On April 24, Senators Coons (D-DE), Moran (R-KS), Stabenow (D-MI) and Murkowski (R-AK) introduced the Master Limited Partnerships (MLP) Parity Act, a bipartisan bill that would give renewable energy projects access to billions of dollars of lower cost capital that has been available to the fossil fuel industry for decades.

Representatives Poe (R-TX), Thompson (D-CA), Welch (D-VT), Gibson (R-NY), and Gardener (R-CO) simultaneously introduced an identical bill in the House.

UCS joined 235 other groups to support the MLP Parity Act. This diverse group of supporters includes manufacturers, project developers, utilities, financial institutions, non-profit organizations, trade associations, and organized labor.

What are MLPs?

This post is part of a series on Ramping Up Renewables: Clean Energy Policies to Watch in 2013.

This post is part of a series on Ramping Up Renewables: Clean Energy Policies to Watch in 2013.

Subscribe to the series RSS feed.

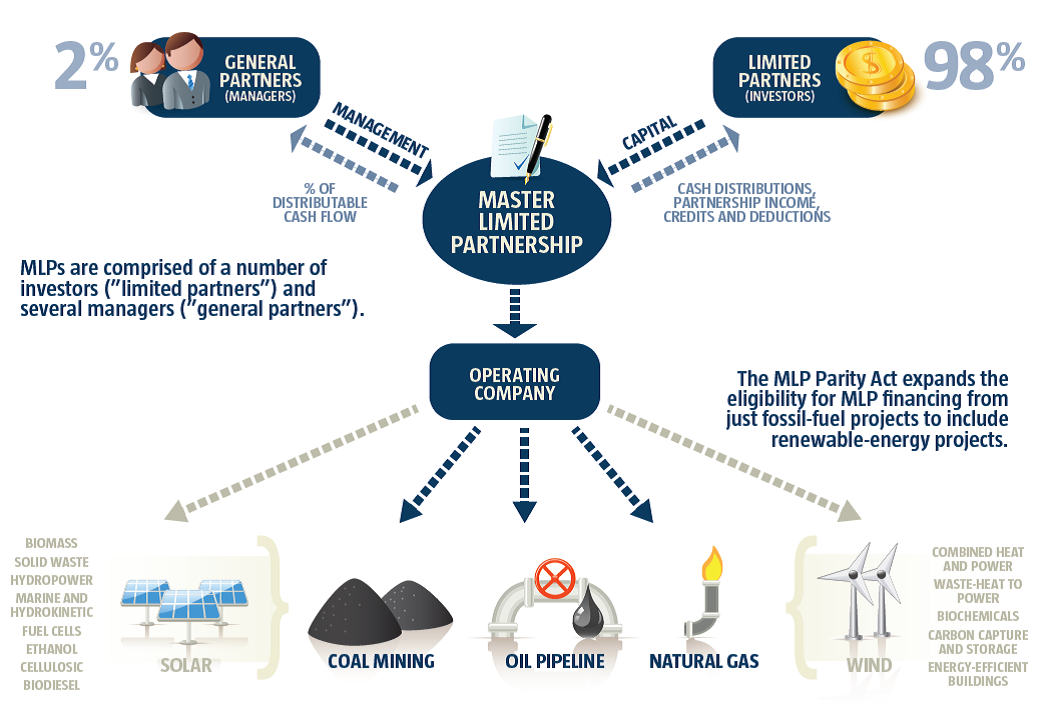

MLPs are a corporate structure that can raise capital by issuing shares of ownership in the stock market, but at the same time enjoy tax benefits not available to typical corporations. While profits from publicly traded corporations are taxed at both the corporate and shareholder levels, income from MLPs is taxed only at the shareholder level because it is treated as a partnership for tax purposes. Established by Congress in 1980, MLPs have been used extensively by the oil, natural gas, and coal industries. Investment in energy-related MLPs has grown from $2 billion in 1994 to $241 billion in 2012, according to Bloomberg New Energy Finance (BNEF).

To be considered an MLP, 90 percent of the partnership’s gross income must be from passive income, such as royalties, interest, and rents from real property, rather than income from business operations. An exception is made, however, for income from production, processing, and transportation of minerals and natural resources. Under this exception, a significant amount of investment has been channeled through MLPs to conventional energy infrastructure such as oil and natural gas pipelines and exploration and coal mining, transportation, and processing. Income from geothermal energy is also eligible. The Emergency Economic Stabilization Act of 2008 expanded MLP-eligible income sources to include transportation of ethanol and biodiesel.

Expanding MLPs to include clean energy technologies

Source: Senator Chris Coons. 2013. Master Limited Partnership Parity Act White Paper. Online at: http://www.coons.senate.gov/MLP

Expanding MLPs to provide tax parity with fossil fuels

The Senate and House bills would expand the definition of MLPs to include 14 new technologies and fuels. This includes several renewable energy technologies such as wind, solar, biomass, marine, hydropower, and biodiesel. However, it would also include energy efficient buildings, as well as several technologies that could use either renewable or fossil fuels such as fuel cells, combined heat and power (CHP), carbon capture and storage (CCS), and electricity storage.

The benefits from these changes could be significant. For example, BNEF concludes that vehicles such as MLPs that make “project investments a more liquid option and that allow…projects to tap a broader pool of investors through capital markets” will be a significant driver in unlocking lower costs of capital in the future. BNEF projects that the cost of capital for financing the commercial operation of renewable energy systems could decrease from a 14 percent cost of levered equity to a cost of 8-12 percent. Such a decrease in the cost of capital would translate into a significant decrease in the cost of generating electricity from renewable energy sources.

MLPs are an important complement to other renewable energy policies

The renewable energy industry currently relies on a relatively small number of investors that require relatively high rates of return. The recent financial crisis greatly exacerbated this problem. By giving renewable energy projects access to a much larger pool of investors and lower cost financing, MLPs help address a specific market barrier that’s currently inhibiting development. In this way, they provide an important complement to other policies such as federal tax credits and state renewable electricity standards, which have been the primary drivers of the recent growth in renewable energy in the U.S. These policies have also created new jobs, reduced emissions, and helped drive down costs, making renewable technologies more cost-competitive with conventional energy sources.

MLPs have played a similar role in the oil, gas, and coal industries over the past 30 years by supplementing dozens of other federal and state tax incentives available to those industries. For example, shale gas developers have received approximately $10 billion in tax credits, and millions in research and development funding, that have helped fuel the shale gas revolution.

Giving renewable energy projects access to the low cost financing available from publicly traded MLPs would help level the playing field with fossil fuels, while giving all Americans the opportunity to invest in the transition to a cleaner, low-carbon economy.