Two new reports have a wealth of information about the cost of rooftop solar in the United States. Here are six important cost-related takeaways, with a whole lot of great news.

Recently Lawrence Berkeley National Laboratory (LBNL) released its annual Tracking the Sun assessment of solar in the U.S., and GTM Research and the solar industry association (GTM-SEIA) put out the latest installment of their quarterly Solar Market Insight reports. Both are consistently useful resources, including for solar cost information.

The latest on rooftop solar costs

Here’s what LBNL and GTM-SEIA have to say:

1. Costs for installed solar systems have continued to drop. Prices for rooftop solar fell yet again in the first half of 2014. We’ve already reported on the impressive recent-year drops in solar costs. For their latest report, GTM-SEIA calculated that, just between the first quarter of 2014 and the second, average residential solar prices dropped another 2.4 percent. LBNL found that in the first half of 2014 the larger state markets had smaller solar systems drop an average of 4 percent.

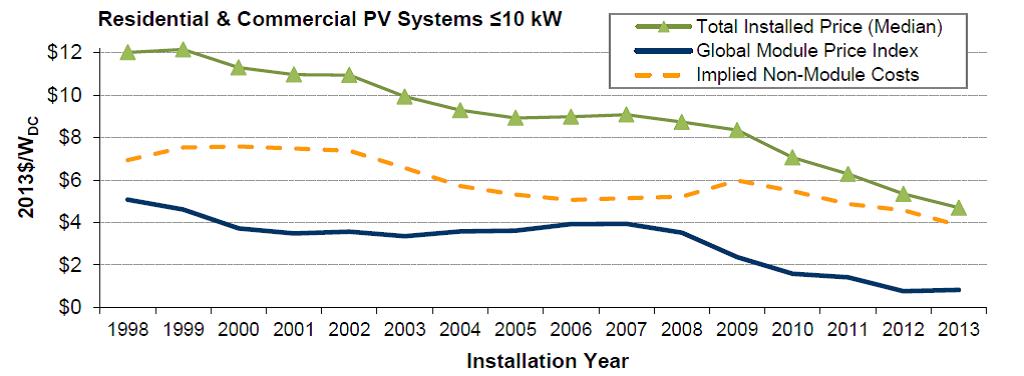

PV system costs have kept dropping, even when module costs haven’t. (Source: LBNL)

2. Costs dropped even though module (solar panel) prices didn’t. LBNL reports that “Installed price reductions in 2013 occurred despite flattening of module prices.” Those continued drops, the report says, could be from lags in module price effects, the fact that the market is still feeling prior-year drops in solar panel costs. But LBNL suggests “possible growing contributions” from cuts in soft costs—costs for stuff like sales, permitting, inspection, and profits—and other technical components. (See #3.)

3. U.S. prices have lots more room to drop. Despite our great progress in recent years, we still have prices higher than those in Europe. LBNL reports that residential systems (less than 10 kilowatts) cost less than half as much per-watt in Germany, the world leader, as in the U.S.

And soft costs may be a big slice of the opportunity pie. LBNL says that “Lower installed prices in other countries largely reflects differences in ‘soft costs,’ which may be driven partly by differing levels of deployment scale, though other factors are also clearly important.”

Another LBNL work we cite in our recent Solar Power on the Rise report points out that soft costs in the U.S. still constitute more than half of a typical rooftop solar system’s cost, compared with one-fifth in Germany.

That suggests we can still do more (much more), particularly with the non-hardware aspects.

4. Cash incentives are falling, too. That isn’t necessarily a good thing, but it’s just what you expect to have happen as an industry matures, as solar is doing nicely. (Of course, long-standing and ongoing fossil fuel and nuclear subsidies—see here or here, for example—show those industries haven’t been given that message, not by a long shot.)

It pays to shop around: PV costs vary, across and within states. (Source: LBNL)

5. Prices and participation may vary. As with just about any product, what you find in your area may differ from national stats. There’s variation among suppliers, certainly.

But pricing also differs, pretty appreciably, based on your state, because of costs of living, or maybe penetration levels/competition. LBNL reports that costs for residential systems can be 25–35% cheaper in some areas (Florida, Texas, Maine, and D.C.) than in others (North Carolina, Minnesota, Illinois, and California).

6. Doing solar right from the start is cheaper. LBNL reports that factors such as economies of scale and economies of scope (homebuilders already got contractors and materials on site) mean that solar on new construction was 16 percent cheaper than retrofitted solar.

Tough to hear, maybe, for those of us in 80-year-old farmhouses, but we should celebrate: With 600,000 new single-family houses being built every year, that’s a whole lot of chances to get it right, solar-wise.

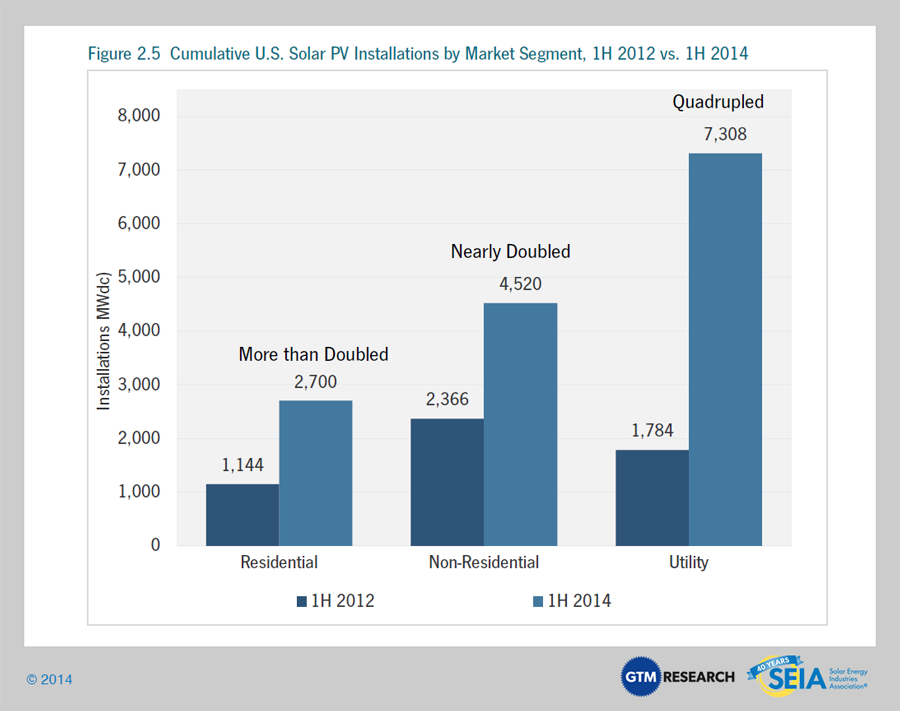

Great growth across the board. (Source: GTM-SEIA)

Converting savings into action

All the positive trends in rooftop solar costs have meant continued rampant growth. We’ve reported on the growth of rooftop solar from 30,000 homes in 2006 to 400,000 in 2013.

GTM-SEIA now reports that residential solar power capacity (megawatts) more than doubled from mid-2012 to mid-2014, and that installations done during Q2 2014 were 45 percent higher than those in Q2 2013.

LBNL and GTM-SEIA both also report on the great strides with commercial and large-scale systems—falling costs and growing capacity.

Add it all up, and you’ve got quite the picture of progress.