.

The problem here is the grid operator not pricing reliability adequately, so when a utility is forced to pay more for reliable electricity, it passes those costs along to its customers by raising their electricity bills. Inadequate reliability pricing also sends inconsistent signals to energy resources that have to decide whether to enter the capacity market or not.

If you’re in the Midwest and served by a utility in the MISO territory that participated in this capacity market, your bill increased. This was the case for customers of the Illinois utility Ameren. Ameren estimated that its average bill would increase by $52 per month, or $626 a year.

MISO’s Independent Market Monitor, which has oversight of MISO’s capacity market, has mentioned that this approach resulted in “understated capacity prices.” It also estimated that about five gigawatts of resources left the market in the four years prior to 2022.

State energy regulators, represented by the Organization of MISO States, have also shared a statement indicating the current system “may not appropriately value the reliability benefits of excess capacity.”

As the MISO region continues to retire polluting power plants, it is important that its growing fleet of energy resources—predominantly clean energy resources—are priced fairly for their contribution to a reliable grid.

With the current red-/green-light-only system, MISO could have multiple years of a green-light outcome, when in reality the actual excess capacity may be shrinking over time. Though capacity may be close to crossing over to red, the market and its pricing structure is not providing that economic signal.

How will MISO set the right price?

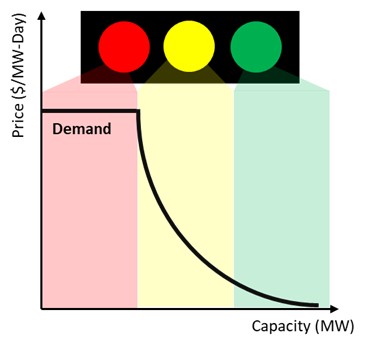

The solution centers on adding the missing range of prices for capacity—the equivalent of a yellow light that would kick in once we have a little extra capacity above the grid operator’s needs, but not so much that we are out of the woods for power outages.

MISO is now designing this solution and most state regulators are on board. The Organization of MISO States issued a statement indicating its support for this change, which would “ensure reliability needs are met across the region at a reasonable cost for ratepayers.”

The expectation is that this new range of prices for capacity will result in fewer price swings and send better signals to energy resources as to when to enter or exit the market.

We would go from a pattern swinging between high and low prices to a method that results in more gradual changes in price. If the auction sees a little excess capacity, the resulting price would be less than if we had a shortage—red light conditions, but not as low as if there was no risk of an outage—green light conditions. This should give better signals to energy resources on the reliability value they provide to the grid.

With this new pricing structure, if an auction sees a lot of excess capacity, the price would be low and signal to resource owners that this much capacity does not need to be available.

The details regarding how much reliability will cost and how much it will change compared with the current system are not yet known. MISO and its stakeholders are working on implementing this conceptual change while considering all the specificities of the grid.

A capacity market that provides more accurate prices tied to the reliability value an energy resource can provide will increase interest in that resource. These more consistent and accurate price signals should also incentivize resources like energy efficiency and demand response because they are even more dependent on consistent price signals than other resources like big power plants.

Implementing this change should contribute to a more reliable grid, reduce the risk of power outages, and result in more stable utility bills.

Special thanks to Casey Roberts at Sierra Club, Sameer Doshi at Earthjustice, and Toba Pearlman and John Moore at Natural Resources Defense Council and Sustainable FERC Project for all their insights on capacity markets and the impact of capacity prices.