Yesterday I posted a lengthy, data-based analysis of the past and present of our biofuels policy. Now I’d like to go back to the future and examine the consequences of expanding mandates for food-based biofuels to make up for the slow commercialization of better, non-food “cellulosic” fuels. While the expansion of biofuel mandates will probably not create a chain reaction that would unravel the very fabric of the space-time continuum, this will be a bit of a walk into frightening territory – so proceed with caution.

This post is part of a series on The Future of Biofuels.

This post is part of a series on The Future of Biofuels.

The U.S. Environmental Protection Agency (EPA) is undergoing a process that will set the volume level for the 2013 advanced biofuel mandate. There are a couple different types of biofuels that make up the advanced mandate: biodiesel, cellulosic (non-food) biofuels, and any other biofuel that achieves 50 percent lower life-cycle greenhouse gas emissions than gasoline.

As I’ve previously mentioned, most of the growth in the advanced mandate was intended to come from cellulosic biofuels – but these have been slower to come online than originally envisioned when the Renewable Fuel Standard (RFS) was enacted in 2007. As a result, the EPA now faces a decision over what to do with the cellulosic shortfall. One option is to maintain the level of growth that the RFS initially called for, thereby allowing sugarcane ethanol, biodiesel, and other advanced biofuels to fill the gap left by the cellulosic shortfall.

There are two potential sources of biofuel large enough to fill the cellulosic shortfall: sugarcane ethanol from Brazil and biodiesel made from vegetable oil or animal fats. Today I’ll look at sugar, and will cover biodiesel in a separate post over the next few days.

Sugarcane ethanol is good for Brazil – if it stays there

Traditionally, Brazil has been a big fan of sugarcane ethanol and has the world’s largest fleet of flex fuel vehicles (FFVs) that can run on either gasoline or ethanol, with a fuel distribution system to match. (The U.S. also has several million FFVs on the road, but without coordinated fueling infrastructure, fuel pricing, and driver education, these cars have not used much ethanol to date.) Recently, however, production of ethanol in Brazil has stalled.

Data source: UNICA Data; BG = billions of gallons

Meanwhile, although overall car ownership and fuel use is growing in Brazil, Brazilian drivers have been moving away from ethanol toward gasoline. The reason for this is simple: with demand for ethanol exceeding supply, gasoline has been cheaper. The result is that even though Brazil has infrastructure (cars and fueling stations) capable of running on a high share of ethanol, the percentage of ethanol in the fuel supply has declined from 41 percent in 2009 to 26 percent in 2012.

Data source: UNICA Data; BG = billions of gallons

Now, what does all of this have to do with American biofuel policy? Well, if the EPA decides to stick to its timeline for reaching 36 billion gallons (BG) of biofuel in 2022, sugarcane ethanol is one of the fuels that will need to fill the void in the mandate left by cellulosic biofuel. U.S. demand for Brazilian sugarcane ethanol would increase sharply, leading to us importing more sugarcane ethanol from Brazil while Brazil shifts their vehicles back to gasoline.

It would be a strange future indeed if Brazil, having built out the most flexible fueling infrastructure in the world, moves their fleet of FFVs back to gasoline while the U.S. uses more and more Brazilian ethanol for the purpose of reducing global warming pollution. Since global warming pollution is global, shifting where the sugarcane ethanol is consumed from Brazil to the U.S. will not accomplish anything.

Long-term implications for sugar ethanol

Looking further down the road, the picture gets even bleaker. In a recent paper, Meyer and Thomson looked into the consequences of different EPA decisions on the future of the RFS. Two of the scenarios they modeled track with what I am calling the 36BG RFS and the 20BG+ RFS. The first consequence of the 36BG RFS is enormous growth of sugarcane ethanol imports, primarily from Brazil.

Data: Meyer and Thompson and additional data provided by the authors

By 2021, their analysis suggests the U.S. would need to import more than 10 billion gallons of sugar ethanol. Since Brazilian ethanol production has never exceeded 8 billion gallons, this would require a very rapid growth of the Brazilian ethanol production, and for the U.S. to import a very large share.

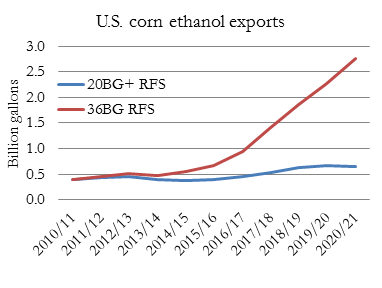

In fact, with Brazil exporting so much ethanol, the Brazilians would likely need to import growing amounts of corn ethanol from the U.S. to meet their domestic demand. The Meyer and Thompson analysis suggests corn ethanol exports would rise more than five-fold.

Data: Meyer and Thompson and additional data provided by the authors

The result for the U.S. agricultural system would be a de facto expansion of the corn ethanol mandate, which is capped at 15 billion gallons to limit the competition between ethanol and other uses of corn, as corn ethanol is exported to Brazil while we import their sugarcane ethanol. Under the more sensible 20BG+ RFS, expanded use of corn for ethanol starts to taper off, which is a good thing.

Data: Meyer and Thompson and additional data provided by the authors

The world is watching

A related analysis was included in the OECD-FAO Agricultural Outlook 2012-2021. The fact that the Organization for Economic Co-operation and Development and the Food and Agriculture Organization of the United Nations devoted an entire chapter of their global long-term outlook to biofuels, and about half of that to evaluating the future of the RFS, is an illustration of how profound the decisions facing the EPA are for the U.S. and the world.

Their analysis suggests that as the U.S. imports more ethanol in a 36BG RFS instead of a 20BG+ RFS, Brazil’s internal use of ethanol will drop by more than 4 BG, and use in the rest of the world will also drop for a total decrease of 4.75 BG. So of 10.6 BG of imported ethanol in 2020/2021, 45 percent of it will be not new production, but ethanol use in other countries, with the shortage made up by increased gasoline use as discussed above for Brazil. With circular ethanol trade between the U.S. and Brazil accounting for much of the remaining ethanol, the net result will be that just a third of the advanced ethanol used in the U.S. will be new advanced ethanol production, and the remainder will be indirectly replaced by gasoline and corn ethanol. If significant indirect impacts are considered, as is required by the RFS, the overall impact of a higher mandate will not meet the greenhouse gas reduction targets required for advanced biofuels.

Fortunately, this is only one possible future. Congress gave the EPA the authority to choose the 20BG+ RFS route, which is a more prudent path to cutting oil use over the long term than the 36BG RFS trajectory. The sooner the EPA decides to make this course correction, the safer for all of us. The fuels of the future are scaling up now, but without a time traveling DeLorean, it is going to take a little longer than planned to reach our 36 billion gallon goal. Sugarcane ethanol has a role to play in our fuel future, but it is no substitute for cellulosic biofuels.

Tomorrow we will examine whether biodiesel is ready to take up the slack (hint: it’s not).

Learn more about the future of biofuels

- The Future of Biofuels in 10 Charts and Maps

- The Future of Biofuels Part 3: Biodiesel

- The Food Versus Fuel Fight Is About Much More Than Corn

- The Coming Fork in the Road for Biofuels