The Department of Energy’s Energy Information Administration (EIA) is one of the go-to sources for reliable information about the US power sector. They just released their 2022 “Annual Energy Outlook” (AEO), which is a big deal: it tells us where electricity is headed over the next 30 years. It’s widely viewed as the “gold standard” for energy projections, even though there’s much debate in the energy community about the validity of the assumptions behind these projections.

This year’s projections are a bit grim.

EIA modeled US energy markets, including laws and regulations that were current as of November 2021 (and included portions of the Bipartisan Infrastructure and Jobs Act and supply chain disruptions due to COVID), and they have interesting insights for what the energy future might bring, assuming no new policies, under a range of assumptions about technology and resource costs.

The biggest takeaway: without robust new policies, US energy sector heat trapping emissions will continue to remain high, far off-track from where we need to be to meet our climate goals. Relying on market trends is nowhere near enough to do the job.

Here are five key takeaways from this year’s AEO, focused primarily on the electricity sector:

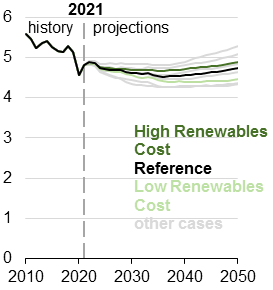

1. CO2 emissions remain mostly level through 2050—nowhere close to meeting US climate goals

According to the forecast, while economy-wide CO2 emissions decrease from 2022 to 2037 due primarily to the growth in renewable energy replacing retiring coal plants, emissions do increase after 2037 from increased usage of natural gas. This is in total opposition to the US commitment under the Paris Agreement to achieve a 50-52 percent emissions reduction below 2005 levels by 2030, and net-zero by 2050. These projections show that without additional policies or incentives, the US is very much in danger of not meeting our climate goals. We’re risking more impacts from climate change due to continued reliance on natural gas and oil.

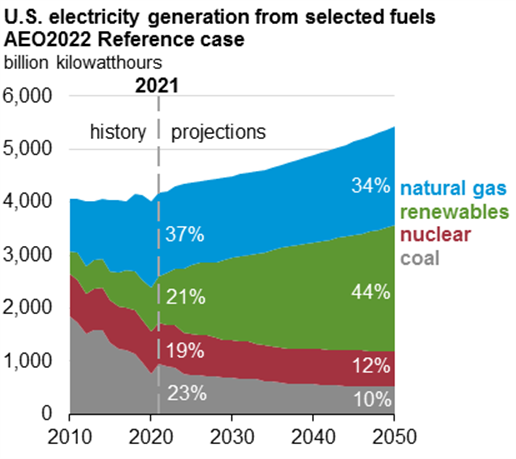

2. Renewable energy generation increases faster than any other technology

The good news: EIA is projecting that the share of renewables more than doubles to 44 percent of the US electricity generation mix by 2050, surpassing natural gas as the leading source of power. Generation from renewable technologies more than covers the increase in electricity demand, also making up for coal and nuclear plant retirements.

Wind capacity steadily increases, mostly due to policy (the federal tax credit, which expires in 2024, and state RPS policies). But solar is the big winner here, with it’s share of total US capacity increasing from 7% in 2020 to 29% in 2050. In fact, due to technology cost reductions and good resource availability, solar generating capacity grows steadily in all regions across the United States. With growth of solar generation, battery storage also increases, reducing natural gas generation during peak hours.

The bad news: the share of natural gas in the generation mix stays constant through the projection, because of high natural gas production and a projected low price of natural gas. Coal generation also remains 10 percent of the US mix through 2050 even as EIA is showing substantial coal plant retirements by 2030. While renewables and nuclear represent more than half of US electricity generation by 2050, this is well short of President Biden’s goal of reaching 100% carbon-free electricity by 2035. Without additional climate or clean energy policies, gas (and to a lesser degree, coal) will both provide electricity and will be used to balance the grid with growing levels of variable wind and solar generation.

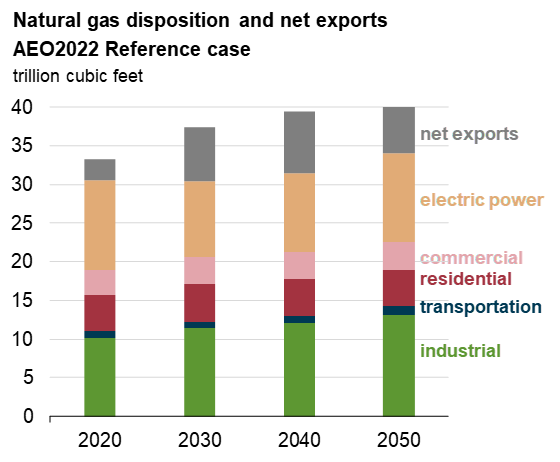

3. EIA is projecting that natural gas prices will remain low

This is where the analysis behind AEO2022 dates itself to November 2021. It is hard to say how natural gas prices will fluctuate in the near future, with Russia’s invasion of Ukraine, recent decisions by many countries to ban Russian oil and natural gas imports, and with continued uncertainty around COVID. From their thinking in November 2021, EIA projects that wholesale gas prices will remain less than $4.00/ million BTU through 2050, lower than gas prices in 2021. These low gas prices play an interesting role in the US and world energy markets.

EIA is also projecting continued cost reductions and low prices for solar and wind power, such that natural gas and renewable energy are price competitive. Even as more renewable energy is being installed and used in the electricity sector, natural gas production continues to increase. Natural gas electricity generating plants continue to stick around but are not being used as much as they are today. Capacity factors for existing natural gas combined cycle plants are cut in half, from nearly 60% in 2020 to below 30% in 2050. Natural gas combustion turbine plants are also being used sparingly (and inefficiently) to provide infrequent peaking capacity.

4. Electricity demand continues to increase, even with increases in energy efficiency and rooftop solar

EIA is projecting that electricity consumption increases after the recent dip due to COVID, growing by around 1% per year. This is mostly due to economic recovery and growth and not due to any electrification efforts that are needed to mitigate climate change. They assume that the only energy efficiency measures adopted are from existing state policies and incentives. EIA also assumes that rooftop solar photovoltaic (PV) systems continue to come down in price, but that the number of rooftop PV systems being installed continues to increase slowly due to supply chain interruptions and restrictions on imports. Increases in electricity demand outpace the adoption of efficiency and rooftop PV.

Economic recovery, population increases, weather changes due to climate change, and increased adoption of charging devices (electronics, electric vehicles) more than offset efficiency gains and rooftop PV. Electrification of the energy sector and more widespread adoption of energy efficiency investments and rooftop PV are critical components of decarbonization strategies. Many studies have shown that to achieve net-zero emissions economy-wide, widespread electrification of end-uses (such as vehicles and home heating and cooking) and energy efficiency measures are needed.

5. Natural gas and oil production, consumption and exports will continue to increase

Another big takeaway is EIA’s projected growth in natural gas and oil production and their export. EIA also recently reported that US coal exports increased 23% between 2020 and 2021. These trends and projections show a very sobering energy future from an emissions perspective; an economy very much wedded to fossil fuels that completely disregards climate risks and agreed-upon climate targets and timelines.

While these projections may show a false-promise of economic gain in the energy sector, my colleague Julie McNamara discusses why this is the wrong path, and why a transition to a clean energy economy now will create new sustainable energy markets and will protect us from highly volatile fossil fuel dependencies.

EIA has a tough time coming to these projections as it’s difficult to predict the events that cause changes to energy markets. Because of uncertainties around technologies, demographics and resources, EIA also publishes a number of side cases that look at high and low oil and gas supplies, high and low economic growth, and high and low renewables price projections. EIA will continue to roll out their release of AEO2022 in the coming weeks; they will be presenting additional side cases in their Issues in Focus series that hopefully includes sample legislation, regulation or standards like climate policy or renewable tax incentives. But EIA does not include other events that cause instability to energy markets in their modeling, such as weather disruptions due to climate change and global political and economic events such as Russia’s invasion of Ukraine.

I’m finding that this 2022 release of the Annual Energy Outlook reference case to be a dangerous example of what could happen if we continue to rely solely on market economics to determine our energy future. Transformative change to our energy system is needed if we are to achieve net-zero emissions by 2050. We must pass strong climate, renewable, and clean energy policies help limit the worst impacts of climate change.