There’s been a lot of nay-saying around EVs lately, including, amongst other things, worries that EV sales are stalling out now that all the early adopters have already made the switch and mainstream buyers aren’t ready to dive in. I wouldn’t blame you if you thought nobody was buying EVs or that sales were about to plummet. While there are some near term headwinds, I’ve never had as much confidence in the ability to zero out tailpipe emissions from our cars and trucks. Here’s why I’m optimistic:

Americans are interested in EVs, and they are buying them!!!

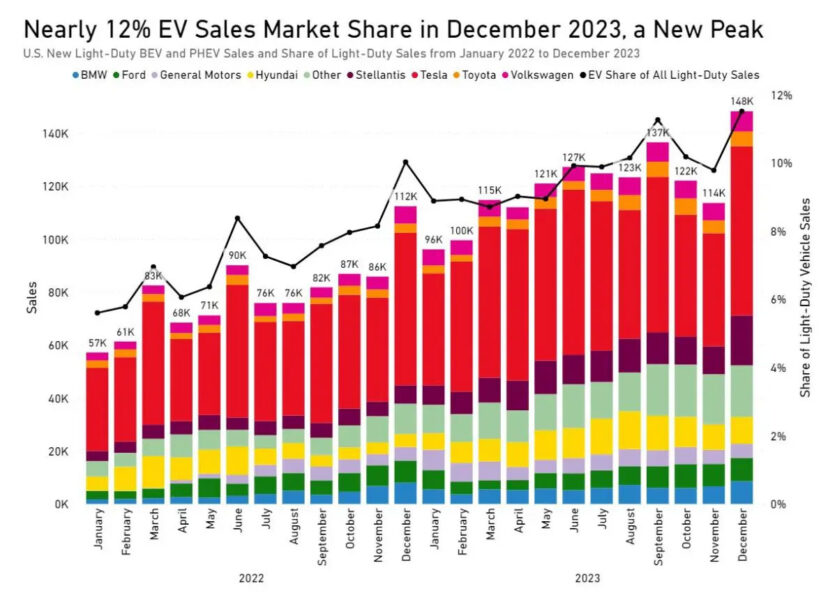

2023 was a milestone year for electric car sales in the US. For the first time ever, annual sales surpassed one million vehicles, accounting for more than seven percent of new vehicles sold. That is A LOT of EVs and A LOT less oil use, air pollution and climate emissions. In December alone, sales hit a new monthly high approaching 12 percent nationally (see figure).

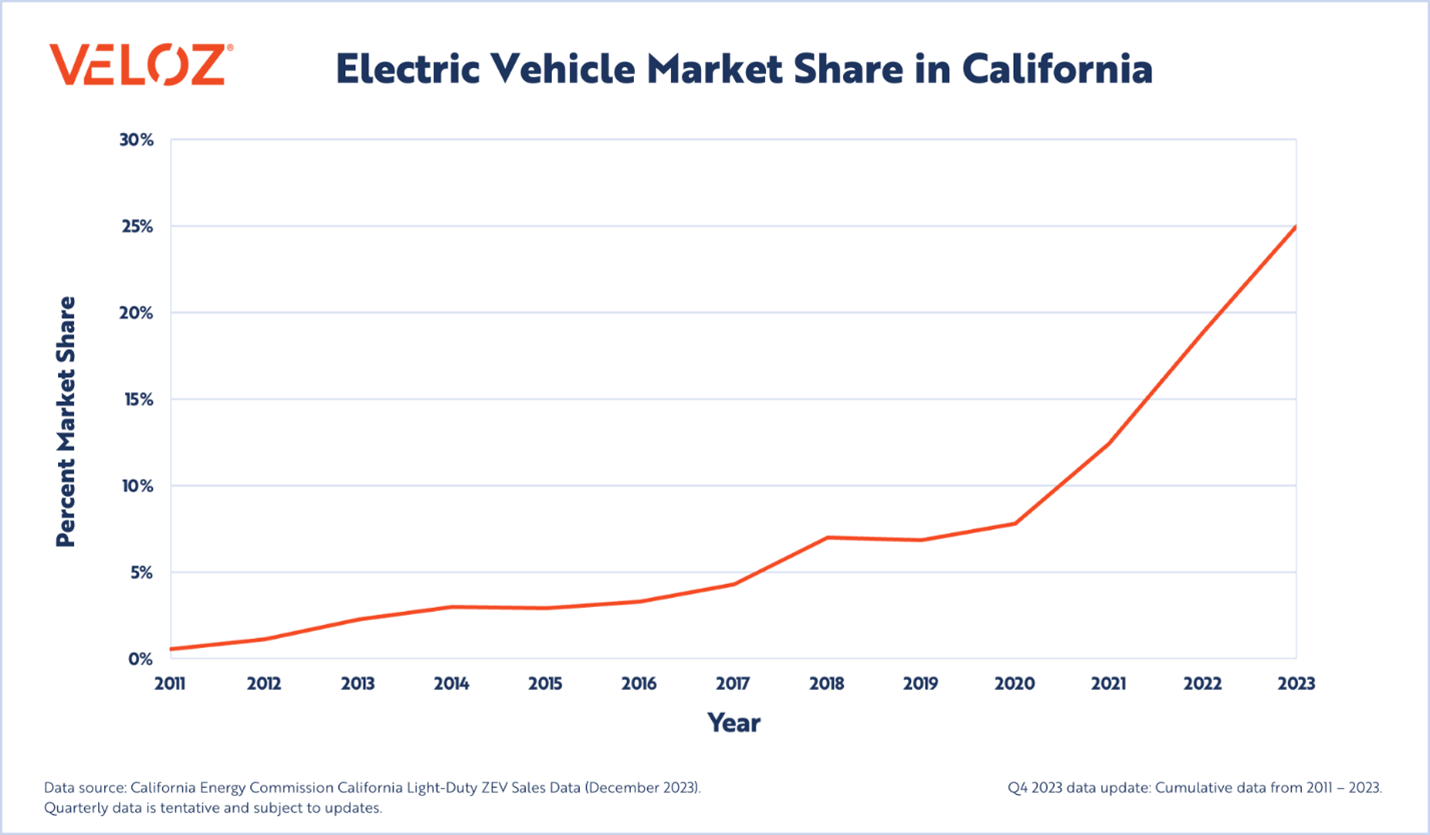

In California, nearly half a million EVs were purchased in 2023 reaching a whopping one in four new vehicles.

The top selling passenger car AND top selling light truck in CA in 2023, according to California New Car Dealers Association, were both electric vehicles with the Tesla Model 3 and the Tesla Model Y taking the top spots…as they also did in 2022.

We are witnessing something the auto industry has never seen in its 100+ year history. A proven, viable alternative to the internal combustion engine has arrived—and millions of drivers are already using these vehicles every day across America.

Despite all these major milestones, there’s been a lot of focus lately on signs the recent rapid growth in EV sales may be slowing. California, where the market is more mature, saw annual EV sales increase 29% year over year, but fourth quarter year-over-year sales grew only about 8% (Veloz). Some manufacturers have had to readjust their overly optimistic EV sales targets and layoffs at some manufacturers (Rivian for one) has added to the gloomy news. But it shouldn’t be surprising that the transition to electric vehicles might not be a straight line up, up and up. Even in California, the sales of EVs over the last 10 years have ebbed and flowed, slowing for a while and then ramping up again as new, more capable and better priced models become available and charging infrastructure has been built out. In 2021 and 2022, if you wanted to buy an EV you might be on a waiting list for many months or even years which in turn drove aggressive projections by automakers for future years sales. Manufacturers have always had to make adjustments when overly rosy projections about their next amazing product are undermined by their competition, which isn’t standing still, or broader market forces (like higher interest rates) and the cyclical nature of the auto industry.)

EV charging infrastructure is about to get super charged

Three BIG things are happening in the charging space that are going to super charge EVs: (1) agreement on a charging standard, (2) Tesla opening up its supercharger network, and (3) billions of private and public investment which is just starting to deliver more chargers.

In every survey I’ve seen over the past decade, access to charging has always been at or near the top of the list of potential EV buyers’ concerns. The vast majority of time, charging happens at home. But when you buy a car, you want to be able to drive it wherever you need to go, so a widespread public charging network is important.

Tesla made charging infrastructure a priority and it has paid dividends for them. If you want a reliable, extensive and easy to use network of fast chargers, Tesla has been the only game in town. But to use it, you had to buy a Tesla. If you didn’t buy a Tesla, you had to choose between two different charging standards and hope you picked right one. Finally, the VHS vs BETA Max moment for EV charging in the US has arrived. And the winner is (Tesla’s) North American Charging Standard.

This is a game changer, the benefits of which will play out over the next few years, as manufacturers make their cars compatible with a single standard AND the Tesla network of chargers is opened up to other manufacturer’s vehicles—which started with Ford this month with others soon to follow.

In addition to moving beyond the uncertainty of charging standards that has weighed on the market for years, there is a huge amount of investment happening to build out a more reliable, and extensive public charging network.

The bipartisan infrastructure law provided up to $7.5 billion in investments to support the buildout of a nationwide charging network through the Charging and Fueling Infrastructure Grant Program and the National EV Infrastructure (NEVI) program. This federal investment is building upon billions of private investments as well. Billions of dollars have been invested as a result of the VW settlement in 2015 which established Electrify America. Many other automakers are investing in charging as well. Rivian is building out a network of chargers and announced plans to open it up to other vehicles, seven automakers announced a partnership with EVGo last summer to build out 30,000 fast chargers, Volvo is partnering with Starbucks to build chargers at that popular beverage chain, and even Walmart is getting in on it, just to name a few.

Many of these announced investments are just starting to result in available chargers. The Joint Office of Energy and Transportation for example just recently announced the first charging stations being opened under the NEVI program. Tens of thousands of more chargers will be deployed in the coming years supported by this program alongside additional state investments, utility investments, and private investment.

There are still some speed bumps in the road; charging reliability remains a concern, and efforts to ensure charging accessibility in lower income communities and in multiunit dwellings must continue. But there is strong momentum moving in the right direction to support the growing market for EVs.

Increasing EV options, easier access to incentives will spur more buyers to make the switch

Yes—there are a lot of EV models out there. But in practical terms, options are still pretty limited and it shows up in the sales data. Tesla dominates the U.S. market with only 2 models—the Model 3 and Model Y—making up more than 40% of all EV sales in 2023, and all of Tesla’s vehicles claiming 45% market share (inclusive of PHEVs). This is not a sign of a mature, competitive market. But that has already started showed signs of changing. Tesla market share used to be even higher (60% in 2020 vs 45% in 2023), and they’ve been trying to maintain it with lower pricing—to the benefit of prospective buyers but the chagrin of competing manufacturers and Hertz (declining prices on new Teslas was a key factor for downsizing their EV fleet). With growing confidence in access to charging and new models on the horizon (for those buyers looking for seven seaters for example, the Kia EV9 was recently released and the VW Buzz and Volvo EX90 are on the horizon), consumers will have more viable options that go beyond the current crop of 250+ mile range 5-seat SUVs that currently represent the bulk of EV models available.

The other BIG game changer is the recent change to the federal incentive for EVs. In the past, buyers could either access up to a $7500 credit only after filing their taxes or indirectly by leasing an EV (where the dealers nominally would pass on the credit through a lower lease price). That all changed starting in January. EV buyers who meet income limits can now access the credit right at the dealership, immediately knocking off up to $7,500. As of early February 11,000 dealers had already signed up for this program and reported 25,000 vehicle sales including both new EV purchases as well as used EV sales—which are now eligible for up to a $4,000 credit.

Requirements for vehicles and batteries to be manufactured or assembled in the US, as well as for mineral sourcing, are currently limiting the vehicle models which can get the full amount of credits which is likely cutting into potential sales (List of eligible vehicles). But as manufacturers invest in their domestic supply chains, more vehicles will be eligible for the credit (and more US jobs will be created to boot.)

Innovation doesn’t stop

EVs today are not the same as the ones from a decade ago, and the ones ten years from now won’t be the same as today. They will be better. They will be less impacted by extreme cold (already something that is manageable). They will have longer ranges or greater towing capacity for those drivers that really need it. They will come in more shapes and sizes. They will charge faster. And they will be even more cost competitive with their internal combustion vehicle counterparts.

I don’t feel like I’m sticking my neck out here. Just look at the past 10+ years. In January 2012, at a hearing of the California Air Resources Board I attended, the board considered updates to the Zero Emission Vehicle standards through model year 2025. There was robust debate about the feasibility of EVs reaching 15 percent market share in CA by 2025. The market at the time (all of 6,743 California sales in 2011) was dominated by the 73-mile range Nissan Leaf, the plug-in hybrid Chevy Volt (with a 35-mile electric range). Automakers pushed back, concerned the rules were too stringent. CARB mostly stuck to their guns, but provided lots of flexibility for how the standards could be met. Today, sales in California not only far exceed these targets, but ahead of schedule, because regulators in part underestimated how fast technology would improve. ).

If there’s one thing that’s been tough for regulators to predict in setting industry-wide vehicle standards, it’s the pace and extent of innovation. But one thing is absolutely certain, innovation will continue and it goes a faster when there are binding standards that require industry-wide investment.

Innovation is hard to predict, auto industry behavior is not.

Automakers love to talk about innovation—heck, they’ve even formed the Alliance for Automotive Innovation. But when push comes to shove, bullish statements on transitioning to EVs and commitments to reducing emissions don’t translate to support for strong industry-wide vehicle standards —standards that have proven critical in the past to move the whole industry forward.

The history of industry resistance is well documented in UCS’s Time for a U-Turn report. The latest stance by the industry—with respect to emissions standards—is a repeat of the can’t do attitude they turned to for decades when fighting fuel economy standards, then claiming the technology didn’t exist, it was too expensive, and consumers didn’t want it (they were wrong). Now the auto industry is dragging its feet once again, this time trying to use China’s progress on EVs as an excuse to slow down on U.S. standards. Really? When you’re falling behind, is slowing down really the right answer?

Luckily, Congress didn’t think so when it passed the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA). Congress understood that we need to ensure that the next generation of vehicle technology is made domestically to be competitive globally. By making historic investments in the U.S. auto industry, supporting EV infrastructure, domestic manufacturing and supply chain development, battery recycling efforts, manufacturing incentives, and consumer incentives, we support a just transition to zero emissions transportation, and move beyond the fossilized fossil fuel stance automakers are clinging to.

Federal vehicle standards are needed to keep us on track

We’re likely to see the next round of vehicle standards finalized by the Environmental Protection Agency (EPA) in the coming weeks. This latest round builds on decades of federal and state vehicle performance standards that have eliminated billions of tons of pollution from the air we breathe, saved consumers trillions (no joke) at the gas pump, and helped to keep climate changing emissions in-check. The stakes frankly have never been higher. We have little more than 25 years to meet critical “mid-century” emissions targets to get climate change under control. The vehicle rules would be in effect through model year 2032 – many of the vehicles built in that year will likely still be on the road in 2050 when global climate emissions need to be near zero to avoid dangerous warming. The rules set declining average pollution levels which help ensure automakers deliver cleaner cars in the form of lower emission gasoline vehicles and zero-tailpipe emission electric vehicles.

Now it’s time for the EPA to set the north star for the auto industry for the next decade to keep us on track. On track toward a strong, globally competitive auto sector in the US that supports good jobs. On track to delivering more clean, affordable options for consumers. And on track toward zeroing out pollution from our cars and trucks.