This year is setting up to be an important one for offshore wind in the United States. Here are five key developments to keep an eye on in 2023.

More turbines in the water

I’ll definitely be watching for more foundations, towers, and turbines in US waters. There’s a strong possibility that this year we’ll see not just one but two large-scale projects taking shape off our shores before the year is up.

One will be in the waters south of Cape Cod, Martha’s Vineyard, and Nantucket. Vineyard Wind is a 62-turbine, 800-megawatt (MW) project—enough to generate the equivalent of more than 400,000 homes’ electricity use—that will supply Massachusetts and support New England’s electricity grid.

The other will be located east of Long Island. The South Fork Wind project, consisting of 12 turbines totaling 132 MW, will feed into New York’s electricity grid.

Those two projects alone will provide more than 20 times the power of the 42 MW (seven turbines) installed in US waters to date.

More permitting for responsible projects

Shepherding projects through state and federal permitting processes isn’t quite as visually stunning as steel in the water, but it’s crucial for making sure those projects happen well. Thanks to lots of movement in 2022 by the Bureau of Ocean Energy Management (BOEM), the agency in charge of coordinating the federal process, several offshore wind projects have draft environmental impact statements (EISs) out for public comment—a key step for project approvals. BOEM also has initiated a “programmatic” EIS (PEIS) for the New York Bight, the area south of Long Island and east of New Jersey. The PEIS will look at the effect of the multiple projects expected for that region to streamline project-specific assessments. Watch for final EISs this year.

Part of the design process is determining how to make projects fit best with other stuff happening in the ocean, as well with other pressures on those environments. For the East Coast, one aspect to watch this year in that regard is how we make sure that offshore wind avoids and minimizes its effects on the critically endangered North Atlantic right whale, whose population continues to decline due to ship strikes and fishing gear entanglement. And for fish, keep an eye on BOEM’s coordination with National Oceanic and Atmospheric Administration Fisheries, the federal agency in charge of marine species, for minimizing impacts.

Also worth watching are efforts to help make offshore wind and fishing itself fit together. Notable in this regard is a December 2022 announcement by nine East Coast states seeking input on setting up a fund “for potential impacts to the fishing community” from offshore wind development.

More contracting and stronger targets

State policy has been a major driver of offshore wind procurements, and states will be working to meet their requirements—and potentially upping them.

Look for states and electric utilities to request proposals and negotiate contracts with offshore wind developers for the next rounds of projects to meet state goals, and the Biden administration’s offshore wind goal of 30,000 MW by 2030. A key piece of contracting to watch for will be strong labor and environmental provisions, such as those included in New York’s procurements and required under a 2022 Massachusetts law.

Watch for leading states to continue to increase their levels of ambition for offshore wind. Massachusetts’s brand-new governor, Maura Healey, for example, pledged in her inauguration speech to double the state’s offshore wind target, from the current 5,600 MW to 11,200 MW. The Union of Concerned Scientists and its Massachusetts allies will be working to help make that happen.

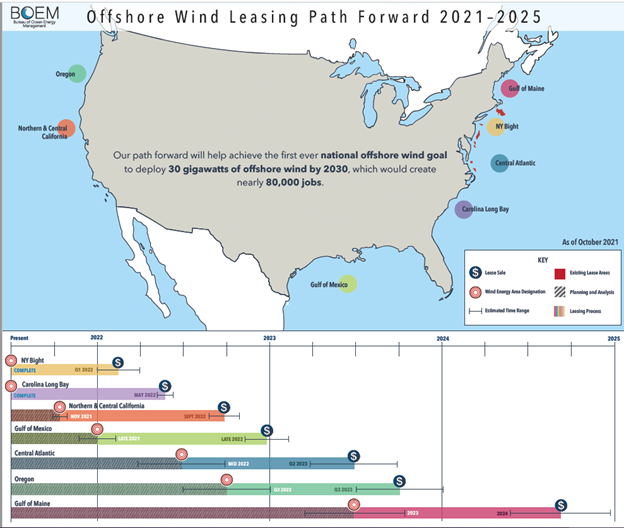

More offshore wind leasing

Earlier in the process of making offshore wind a reality is defining where projects might go. Last year saw BOEM lease auctions in several areas: in the New York Bight in February, off the Carolinas in May, and off California in December. The New York sale was a record-breaker, bringing in $4.37 billion in total revenue from six leases, with enough area for turbines to meet the electricity needs of some 2 million households. California’s sale of five leases was the first in US Pacific waters, the first for projects that will involve floating offshore wind, and—at $757 million—the second-highest in revenue.

An earlier stage for figuring out where leases would make most sense is defining broader possible areas. BOEM defined two “Wind Energy Areas” (WEAs) in the Gulf of Mexico in October 2022, has asked for public comments on ones in the Mid-Atlantic, and is gauging interest in waters off Oregon.

I’ll be watching for projects to take shape in lease areas, and lease areas to take shape in WEAs.

Watch for progress on equity in how offshore wind happens; equity considerations are important throughout the offshore wind development process. One thing that stuck with me from the industry’s annual offshore wind conference last fall was the clear call from Native American nations about consultation early and often, starting with how offshore wind areas are defined and through to how the projects happen.

More technical advances, cost progress

In recent years, part of the growing interest in offshore wind has stemmed from the strong progress in making the technology more competitive, and it’ll be important to see how wind fares along with the rest of the economy. While some existing contracts have bumped up against the challenges of unexpectedly high inflation and supply chain crunches, other areas to watch are more positive.

One way to lower costs is scale, and one thing to watch for driving scale is implementation of the 2022 Inflation Reduction Act. While important for our move toward clean energy in so many ways, the legislation included specific, important provisions for offshore wind around leasing, transmission, and tax credits.

Cost progress is also driven by technical advancements. One area I’ll be watching in 2023 is floating offshore wind. That technology will be key particularly for wind farms off the West Coast and in the Gulf of Maine, both places where water depths quickly get too deep for placing foundations directly on the seabed. That underwater topography helps explain the Biden administration’s strong additional targets it announced in September 2022 for floating offshore wind: 15,000 MW and 70-percent cost reductions by 2035.

I’ll be watching offshore wind for continued progress in cost effectiveness and technology developments.

Making 2023 a year to remember

There’s so much potential in offshore wind. Not just in the wind itself, though the United States does have some of the best resources on the planet. But also in areas like job creation, economic development, reliability, and public health benefits, along with progress in avoiding the worst consequences of climate change and reducing other risks by cutting our use of fossil fuels.

So watch offshore wind in 2023. With strong attention to getting it right, we can make a lot of gains for realizing the technology’s potential this year in ways that set us up for a whole lot more success in years to come.