Today’s high energy prices are the result of recent events and long-term strategies.

Reliance on fossil natural gas and the slow adoption of renewable energy contributed to electricity bills in New England in the first nine months of 2022 that are $5 billion higher than the prior year. Prices elsewhere in the country doubled.

Renewable energy policies are how we manage risks

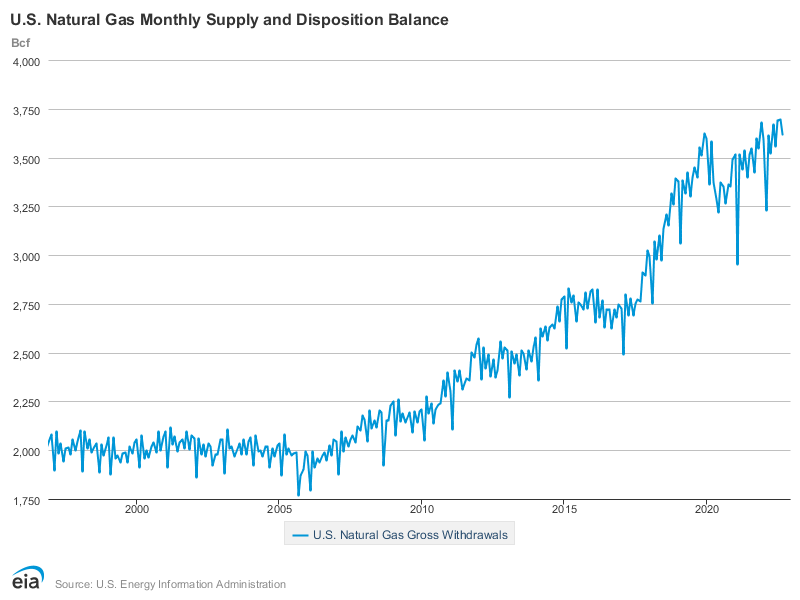

The boom in gas production got us into this situation. Light-handed fracking gas well regulation and favorable treatment of gas-burning electric generation set the stage for our increased dependency on fossil natural gas. The gas industry saw the resulting gas glut as an export opportunity, and liquefied natural gas (LNG) export terminals as the best way to raise prices. That strategy has paid off very well for gas producers, particularly after the Russian invasion of Ukraine led to the cutoff of pipeline gas supply from Russia to Europe, prompting an increase in US LNG imports to fill the resulting supply gap.

For US consumers, gas and electricity this year are costing billions more because utilities are moving too slowly to adopt gas replacements, namely renewable energy, energy efficiency, as well as building electrification. Utilities, regulators and consumers need to make that transition to manage risks to energy security and cost spikes.

When gas production grew

The gas industry predicted in 2016 that LNG exports would raise the price of gas in the United States, and the Union of Concerned Scientists (UCS) warned that a slow approach to renewable energy made the country vulnerable to higher prices. Those predictions have come true. Instead of the gas production boom creating stable, lower costs, the United States is now experiencing higher prices tied to the world market because of LNG exports.

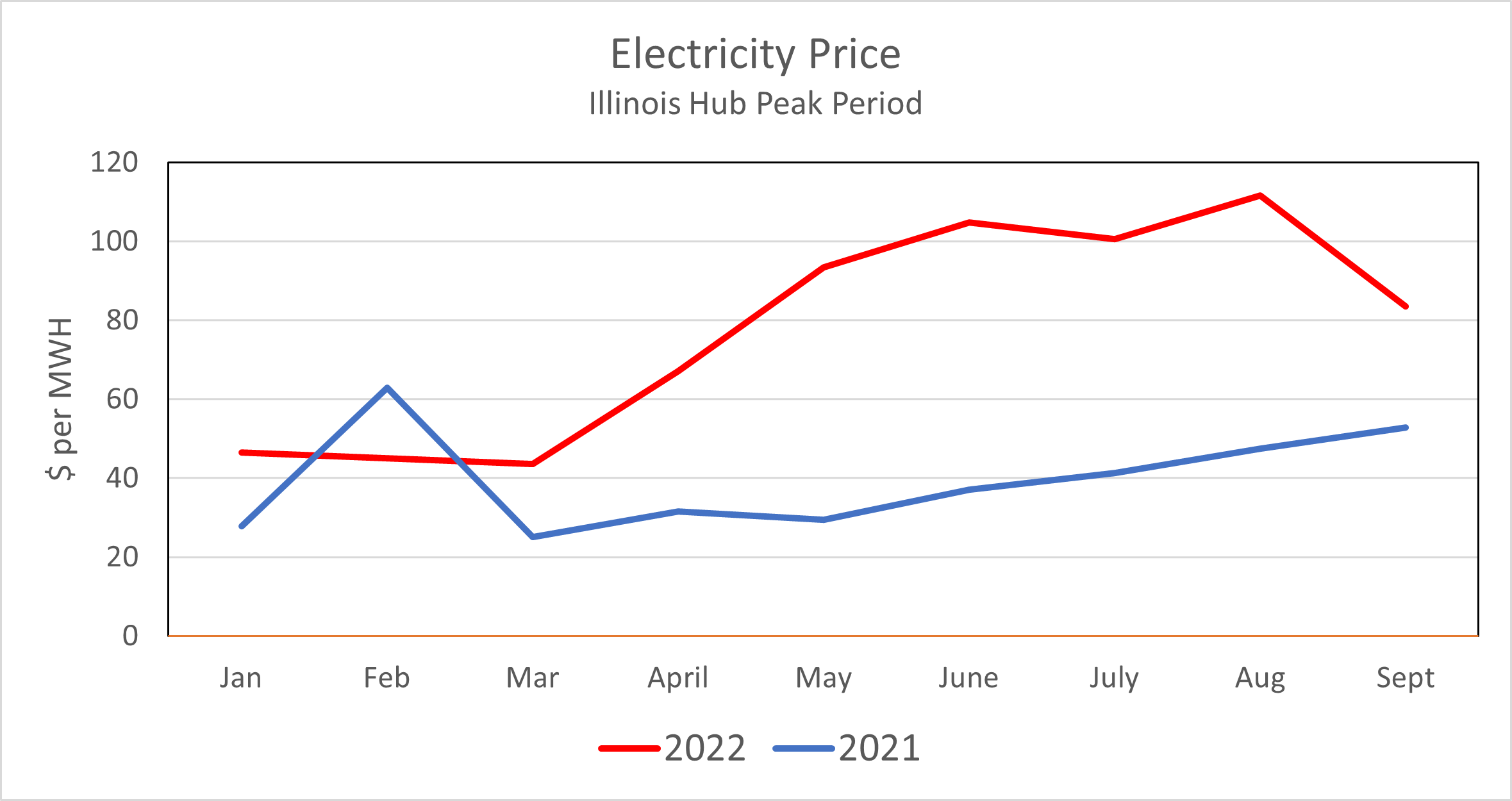

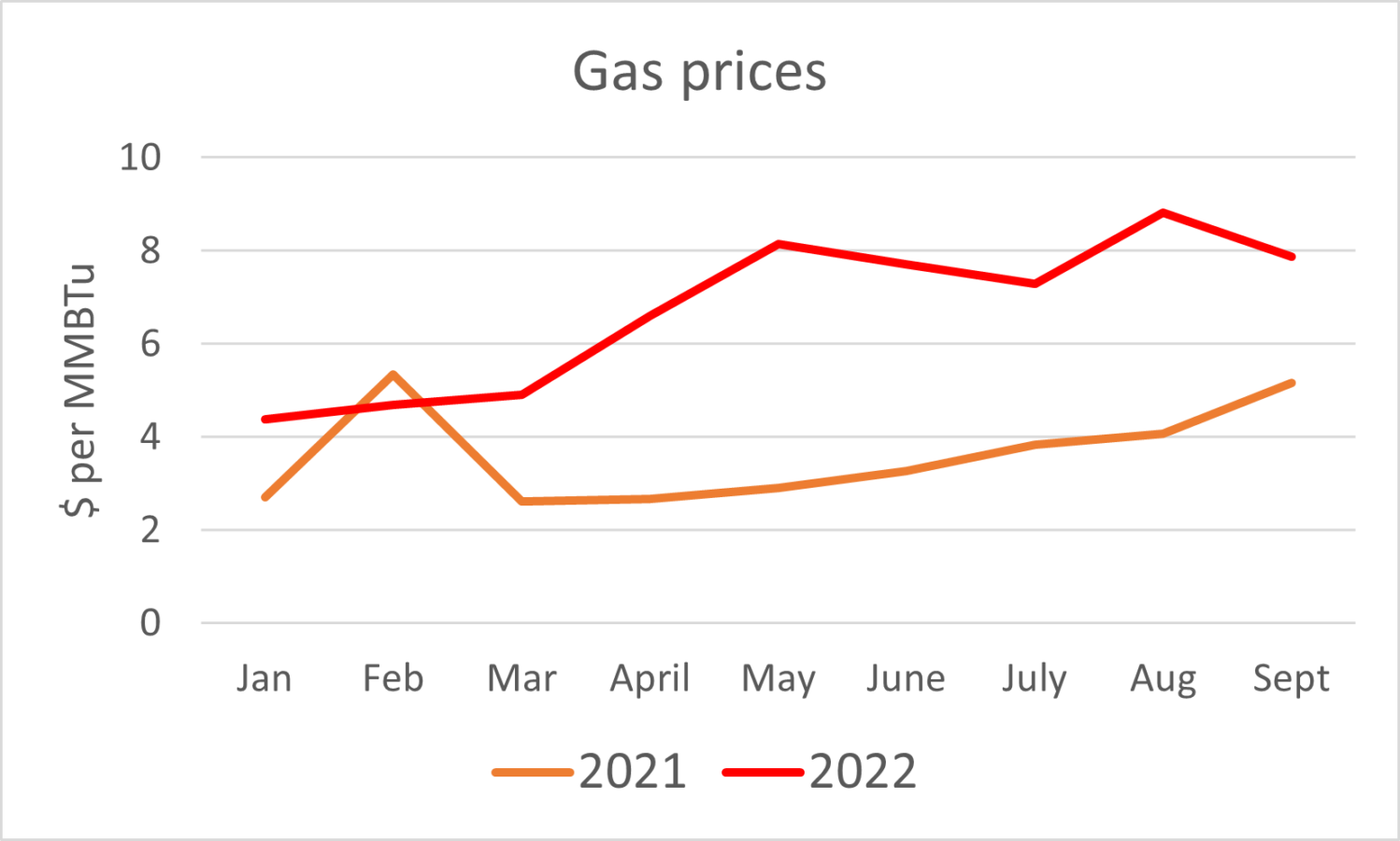

Picture those higher prices

Fossil gas is a primary fuel for electric generation, so rising gas prices mean higher electricity prices. Gas generated 53 percent of New England’s electricity in first nine months of 2022, and 47 percent in the central part of the country. These two examples illustrate my point: Relying on gas for electricity instead of renewables sets up the risky conditions for the high costs we see today.

From January through September, electricity in New England cost $5 billion more than during the same time period in 2021, according to data reported by ISO New England, New England’s grid operator, in its monthly operations reports. For the same months in southern Illinois, served by Ameren/Midcontinent Independent System Operator (MISO), wholesale electric prices on-peak nearly doubled, according to MISO data.

Below are two graphs of electricity prices from southern Illinois based on MISO reports on monthly averages for on-peak prices, and average national US gas market prices reported by the US Energy Information Administration. The graphs show very similar patterns, because higher gas prices drive higher electricity prices.

Renewables reduce the impact of gas prices on electric prices

There is a straightforward way to reduce the risk of high gas prices affecting electricity prices: Use less gas. The smaller the percentage of US energy needs that depends on gas with fluctuating prices, the lower the risk of unpredictable higher bills.

Let’s explore from the consumer perspective

Adding more renewable energy, either at home or in the utility supply mix, would reduce consumer risk of having to pay higher costs. That reduction comes from the fixed-cost nature of renewables. Once a wind farm or solar project is built and financed, the cost is not going to change for a given quantity of energy produced from that project. If that quantity is only 10 percent of the supply, then high gas prices will affect 10 percent less of the energy purchased. If the renewable supply is 60 percent of the supply, the quantity impacted by the price spike is 60 percent lower.

Let me explain with an illustration. Say prices rise $100 per megawatt hour (MWh) above the usual ~$35 per MWh, and the demand for electricity is 1,000 MWh per day. If all that was supplied by fossil natural gas—which has no price stability—consumers would pay $100,000 more than the norm each day. But if 60 percent of supply came from wind and solar, and only 40 percent is subject to the price spike, consumers would pay $40,000 each day above the usual amount.

Regions differ in exposure to high gas prices

New England entrepreneurs were early and aggressive in developing hydropower on the many rivers in the region, but that was a century or more in the past. Currently, new renewable energy has been limited by land availability and grid transmission. In New England, wind contributed only 3.4 percent of the electricity this year and solar provided 3.6 percent during the first 9 months, according to ISO-New England data. But that data do not include most of the region’s distributed solar, which is estimated at more than 4,700 MW.

Offshore wind will reduce Northeast gas needs

Northeast electric grids (and ratepayers) will soon enjoy the benefits of additional renewable energy from offshore wind. An analysis by ISO-New England of how much the first 800 MW offshore wind farm could lower prices found that 9 percent less gas would be needed for a cold snap with such a wind farm in operation. Contracts, permits and construction are in progress for wind farms that could provide five to 10 times more energy than 800 MW to Northeast grids. Those wind farms should be up and running in four to six years.

Looking forward, regions across the country have different approaches to grid planning and renewables development that can replace gas. Hopefully, they will take into account the risks of high prices—and the worst failures of the gas system—in those assessments.