Offshore wind has been getting a lot of attention lately—some good, some less good. As in other parts of the economy, high interest rates hit the offshore wind industry hard, given the billions of dollars required upfront to build a single project, and inflation didn’t help. Supply chain crunches also have hit, including with the supply of the special ships that help install these huge machines. The results include two developers cancelling their offshore wind power contracts with states and utilities, another cancelling two projects altogether, and hesitation elsewhere.

The good news-bad news balance, though, would seem to tip decidedly in favor of a whole lot more offshore wind. Why? There are five good reasons: power, place, people, policy, and price.

Power

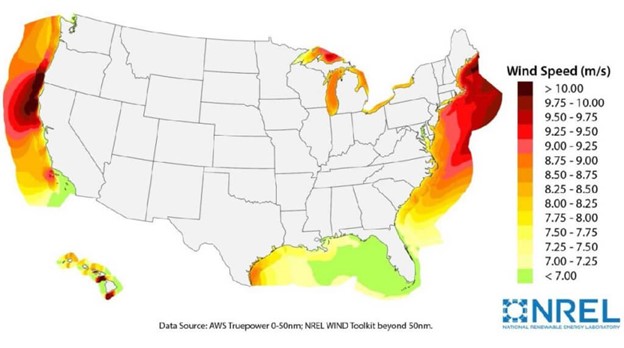

Offshore wind is powerful, including when we need it most. The winds off our coasts are some of the strongest in the world. That’s particularly true off the Northeast, West Coast, and Hawaii, but includes parts of the Gulf Coast and the Great Lakes, too.

Equally important is when that wind is likely to blow. In the Northeast, for example, offshore wind is strongest in winter. That timing makes it a hugely important potential resource when winter hits hard and fossil fuels fail. And it will make it even more important when winter electricity demand increases because more households are using electric heat pumps. It also makes offshore wind an important seasonal complement to the region’s abundant and growing solar power capacity.

Place

Offshore wind has the distinct advantage, for many of us as consumers, of being close to where a lot of electricity demand is. The topography of the US Outer Continental Shelf means shallow waters for tens of miles off much of the East and Gulf coasts, which makes for easier wind turbine installation. And more than 60 percent of US residents live in coastal states, with another 20 percent in states bordering one of the Great Lakes. Plus, offshore wind power can stretch far beyond the coasts, given regional electric grids and electricity flows between regions.

Contrast the “location, location, location” attractiveness of offshore wind with the fact that many of the potential offshore wind hotspot regions are at the other end of the pipeline (literal or figurative) when it comes to fuels—as with New England and supplies of gas (or coal, or oil).

While new transmission lines are never easy, getting the power back to shore can involve a straighter shot with a connection cable than is often the case on land, even when projects are sited far enough offshore to be mostly or fully invisible from land. The ocean bed has a diverse landscape with plenty of challenges, but dealing with a single entity—the Bureau of Ocean Energy Management (BOEM)—for federally controlled waters does have advantages over the potential patchwork of landowners for land-based transmission. (Project developers do, however, need to also work out the pieces in state waters and on land.)

People

A strong consideration for many in advocating for offshore wind is its potential to address the harmful effects of fossil fuels in the power sector, which disproportionately impact Black and Brown communities. Offshore wind generation directly displaces coal, gas, and oil power and the various pollutants from those power plant smokestacks, and reduces impacts upstream (from fuel extraction, for example) and down (including water pollution).

Offshore wind development also is driving economic development and revitalization, as well as providing strong potential for lots of quality jobs. Unions and their allies, including the Union of Concerned Scientists, have called for strong labor standards in state offshore wind requirements, as in the important offshore wind law Maine passed earlier this year. Our coalitions also have pushed for workforce diversification.

Policy

Another important driver of offshore wind has been targeted commitments from coastal states around the country, often in the form of requiring local utilities to contract with offshore wind developers. These mandated requirements alone total more than 40,000 megawatts (MW)—enough to supply the equivalent of more than 15 million typical US households. And the requirements plus broader state offshore wind goals have been strong signals to utilities and the industry that states are serious about having offshore wind as a big part of their electricity mixes for decades to come.

Many of those same states also have strong climate and clean energy goals, and commitments to increase renewable energy and cut carbon emissions—in many cases aimed at zeroing out emissions from their electricity use or even across their economies. Offshore wind offers one of the best opportunities for large-scale, zero-carbon electricity production in some regions, and is an important tool for diversifying the sources of clean electricity.

Price

While this one may be a little harder to envision given trends of late, there are strong reasons why price also is part of what’s likely to continue to drive offshore wind. The prices associated with projects New York approved in October will have twice as much impact on household electricity bills as ones approved two years earlier, before the pandemic recovery and related economic effects kicked in, the state estimates. And we’ll certainly see prices on the higher end for contracts awarded next year around the country. But offshore wind’s many benefits were attractive even before prices started coming in much lower and dropping much more quickly than expected. Some of the same factors that made those prices possible, including the scale of projects and the scale of the industry, should ultimately help push prices back down.

Offshore wind also offers much needed price stability. Contracts between projects and utilities or states offer 15 to 20 years of price certainty, something that would have been welcome indeed when methane gas prices shot upward in the wake of global turmoil and drove up electricity prices with them. Even with states now allowing bids to include adjustments for inflation before construction, the turbines—once up and spinning—will offer valuable predictability.

Where Things Stand

So, there are lots of reasons why offshore wind is attractive and has generated a lot of attention and support—and why it is making real progress. Here’s a taste of what all that attractiveness, attention, and support is delivering:

- Projects are getting through the permitting process. The federal government issued final approval to a fifth offshore wind project in October and a sixth in November. BOEM also has just issued a final environmental impact statement for another project, the final stage before it issues a permit.

- States are looking for more offshore wind right now. New York’s October selections of new renewable energy projects it was contracting with included three offshore wind projects totaling 4,000 MW, and the state is currently seeking 4,300 MW more in bids, due in January 2024. Connecticut, Massachusetts, and Rhode Island have issued a joint request for proposals totaling 6,000 MW, also due in January. And New Jersey will be issuing its own request next month for as much as 4,000 MW—another sizable step toward meeting its nation-leading target of 11,000 MW.

- It’s happening! Most important for the seeing-is-believing crowd, construction is underway for the first turbines in two projects, and a third has begun construction on the onshore transmission it will need. The first two projects will add almost 1,000 MW of offshore wind—enough to meet the equivalent of a half a million households’ electricity needs. Earlier this month one of those projects, off Long Island, delivered its first power into New York’s electric grid. The first turbines from the other advanced project, off Massachusetts, should begin feeding power into New England’s grid in the next couple of weeks.

US offshore wind has faced its fair share of obstacles, and the economic effects of the pandemic recovery and a war in Eastern Europe haven’t helped. But some of the challenges, at least (supply chain issues, for example), are thankfully temporary.

Most important, so much is riding on figuring out how to keep making offshore wind happen, and happen well, that the smart bets will be on offshore wind emerging in a big way, and soon.