Part two of a three-part blog series.

Yesterday, we released an update of our 2012 Ripe for Retirement study that was published in the Electricity Journal, which analyzed the economic viability of updating the nation’s coal fleet compared to investing in cleaner alternatives. (For more details on the study, see this blog by my colleague Jeff Deyette.) Thanks to new technology developments that have lowered the costs of new wind projects and increased electricity production, our new analysis shows wind power could play an even greater role than natural gas in replacing existing coal plants.

The analysis shows that retrofitting 71 gigawatts (GW) of existing U.S. coal capacity with modern pollution controls would be more expensive than the cost of building new wind projects with the federal production tax credit (PTC) included. This is 12 GW, or 21 percent, higher than our core scenario comparing coal to the cost of increasing generation at existing natural gas combined cycle (NGCC) power plants.

Windy states move up in the ranking

Texas ranks first in the nation with 7,200 megawatts (MW) of ripe-for-retirement coal capacity when compared to the cost of developing new wind projects. In contrast, Texas ranked 33rd with only 175 MW of economically vulnerable coal capacity compared to the cost of existing NGCC plants. Texas’ ranking under the wind scenario is not surprising given that it led the nation with 12,200 MW of installed wind capacity at the end of 2012, and the state has a significant untapped potential of low-cost wind resources still available.

Oklahoma also moved up in the ranking to number five, joining Michigan, Alabama, Georgia, Indiana, and Tennessee – each with more than 3,500 MW of coal capacity that is more expensive than new wind. The utilities with the most ripe-for-retirement coal capacity under our wind scenario are mostly located in those seven states. They include Southern Company, Tennessee Valley Authority (TVA), DTE Energy, OGE Energy Corp., NRG Energy, Texas Energy Future Holdings LP, American Electric Power (AEP), Xcel Energy, and CMS Energy Corporation.

Our wind scenario most likely represents a lower bound because we only compared coal plants to wind facilities located within the same region. But many power companies are finding better deals outside their regions. For example, several Southeast utilities such as Alabama Power and Georgia Power (subsidiaries of Southern Company), TVA, Arkansas Electric Cooperative, and Southwestern Electric Power Company have recently signed long-term contracts with wind projects in Oklahoma, Kansas, Texas, and the Upper Midwest based primarily on economics.

New wind technology has increased power output and lowered costs

The amount of economically vulnerable coal capacity compared to new wind projects is 8 GW higher than our 2012 study. The main reason for this is because we assumed higher capacity factors for wind to reflect new technology developments such as taller towers, longer blades, and advances in low wind speed turbines based on data from Lawrence Berkeley National Lab (LBNL) and recent projects. In addition, we assumed regional average capacity factors ranging from 35-47 percent rather than assuming a national average of 35 percent for all regions in our 2012 analysis.

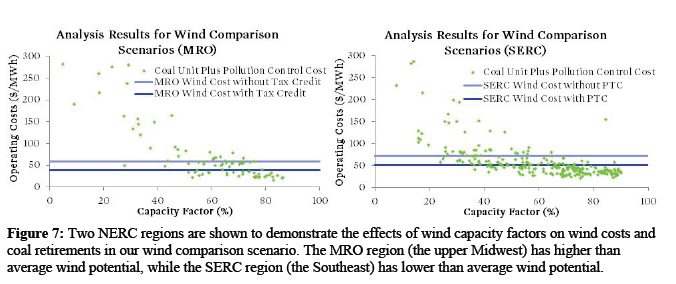

As I discussed in a recent blog, LBNL data shows these higher capacity factors combined with reductions in capital costs has resulted in a 43 percent drop in U.S. average power purchase prices (PPAs) for wind over the past 3 years (from ~$70/megawatt-hour (MWh) in 2009 to below $40/MWh in 2012). This is consistent with our study which assumes regional costs ranging from $39-56/MWh with the PTC, and $58-76/MWh without the PTC (see figure below from the Electricity Journal article). To be conservative, these figures also include wind integration costs of $5/MWh based on studies by utilities and power system operators.

At these prices, our study shows wind is cheaper than existing coal plants retrofitted with pollution controls and existing NGCC plants in many parts of the country. This is consistent with a recent statement by Stephen Byrd, Morgan Stanley’s Head of North American Equity Research for Power & Utilities and Clean Energy:

“In the Midwest, we’re now seeing power agreements being signed with wind farms at as low as $25 per megawatt hour. Compare that to the variable cost of a gas plant at $30/MWh, the all-in cost to justify the construction of a new gas plant would be above $60/MWh.”

Our analysis assumes costs of $52/MWh for existing NGCC plants and $68/MWh for new NGCC plants based on EIA assumptions. Our costs from EIA are slightly higher than Byrd’s because we are assuming average fuel prices for natural gas over a 20-year period to compare with wind and coal investments.

Extending the PTC makes sense even with low wind costs

Without the PTC, our analysis shows that only 22 GW of existing coal capacity is ripe for retirement — less than one-third as much as the scenario with the PTC. The PTC, combined with state renewable energy standards, has been a key driver for the recent growth of the wind industry and the resulting cost reductions that have brought significant economic and environmental benefits at both the state and national level.

When Congress has allowed the PTC to expire in the past, the wind industry has fallen off a cliff. The PTC also helps level the playing field distorted by much larger, longer-term subsidies for fossil fuels and nuclear power that are still in place today. Smart policies like the PTC and carbon standards for new and existing power plants are needed to ensure a transition to cleaner, more affordable alternatives.