California’s Advanced Clean Car II (ACCII) regulations are set to go into effect starting with model year 2026 vehicles. These rules include requirements that automakers provide Zero Emission Vehicles (ZEVs) for sale in California in increasing volume through 2035.

In the last few weeks, there has been a flurry of misleading information about how these rules work and the ability of industry to meet them. Some in the auto industry are acting as if these rules are a surprise. This is disappointing, as these ACCII rules were under discussion since 2020 and are the natural extension of ZEV rules that were first adopted in 1990. Automakers have had extensive notice of the rules and some of the traditional automakers had ZEVs make up over 30 percent of their California sales.

However, there is also a long history of the auto industry resisting change by claiming that regulations are an existential threat to their business. In 1970, Lee Iacocca, then Ford’s executive vice president, said that the Clean Air Act’s limits on tailpipe pollution “could prevent continued production of automobiles” and “do irreparable damage to the American economy.” Now 55 years later, the same type of arguments are being recycled to attack California’s ACCII standards.

The truth is that standards can be met, and with fewer sales than the opponents of ACCII claim. Auto companies that are actually offering consumers attractive EV options are well positioned to comply with the regulation, and Tesla’s slowing sales are masking the growing EV sales from other manufacturers. California’s clean car rules will save drivers money at the pump, slow the damage from climate change, and reduce exposure to harmful air pollution for everyone in the state. We can’t let the laggards in the auto industry prevent the state from moving forward with better transportation options than burning gasoline and diesel.

What is the actual ZEV sales requirement?

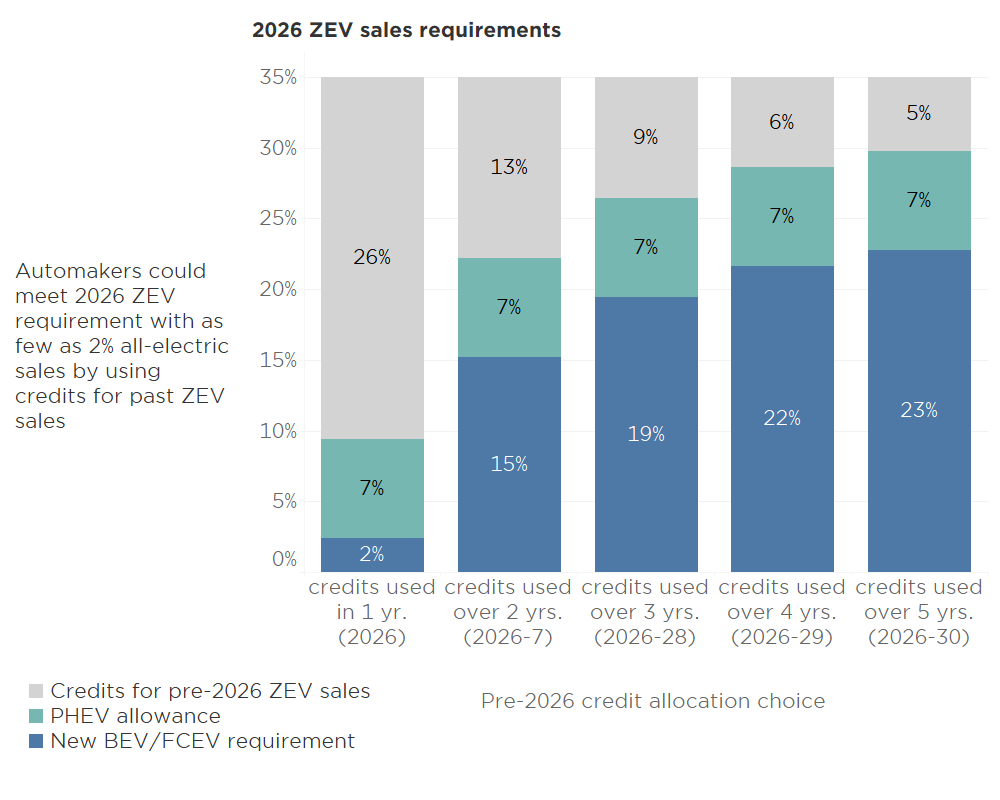

The automakers’ true ZEV sales requirement for model year 2026 is between 9 and 30% of their sales, and some of that requirement can be satisfied with plug-in hybrids that have gasoline engines. The range in the requirement is because the ZEV regulation has significant flexibility built into the sales requirements: automakers can use past credits for compliance, participate in early action and pooling provisions, and use plug-in hybrids to reduce the number of fully electric vehicles required. The exact requirement will depend on how a manufacturer decides to use these flexibility provisions.

Using only the past credits and 2026 plug-in hybrid sales would allow an automaker to meet the 2026 sales requirements with as little as 2 percent fully electric ZEV sales. Most automakers have a significant excess of ZEV credits in the current program and would be able to offset a portion of the 2026 requirement. Not all automakers will likely use all the past credits in the first year (2026), but even spreading out the credits over the first 5 years would reduce the total 2026 requirement to less than 30 percent ZEVs and only 23% would need to be battery electric (BEV) or fuel cell electric vehicles (FCEV). And any automaker that doesn’t have sufficient existing credits are allowed to buy credits from other carmakers. With the vast oversupply of old credits, there are a number of potential sellers for any automaker that is currently not meeting the ZEV requirement.

Supply and demand

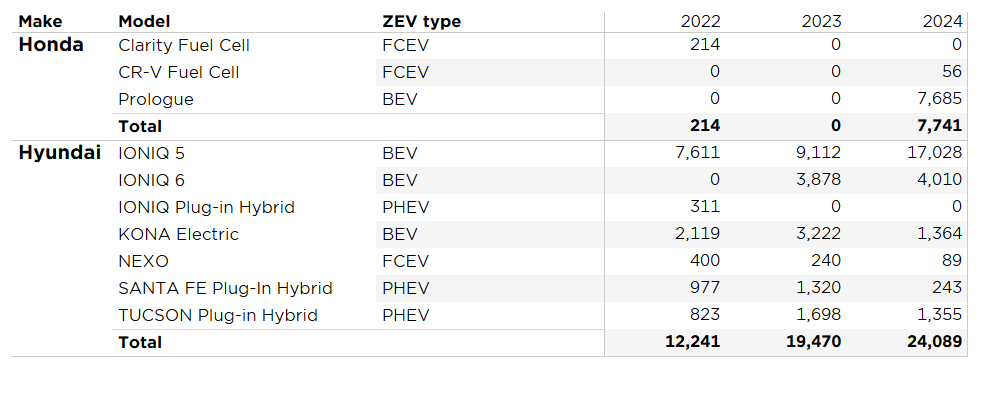

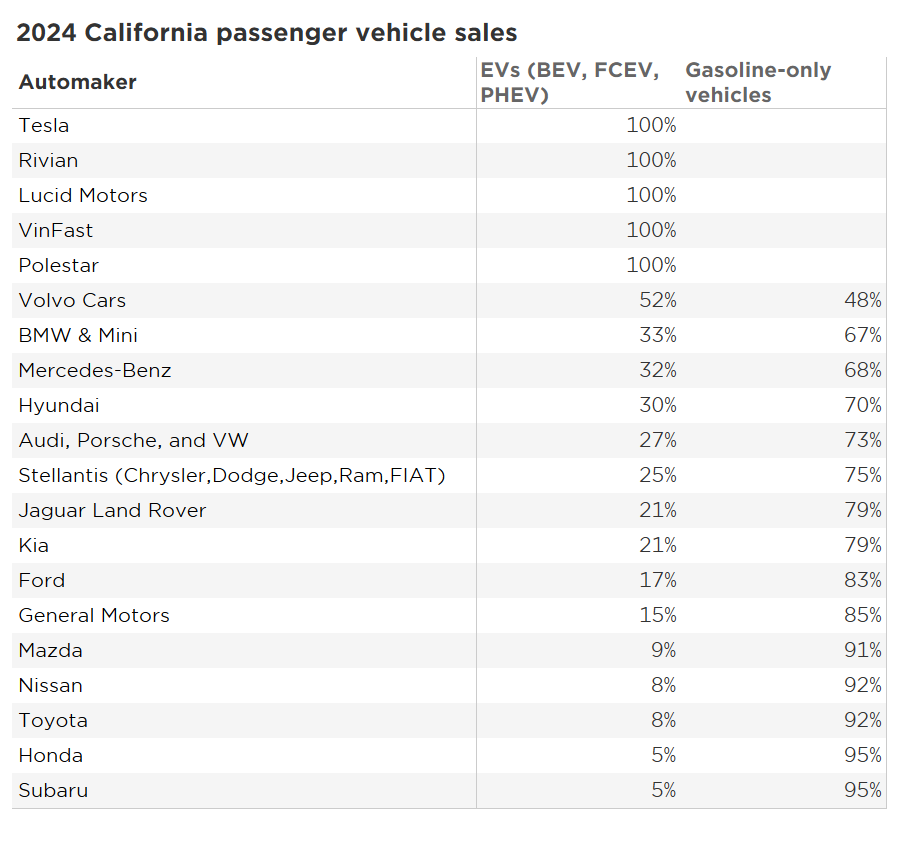

One common complaint from those lagging behind in ZEV sales is that demand for EVs is low. But buyers can’t purchase EVs that aren’t for sale. The fact that only 5 percent of Honda sales in California were ZEVs in 2024 is much less an indicator of demand as it is of supply of ZEV models by Honda. Last year, Honda offered an array of models of gasoline cars and SUVs for sale, plus a pickup truck and minivan but only one BEV model. And that one BEV was actually manufactured by General Motors. In 2022 and 2023, Honda effectively offered no EVs at all in California. Buyers showing up at Honda dealerships are seeing an automaker that has little to offer in EV options or distinctive technology and no track record of EV manufacturing. Why would we blame the shoppers for the lack of Honda EV sales?

Contrast Honda’s lack of effort with that of Hyundai. Over 30 percent of Hyundai sales in 2024 in California were fully electric EVs and plug-in hybrids. Shoppers at Hyundai brand dealerships in 2024 had 3 battery electric options, 2 plug-in hybrids, and 1 fuel cell EV to pick from. And buyers likely have more confidence in an automaker that has been selling EVs in increasing numbers for several years and has more models coming soon.

Automakers like Honda and Toyota that offer paltry EV options will have trouble meeting the ZEV requirements if they continue down the road they are on. But automakers and dealers shouldn’t blame consumers for not buying EVs that they haven’t made and aren’t offering to shoppers.

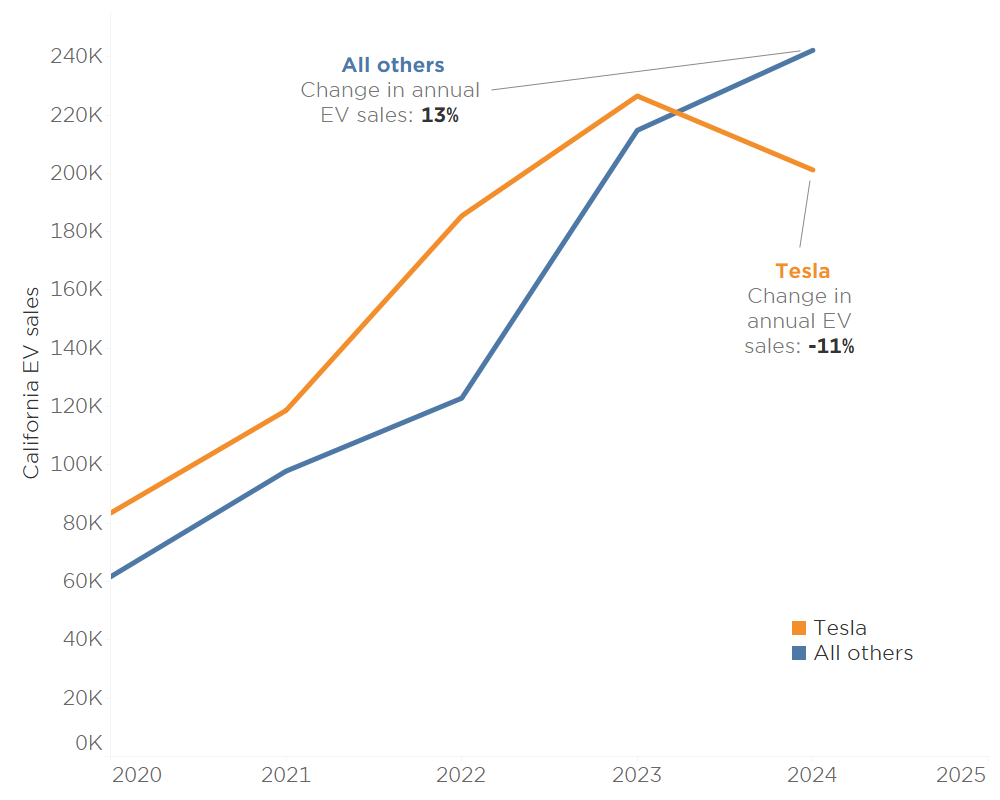

Tesla’s downward trend is masking increasing EV sales from other carmakers

Overall, EV sales in California in 2024 were essentially unchanged from 2023 (441,000 in 2023 and 443,000 in 2024). However, the overall sales figures mask a significant change happening in the market. Sales leader Tesla’s sales are down 11 percent year-over-year, while EV sales for the rest of the industry are up 13 percent over the same span. Tesla’s decline is likely due to factors unrelated to interest in EVs in general. Tesla CEO Elon Musk’s high-profile support for Donald Trump and his likely illegal activities in the new administration are almost certainly causing many in Democratic-leaning California to avoid Tesla, especially now that there are many other options available. Having people put bumper stickers on their Tesla EVs saying that they regret their purchases is a bad sign for the company and not the kind of publicity any manufacturer would want.

But even beyond the actions of Musk, Tesla has a small number of models and has been slow to update their lineup. Their most recent debut, the Cybertruck, is polarizing and doesn’t appear to be selling in high volumes. And one of the company’s key advantages over other EV makers, its charging network, has been opening up to drivers of other EV models. Two years ago, the only way to get access to the top-rated Tesla charging network was to buy a Tesla, but now many different brands are offering that same access.

The ACCII and ZEV regulations are important to keep us on track to reduce emissions, air pollution

While there are some companies that see the long-term gains for moving from gasoline to electricity and are leading the transition, the ZEV regulations are critical to ensure that the entire industry moves in the right direction. Companies like Honda and Toyota shouldn’t be rewarded for dragging their feet and ignoring regulations like ZEV rules that have been developed over the course of decades.

| Global Warming Emissions Reductions | Air Pollution Reductions | Total cost of vehicle ownership savings |

| Reduction of 58.4 million metric tons per year of CO2eq by 2040 | Reduction of 30.4 tons per day of nitrogen oxides (NOx) by 2040 | $17 billion in total vehicle ownership savings in 2040 |

| Cumulative GHG emissions reductions of 395 million metric tons through 2040 | Reduction of 2 tons per day of fine particulate matter (PM2.5) by 2040 | $92 billion in cumulative savings from 2026-2040 |

| $9 – 41 billion avoided climate damages | 1010-1570 avoided cardiopulmonary deaths through 2040 | BEV 10-year ownership savings of more than $4,000 per vehicle in 2026, compared to gasoline vehicle |

| Total health benefit from 2026-2040 of $12.9 billion | BEV 10-year ownership savings of almost $9,000 per vehicle in 2035, compared to gasoline vehicle |

The ACCII regulations, which include the ZEV rules, have economic benefits for drivers and reduce air pollution for everyone in the state. That’s why it’s important that we continue to make this transition now.