It’s been just over a year since the California Air Resources Board unanimously adopted the Advanced Clean Fleets (ACF) Rule, which requires the largest commercial and public fleets operating in the state to gradually transition to zero-emission trucks and buses over the next two decades. By accelerating the adoption of zero-emission trucks and buses by around 80 percent, the ACF will usher in massive reductions in pollution, as well as billions of dollars in savings to fleets – estimated at $48 billion through 2050 to be exact, even when considering costs related to higher upfront vehicle purchase prices, installing charging infrastructure, and retraining drivers and mechanics.

Such meaningful and transformative efforts are not free from hiccups, however. Because of this, regulators worked closely with impacted businesses, community advocates, and technical and policy experts (like UCS!) to include a wide array of flexibilities for fleets to maintain compliance under the rule.

Similarly, the transition to a cleaner and more equitable freight system will not be free from increased upfront costs for fleets, but today there are more funding opportunities from both state and federal programs than ever before. The current incentives for zero-emission vehicles (ZEV) purchases can lower the upfront cost of zero-emission trucks and buses for California businesses to a rate comparable to, and sometimes even lower than, the exponentially dirtier diesel models on our roads today.

Despite the generous funding opportunities and holistic flexibilities baked into ACF, confusion around and misinformation about the rule may undermine this much-needed shift away from fossil-fueled trucks and buses. To set the record straight, we have answered some of the most frequently asked questions about the ACF’s feasibility, flexibility, costs, and benefits.

Funding for Advanced Clean Fleets (ACF)

What state funding is available to help with ACF compliance?

California provides more state incentives to electrify commercial vehicles than any other state:

- The California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) program provides eligible fleets who purchase zero-emission trucks with a voucher roughly equal to the difference in upfront cost between comparable zero-emission vehicle (ZEV) and internal combustion engine (ICE) models. The HVIP program has invested over $1 billion in California as of the year 2023, with over 12,000 vouchers.

- Fleets that utilize electric and hydrogen vehicles are eligible to earn Low Carbon Fuel Standard (LCFS) credits, which can be sold to offset ZEV costs. Revenue generated by LCFS credits depends on credit prices, but estimates can be calculated using the LCFS Credit Price Calculator (click here to download the calculator from CARB).

- The Carl Moyer Grant Program also provides incentive funds (around $60 million/year) to private companies and public agencies to purchase cleaner-than-required engines, equipment, and emission-reduction technologies for heavy-duty equipment.

- Additionally, the California Public Utilities Commission has approved programs for four separate utilities, with $739 million for investments in zero-emission medium-and heavy-duty vehicles (MHDVs) and charging infrastructure.

What about federal funding?

There are several federal programs with funding available to target medium and heavy-duty ZEV transition, including:

- The Commercial Clean Vehicle Credit (45W) under the Inflation Reduction Act of 2022 (IRA) assists fleets by defraying upfront costs associated with purchasing a clean vehicle, a tax credit of up to $40,000 per vehicle. The IRA also provides up to $100,000 in assistance per commercial vehicle charger under Section 30C.

- The Clean Ports Program (CPP) funded by the IRA and provided through U.S. Environmental Protection Agency (EPA), has been allocated $3 billion to fund zero-emission port equipment and infrastructure as well as climate and air quality planning at U.S. ports. The funding under the CPP will likely usher hundreds, if not thousands, of new zero-emission drayage trucks onto our roads with many replacing aging diesel trucks.

- The Climate Pollution Reduction Grants (CPRG) program provides $5 billion in grants to states, local governments, tribes, and territories to develop and implement ambitious plans for reducing greenhouse gas emissions and other harmful air pollution. Also funded through the IRA, the program provides $250 million for non-competitive planning grants and around $4.6 billion for competitive implementation grants.

Flexibility in Advanced Clean Fleets

Are there compliance extensions or exemptions within the ACF?

The ACF includes both generous extensions and exemptions for fleets that act in good faith but are unable to meet the requirements of the rule due to lack of appropriate model availability, delay in vehicle delivery, delays in infrastructure construction, and in cases where necessary electricity to support depot charging is not available. Some examples of compliance extensions and exemptions under the ACF are:

- Backup Vehicles– if a backup vehicle is in operation for fewer than 1,000 miles per year, compliance exclusions may apply.

- Daily Usage– if a fleet owner cannot comply because the daily usage of the vehicle cannot be adequately met with ZEV technology, exemptions may apply.

- ZEV Infrastructure Construction– if a fleet owner initiates a project for ZEV charging or refueling infrastructure, a construction delay can grant rule extensions for up to 2 years.

- ZEV Infrastructure Site Electrification– if fleets are unable to obtain the amount of electricity necessary to support ZEV operations, they may be granted an extension of up to five years.

- Vehicle Delivery Delay and Cancelation– if a fleet owner purchased ZEVs but the delivery from the manufacturer is delayed/canceled, extensions can apply.

- ZEV Purchase Exemption– fleet owners may request a compliance exemption if a ZEV model is unavailable in the configuration needed. CARB will maintain a list of unavailable ZEVs in popular configurations.

- Declared Emergency Response– a vehicle operating under contract to support a declared emergency may be exempted from compliance.

- Mutual Aid Assistance– some exemptions apply for fleet owners that have mutual aid agreements to send their ICE vehicles out to others during emergencies.

- Rarely operated vehicles (Five-day pass)- a 5-day exemption can be available to vehicles entering California once a year for up to 5 consecutive days.

- Non-Repairable Vehicles– if an existing ICE vehicle is damaged beyond repair, an exemption may apply for the ICE replacement model.

Other Frequently Asked Questions…

What are the climate benefits from the ACF Regulation?

The ACF is estimated to significantly reduce pollution from the statewide commercial truck and bus fleet. By 2050, the climate benefits from compliance with ACF will translate to a reduction of 146,000 tons of nitrogen oxides, nearly 7,000 tons of fine particulate matter, and 327 million metric tons of carbon dioxide.

What if a fleet just purchased new diesel medium- or heavy-duty vehicles?

ACF offers several flexible compliance pathways and many exemptions and extensions to improve the ease of compliance for California’s diverse set of fleets. In some cases, fleets who purchased certain ICE model year 2024 trucks would be able to operate them through 2042.

When will enforcement begin?

Compliance began on January 1, 2024 for state and local fleet and drayage requirements, but different portions of the rule phase in gradually through 2042. Under the federal Clean Air Act, California must obtain a waiver from EPA for certain air quality regulations that go beyond federal standards.

While drayage and high-priority fleets reporting and registration requirements were subject to enforcement as of January 2024, CARB communicated in December of 2023 that it would not be exercising its enforcement authority concerning the drayage or high-priority fleet reporting requirements or registration prohibitions until the EPA grants a preemption waiver applicable to those regulatory provisions or determines a waiver is not necessary. CARB requested the preemption waiver from EPA in November of 2023.

What counts as a ZEV under ACF?

Trucks and buses that produce zero tailpipe emissions, including battery-electric and hydrogen fuel-cell vehicles, count as ZEV compliant. Plug-in hybrid trucks and buses with certain all-electric ranges count towards compliance through 2035.

How many and what types of medium and heavy-duty vehicles are available today?

There are over 150 medium and heavy-duty zero-emission vehicles currently available across multiple categories, including school buses, tractors, vans trailer trucks and refuse trucks. CalSTART’s Zero-Emission Technology Inventory tool and the California HVIP website are two resources that offer MHDV inventory availability by brand and type to help assist with current vehicle options, as well as new inventory expected.

What is the total cost of ownership for ZEVs compared to diesel trucks?

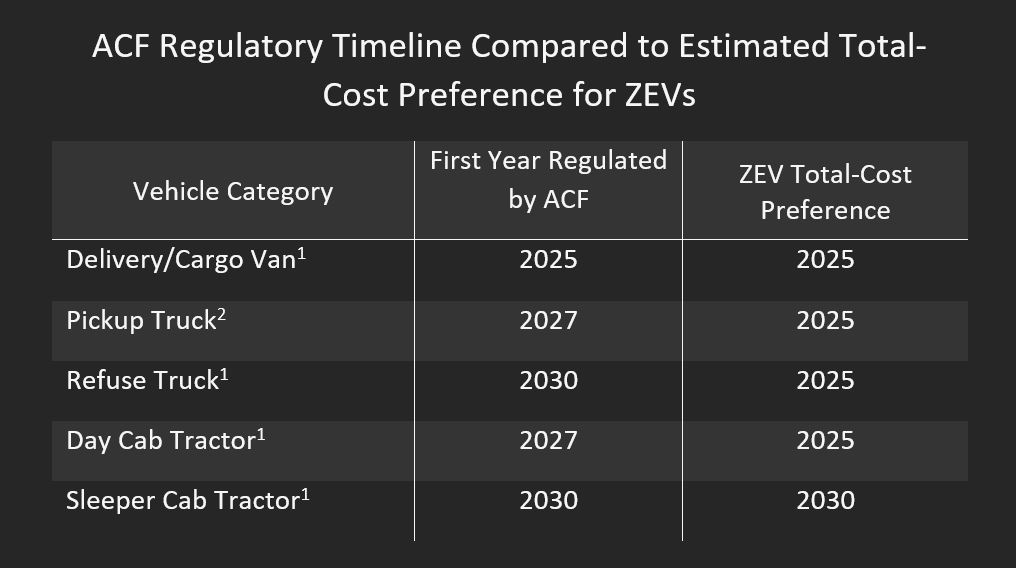

ZEV options for several common truck types have preferable total cost estimates today, and ZEV models for all truck types are estimated to have lower total cost by 2030 (I’ve blogged in detail about this previously). While initial purchase prices may be higher, savings from fuel costs generate the greatest offset, even in California with the state’s historically higher electric rates. If state and federal ZEV funding incentives are applied in cost comparisons, buying a zero-emission MHDV realizes even further savings.

Where can I get more information?

You can find more details on CARB’s website or by checking out our other blogs on the rule. My colleague Michele Canales’ blog post explains what the rule will do for California.