Coal—and the president’s ill-conceived plan to bailout the industry—is taking up a lot of bandwidth in discussions around national energy policy. As the president and the coal industry continue to rely on dubious arguments to justify the idea of keeping economically struggling coal plants afloat, we began to wonder: what are electric utilities doing on the ground? How are they approaching the question of future investments in technology?

Today I’m handing my blog over to our 2018 UCS Schneider Fellow Eli Kahan, who has studied how utilities are planning for future electricity needs, what they are doing in terms of new investments in low-carbon generation sources, and how that compares to their stated goals.

—

Market pressures

In the past decade, due to advances in horizontal drilling technology and the fracking boom, domestic natural gas prices have plummeted, incentivizing many power plant owners to shift from coal to natural gas. Moreover, in the past few years, renewable energy such as wind and solar have continued to grow at record rates as these renewables have become highly economically competitive with traditional forms of electricity generation. A look at Lazard’s 2017 Unsubsidized Levelized Cost of Energy report shows wind as the world’s cheapest source of energy with utility scale solar not far behind.

As such, this rapid decline in coal generation has been driven primarily by market forces. While the administration’s proposed bailout might buoy a few coal plants destined for retirement in the next few years, this crutch is unlikely to keep coal afloat in a time of ever-falling costs of renewable energy, to say nothing of the urgent need to act on climate change.

Another key reason this bailout is unlikely to stick is due to a recent surge in announcements of utility goals to reduce CO2 emissions. Who is setting these targets? What is driving them? And how are utilities planning to meet these goals?

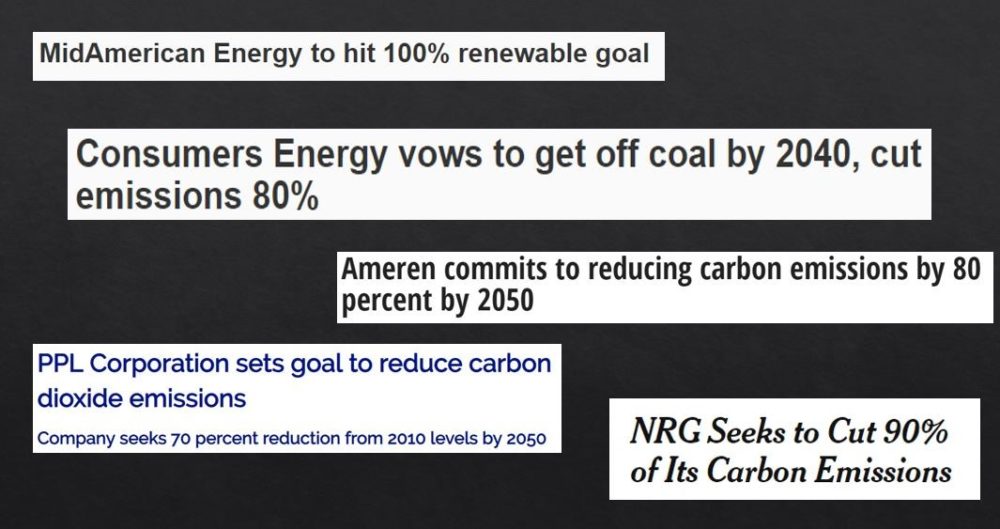

Utilities around the country have announced significant emissions reduction goals.

The targets

To begin answering these questions, I gathered data on more than 100 of the nation’s largest electric utilities and parent energy companies—more than 30 of which have set quantitative targets for reducing CO2 emissions, achieving higher percentages of renewable energy, and/or completely moving off of coal. Together, these companies, including 7 of the 10 largest electric utilities by market value in the country, account for nearly 40% of 2016 US electricity sales. These utilities are showing awareness of the science, costs, and their consumers’ concerns in setting sights on a lower carbon future.

While these goals come in many shapes and sizes, they all share one thing in common: additionality—all of them voluntarily exceed state goals and mandates. Moreover, the majority of these targets have been set in the past couple years—a time when the Clean Power Plan has been on the chopping block and during a fossil-fuel-friendly presidency.

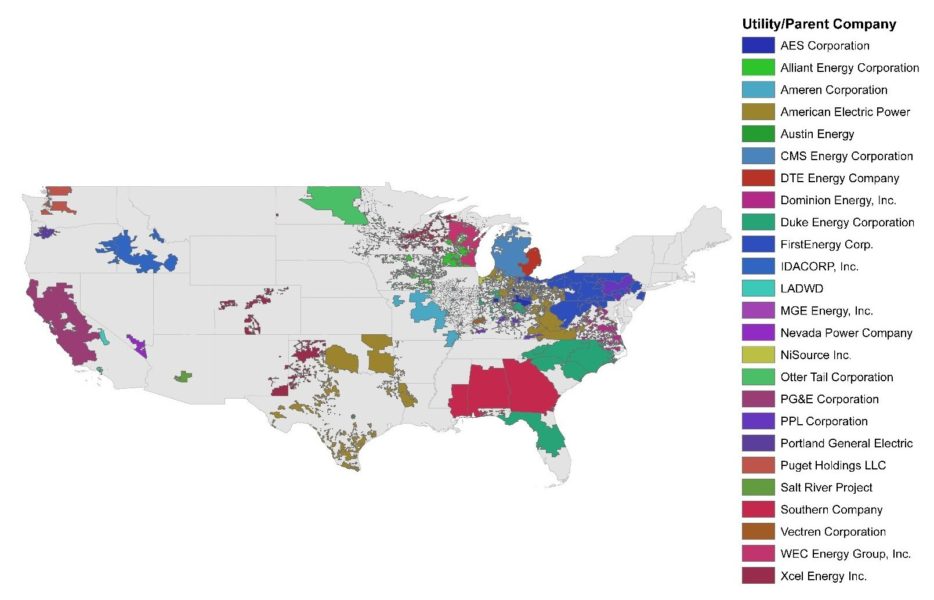

Furthermore, as the map below shows, this is a national trend—these targets are not restricted to just a few leading states but rather can be found all around the country, even in places that rely heavily on coal.

Electric Utility Companies with targets deemed to provide additionality. Not shown: Avangrid, Engie, Great River Energy, MidAmerican Energy, Minnesota Power, NextEra Energy, NRG, Tennessee Valley Authority. Since the analysis done for project, California’s SB100 has nullified the additionality from PG&E’s and LADWDs’ goals.

What else is driving this trend?

There’s little doubt that falling prices for natural gas and renewables have aligned cutting emissions with cutting costs, and the success of state renewable portfolio standards (RPSs) and greenhouse gas (GHG) emissions reductions targets has played a role in breaking up the inertia on decarbonization. But according to the utilities themselves, there exists a whole host of additional motivating factors.

For AEP’s Appalachian Power President, Chris Beam, the motivation is customer preferences:

“At the end of the day, West Virginia may not require us to be clean, but our customers are” –Chris Beam

For Berkshire Hathaway Energy’s vice president for government relations, Jonathan Weisgall, it’s customer input focusing on the role of corporate commitments:

“We don’t have a single customer saying, ‘Will you build us a 100 percent coal plant?’…Google, Microsoft, Kaiser Permanente — all want 100 percent renewable energy. We’re really transitioning from a push mandate on renewable energy, to more of a customer pull.” –Jonathan Weisgall

For DTE, it is a science-based response to the issue of climate change:

“Through our carbon reduction plan DTE Energy’s is committed to being a part of the solution to the global climate crisis. There is broad scientific consensus that achieving 80 percent carbon reduction by 2050 will be necessary to begin to limit the global temperature increase below two degrees Celsius over preindustrial levels” –DTE 2018 Environmental, Social, Governance, and Sustainability Report, p.3

Even coal-heavy American Electric Power (AEP) is moving toward a clean energy future, recognizing the value of investing in renewable energy. AEP serves customers in 11 states—including Ohio, Indiana, Kentucky, Virginia, and West Virginia. Nick Akins, AEP’s CEO, is skeptical of the administration’s plans to bailout certain coal and nuclear plants. Although his position is a bit more nuanced—claiming that coal “remains important to the reliability and resiliency of the grid”—Akins is clear-eyed about the future, charting AEP’s path toward a 60 percent reduction in carbon emissions by 2030, and 80 percent by 2050:

“Our customers want us to partner with them to provide cleaner energy and new technologies, while continuing to provide reliable, affordable energy.” –Nick Akins

How are utilities meeting these goals?

For the past decade, utilities have been cutting GHG emissions and costs by shedding coal and transitioning onto natural gas. Natural gas is sometimes seen as a “transitional fuel” on the path to a clean energy future, as it is known for producing 50-60 percent less CO2 than coal does in combustion. Southern Company, shown below, provides a particularly illustrative example of this coal to natural gas switching.

However, natural gas is not particularly clean, especially when considering available renewable energy alternatives. And with the recent dramatic cost declines in wind and solar, companies like MidAmerican Energy, shown above have realized they can skip the “transition fuel” and get a head start on investing in a more long-term energy solution.

Over and over, it’s the same story:

“Retiring older, coal-fueled units. Building advanced technology natural gas units. Investing in cost-effective, zero-carbon, renewable generation” – WEC Energy Group

“The company expects to achieve the reductions through a variety of actions. These include replacing Kentucky coal-fired generation over time with a mix of renewables and natural gas” – PPL

“Traditionally, our generation portfolio has depended on coal, but we are transitioning our energy supply away from coal to rely more on renewable energy and natural gas generation as backup. From 2005 through 2026, we will retire more than 40 percent of the coal-fueled capacity we own under approved plans, and if regulators approve our proposed Colorado Energy Plan in 2018, we will retire even more.” – Xcel

In short, utilities around the country are retiring coal, and investing in natural gas and renewables. But it’s important to emphasize that there is a serious risk of an overreliance on natural gas. Natural gas is subject to price volatility (putting consumers at risk of higher prices) and is inconsistent with long-term deep decarbonization targets. Utilities prioritizing clean, cost-effective renewable energy instead are protecting their customers from gas-related risks.

Connecting the dots

We’ve seen a recent flurry of utility announcements of decarbonization goals and renewables targets. In the last decade, natural gas has steadily eaten away at coal’s market share of the nation’s electricity production. And the costs of renewables continue to fall dramatically, making them both clean and cost-effective. This trend shows no sign of changing. Some utilities such as Consumers Energy have even explicitly pledged to drop coal altogether.

In that context, how does the administration’s proposed bailout, which would cost billions to keep a few of the nation’s oldest, dirtiest, most expensive coal plants on line for another couple years, make sense? Grid operators and federal regulators have consistently said that near-term retirements pose no threat to grid reliability. Reserve margins—that is, how much extra electricity generating capacity is available beyond expected peak demand levels—are sufficient in most regions of the country. And besides, studies show renewables are diversifying the electricity mix, making the electricity grid more reliable and resilient.

We see that some utilities are making decisions prudent for their long-term planning: smart investments, achievable decarbonization targets, and a mix of energy sources in their portfolios. But a bailout of this nature will send utilities—along with their investors—scrambling to square established goals with the administration’s backward steps.

Even with the temporary crutch, coal has no long-term future, as it continues to be displaced by cheaper and cleaner forms of energy. Instead of propping up a dying industry, our collective interests would be better served by ensuring that the miners and coal plant workers—whose livelihoods will be threatened by this transition—have new opportunities to find good jobs with family-supporting wages. We can and should look to our nation’s utilities and their clean energy targets for a clearer vision forward.